Wintrust Financial (WTFC): Assessing Valuation After Recent Outperformance in Regional Bank Stocks

Wintrust Financial (WTFC) has quietly outperformed many regional peers this month, with the stock gaining about 5% as investors lean into its steady loan growth and improving profitability trends.

See our latest analysis for Wintrust Financial.

That latest move builds on a solid year to date, with a roughly 11% year to date share price return and a powerful 3 year total shareholder return of about 74%, suggesting momentum is still very much intact as investors reassess regional bank risk.

If Wintrust’s steady climb has you rethinking your financials exposure, it could be worth broadening your search and discovering fast growing stocks with high insider ownership

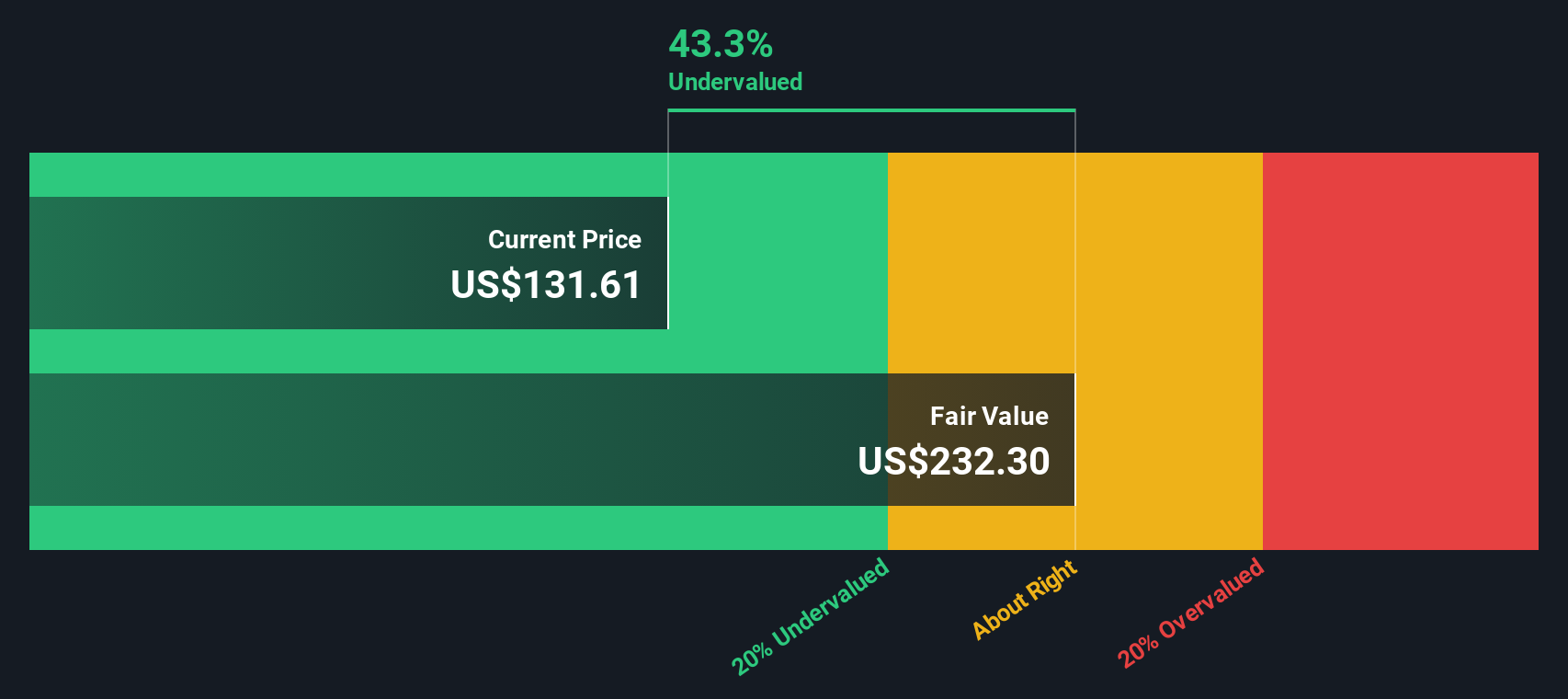

With shares still trading at a double digit discount to analyst targets and an even steeper gap to some intrinsic value estimates, the question now is clear: is Wintrust Financial a buy, or has the market already priced in its growth?

Price-to-Earnings of 12.5x: Is it justified?

On a price-to-earnings basis, Wintrust Financial looks modestly cheap, trading at 12.5x earnings despite its recent share price strength.

The price-to-earnings ratio compares what investors are willing to pay today for each dollar of current earnings, a key yardstick for established, profitable banks like Wintrust. With earnings growing and profitability metrics improving, a lower multiple can suggest the market is not fully crediting the bank for its earnings power.

Against direct peers, Wintrust sits at a slight discount, with its 12.5x price-to-earnings ratio below the peer average of 13.2x, yet it also screens as more expensive than the broader US banks industry at 11.6x. Notably, this current multiple also sits under the estimated fair price-to-earnings ratio of 13x, which some investors may interpret as leaving room for the valuation to edge higher if fundamentals continue to track as they have.

Explore the SWS fair ratio for Wintrust Financial

Result: Price-to-Earnings of 12.5x (UNDERVALUED)

However, investors should still watch for credit quality deterioration or a sharper-than-expected margin squeeze if funding costs rise faster than loan yields.

Find out about the key risks to this Wintrust Financial narrative.

Another View: SWS DCF model points to deeper value

While the earnings multiple suggests modest undervaluation, our DCF model is far more optimistic. It implies WTFC trades about 41% below its fair value of roughly $234 per share. That kind of gap hints at either a real opportunity or overly cautious cash flow assumptions. What do you think the market is missing?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Wintrust Financial for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 902 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Wintrust Financial Narrative

If you see the story differently or would rather dig into the numbers yourself, you can build a fresh perspective in just minutes, Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Wintrust Financial.

Ready for your next investing move?

Wintrust might fit your strategy, but the market will not wait while you hesitate. Use our powerful screeners now to uncover your next advantage.

- Capitalize on mispriced opportunities by scanning these 902 undervalued stocks based on cash flows that could offer stronger upside than many headline names.

- Ride the next wave of innovation by targeting these 27 AI penny stocks positioned at the forefront of real world AI adoption.

- Strengthen your income stream by focusing on these 15 dividend stocks with yields > 3% that may keep paying you even when markets turn choppy.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal