This Popular Wall Street Strategist Says It’s a ‘High-Risk Bull Market.’ He’s Right, with the Fed in Focus.

Wall Street is a place where pundits frequently bring up a few historical truths. For instance:

- Stocks go up most of the time. They do, if we look at the number of up years versus down years over the past 100 years or so.

- Bear markets are less frequent and often do not last long. This is also true. However, the current bull market is such that it might be followed by a bear market of historic proportions. We’ll come back to that thought, in about 2-3 years.

However, in this era of buying the dip at every turn, while most stocks continue to languish versus the “headliners” like the Magnificent 7, I’m not so sure it is that simple.

That is, the eventual next bear market may not just be the proverbial “pause that refreshes.” Assuming that it will be is a big risk.

That’s why I was glad to hear one veteran market strategist, Bob Doll of Crossmark Global Investments, describe the current stock market climate exactly the way I would. As he wrote recently, “We’re in a High-Risk Bull Market.”

Why This Bull Market Has High Risk

The economy is not sliding into a recession at the headline level, but it is not booming either. The K-shape, where those at the top are flourishing, while many others are suffering economically, is as good a visual as I can think of.

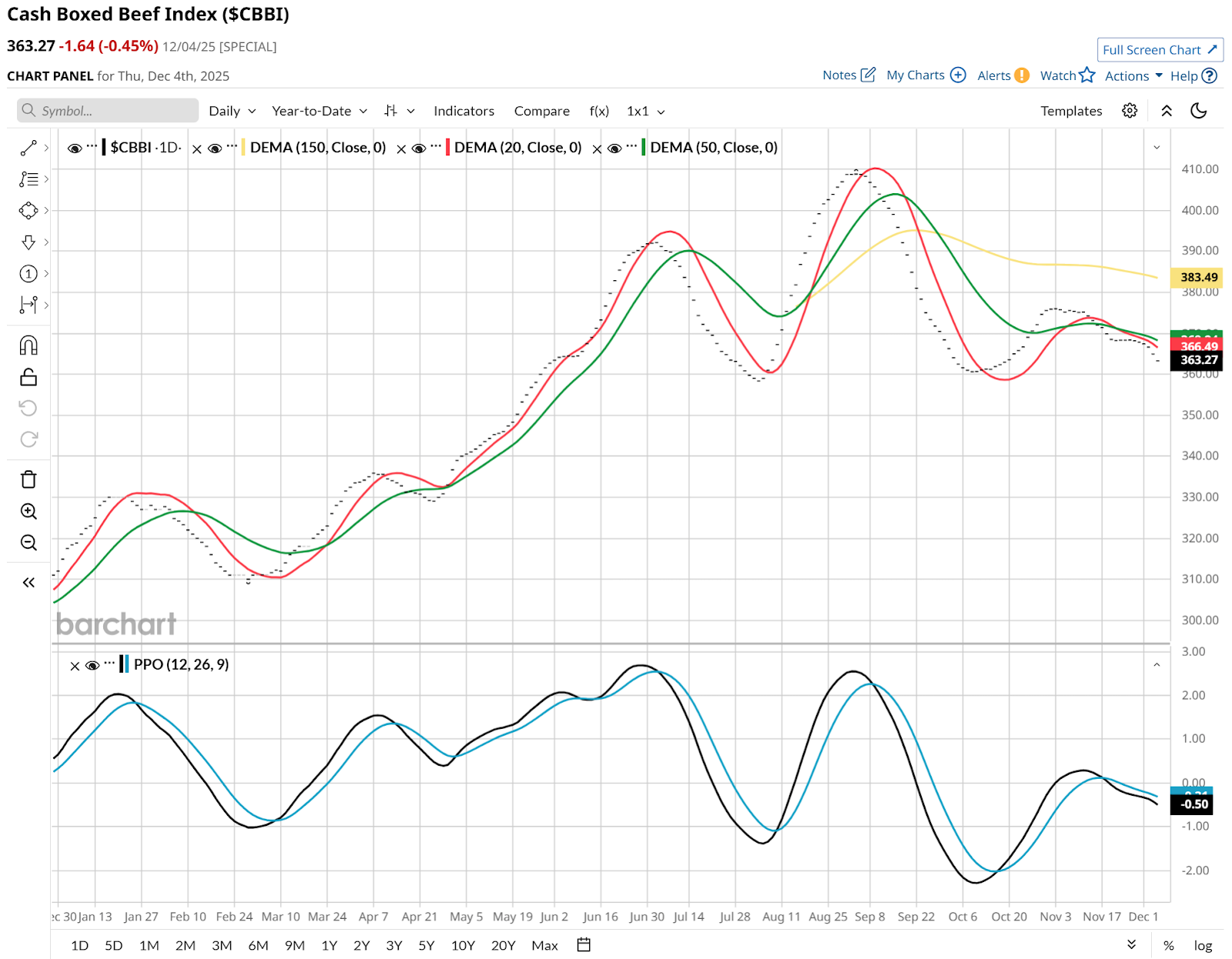

Inflation is stubbornly high. Just ask anyone who’s been to the supermarket recently. Beef prices in particular are well above where they’ve been the past few years, even with a recent pullback.

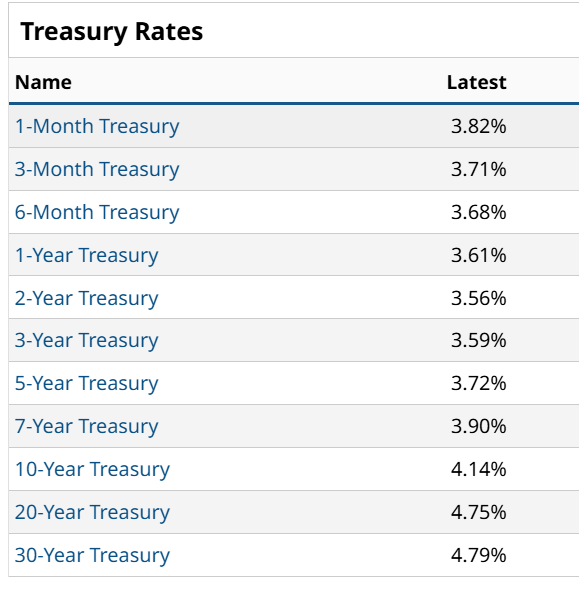

Bond prices are not helping matters, as rates are actually ticking up where it matters to consumers: rates for bonds 10 years and beyond. That’s what most consumer debt is priced off of. So pay no attention to those falling short-term rates. Because mortgages and other forms of consumer loans are based on 10-year Treasury yields or longer.

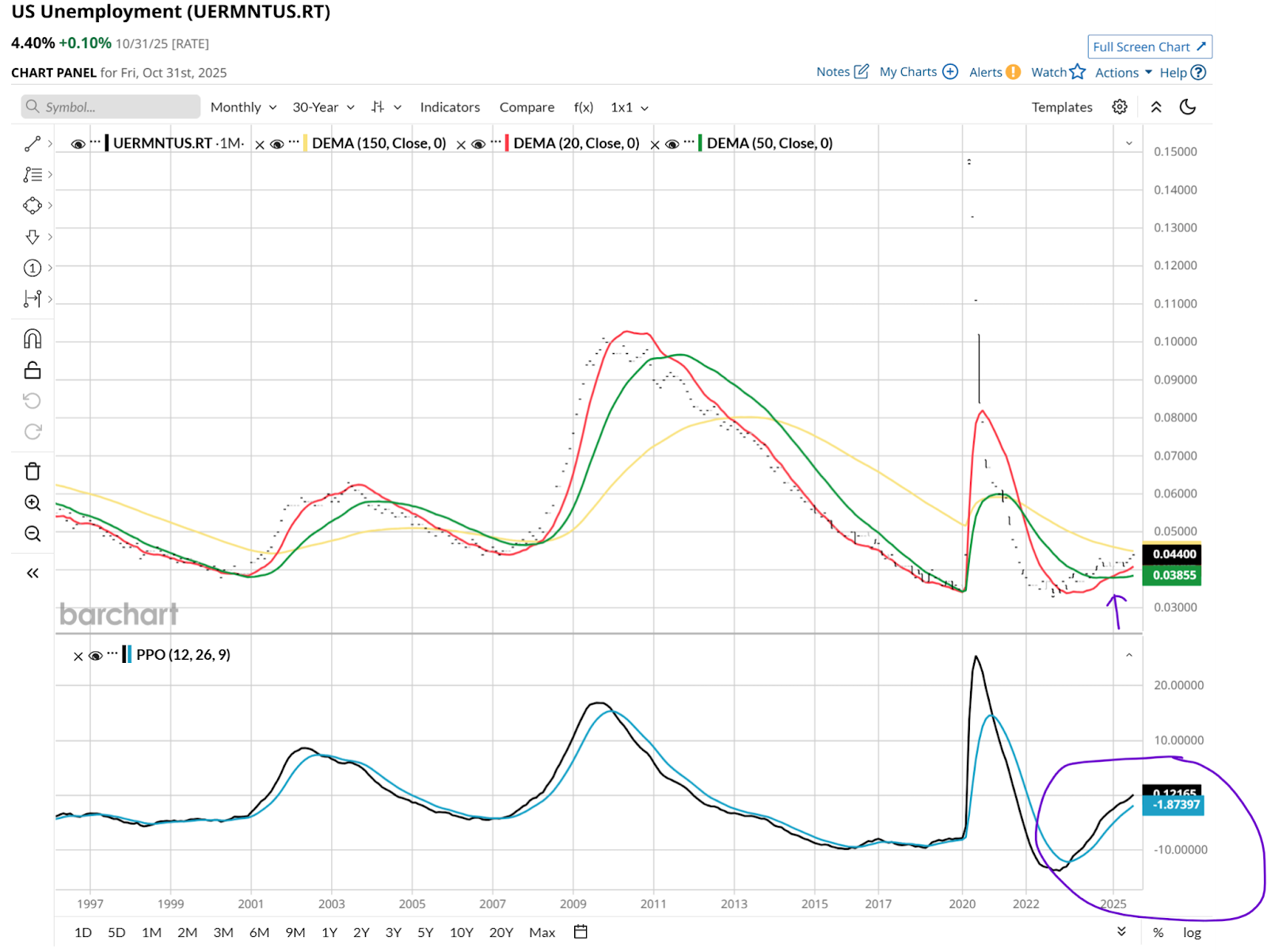

Employment is a budding concern for the market. At least it should be. The very thing that makes AI so special – efficiency – has a segment of the workforce in its crosshairs.

I don’t normally use my technical chart approach to analyze economic indicators. Those are usually best for stocks and ETFs. However, I can’t help but notice that for the first time in a long time, the U.S. unemployment rate is exhibiting “crossover” activity to the upside. That is, the momentum on both the 20-month moving average and Percentage Price Oscillator (PPO) indicator (at the top and bottom of this chart) are perking up, after a long dry spell. That spells higher unemployment. Enough to break the economy and in turn the bull market? We’ll see.

The Fed in Focus

This week’s Federal Reserve policy decision will be the usual market-shaking, tea-leaf-reading competition for Wall Street folks. But to me, the bigger issue is what’s already baked in the cake. That inflation remains, unemployment is becoming a concern, and the AI trade might be all that is left for bulls to hang on to. Yes, it’s a “high risk bull market.”

How to Play It

While naturally it’s a “to each their own” situation, I see part of my role here as using my voice to alert investors and traders to some straightforward risk management strategies. For instance:

- Small position size. Smaller than normal, that is. A risky bull market means there’s a higher likelihood of the music stopping sooner rather than later. So for instance, if my normal stock allocation within my portfolio was 5%, maybe it would be 3% or even 2% currently.

- Call and put options as stock or ETF surrogates. Instead of buying 100 shares of a stock or ETF you like, consider owning 1 call option contract. Barchart has about as much educational content on option strategies as any site on the planet. This is a great time to learn. And if there’s a stock or ETF you are bearish on, a put option contract gives you the right, but not the obligation, to sell 100 shares of that security at a specific price, before a specific date. It is not shorting, which risks an unlimited amount of capital. The risk is limited to what you put up to buy the put. Same thing with call options.

- Cash can be queen, king and court jester, all at once. Check that rates table above. Look at the 3-month T-bill rate, then the 5-year note rate. They are essentially the same. So if I can get a “free look” at what happens next in this market cycle, at the same rate I’d lock into through the year 2030, I have to consider that a nice alternative to putting more capital at risk.

It’s a high risk bull market. But it’s also a bull market in my favorite topic: investment risk management. Because we all learn to play “offense,” but not “defense.” This is an ideal time to learn the other side of the trade, so to speak.

Rob Isbitts, founder of Sungarden Investment Publishing, is a semi-retired chief investment officer, whose current research is found here at Barchart, and at his ETF Yourself subscription service on Substack. To copy-trade Rob’s portfolios, check out the new Pi Trade app.

On the date of publication, Rob Isbitts did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal