European Dividend Stocks To Watch In December 2025

As December 2025 unfolds, the European market is experiencing mixed returns with the pan-European STOXX Europe 600 Index inching higher amid speculation of interest rate cuts in the U.S. and UK, while inflation and GDP revisions continue to shape economic discussions. In this environment, dividend stocks can offer a measure of stability and income potential, making them an attractive consideration for investors looking to navigate these dynamic market conditions.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.35% | ★★★★★★ |

| Telekom Austria (WBAG:TKA) | 4.65% | ★★★★★★ |

| Holcim (SWX:HOLN) | 4.06% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.80% | ★★★★★★ |

| Evolution (OM:EVO) | 4.86% | ★★★★★★ |

| DKSH Holding (SWX:DKSH) | 4.20% | ★★★★★★ |

| Credito Emiliano (BIT:CE) | 5.16% | ★★★★★☆ |

| Cembra Money Bank (SWX:CMBN) | 4.42% | ★★★★★★ |

| Bravida Holding (OM:BRAV) | 4.44% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.51% | ★★★★★☆ |

Click here to see the full list of 205 stocks from our Top European Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

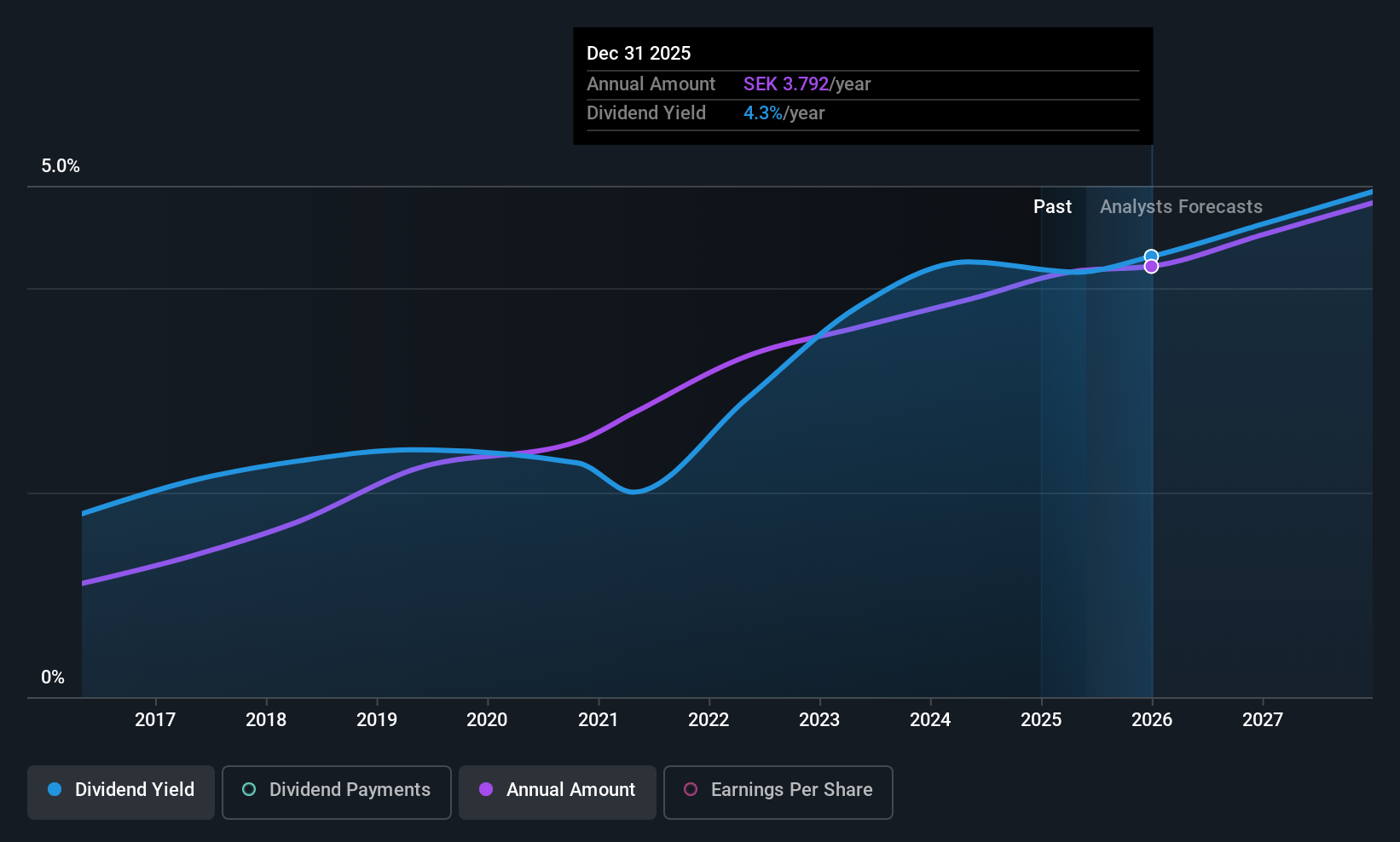

Bravida Holding (OM:BRAV)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Bravida Holding AB (publ) offers technical services and installations for buildings and industrial facilities across Sweden, Norway, Denmark, and Finland, with a market cap of approximately SEK17.28 billion.

Operations: Bravida Holding AB (publ) generates its revenue by providing technical services and installations for buildings and industrial facilities in Sweden, Norway, Denmark, and Finland.

Dividend Yield: 4.4%

Bravida Holding offers a stable and growing dividend, with payments covered by earnings (66.1% payout ratio) and cash flows (77.2% cash payout ratio). Its 4.44% yield ranks in the top 25% of Swedish dividend payers. Despite recent sales decline, net income rose to SEK 244 million in Q3 2025 from SEK 197 million a year ago, supporting its reliable dividend track record over the past decade. The stock trades significantly below estimated fair value.

- Unlock comprehensive insights into our analysis of Bravida Holding stock in this dividend report.

- Our valuation report unveils the possibility Bravida Holding's shares may be trading at a discount.

NOTE (OM:NOTE)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: NOTE AB (publ) is a company that offers electronics manufacturing services across Sweden, Finland, the United Kingdom, Bulgaria, Estonia, China, and other international markets with a market cap of SEK5.19 billion.

Operations: NOTE AB (publ) generates revenue from electronics manufacturing services primarily in Western Europe, contributing SEK2.89 billion, and the Rest of World segment, which adds SEK995.31 million.

Dividend Yield: 3.8%

NOTE's dividend payments are well covered by earnings (74.4% payout ratio) and cash flows (41% cash payout ratio), but they have been volatile over the past decade. The dividend yield of 3.85% is slightly below the top tier of Swedish payers, though dividends have grown over ten years. NOTE trades at a discount to its estimated fair value, with recent Q3 2025 results showing increased net income to SEK 54 million from SEK 43 million year-on-year.

- Click to explore a detailed breakdown of our findings in NOTE's dividend report.

- The valuation report we've compiled suggests that NOTE's current price could be quite moderate.

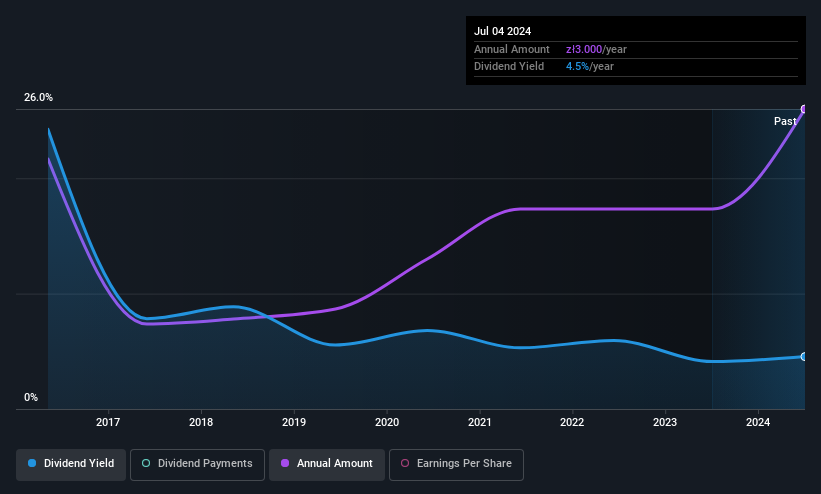

Decora (WSE:DCR)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Decora S.A. is involved in the production, distribution, sale, and export of flooring products and accessories in Poland with a market capitalization of PLN767.83 million.

Operations: Decora S.A.'s revenue is primarily derived from its flooring segment, which accounts for PLN473.44 million, and its wall segment, contributing PLN157.12 million.

Dividend Yield: 5.5%

Decora's dividends, although covered by earnings (55.8% payout ratio) and cash flows (68.9% cash payout ratio), have been unreliable and volatile over the past decade, with significant annual drops. The dividend yield of 5.49% is below the top tier in Poland's market. Despite this, dividends have grown over ten years, and the stock trades at a substantial discount to its estimated fair value. Recent Q3 results showed revenue growth to PLN 173.18 million from PLN 153.07 million year-on-year, though net income saw only a slight increase to PLN 22.34 million from PLN 21.8 million.

- Dive into the specifics of Decora here with our thorough dividend report.

- Our expertly prepared valuation report Decora implies its share price may be lower than expected.

Next Steps

- Explore the 205 names from our Top European Dividend Stocks screener here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal