Fluence Energy (FLNC): Taking Stock of Valuation After Upbeat Analyst Upgrades and 2026 Guidance Boost

Fluence Energy (FLNC) just caught the market’s attention after a sharp move higher, as upbeat analyst sentiment converged with fresh 2026 guidance that leans on a heavily backed revenue pipeline and margin improvement.

See our latest analysis for Fluence Energy.

That enthusiasm has landed on a stock that was already on a tear, with a 90 day share price return of 253.39% and a 3 year total shareholder return of 39.30%. This suggests momentum is clearly building rather than fading at the current share price of $23.96.

If Fluence’s surge has you rethinking where growth could come from next, it might be worth scanning high growth tech and AI stocks to spot other potential winners riding the same structural themes.

Yet with shares now trading above the average analyst target and the company guiding for another year of rapid growth, investors face a tougher question: is this a fresh buying opportunity, or is future upside already priced in?

Most Popular Narrative: 60% Overvalued

With Fluence Energy last closing at $23.96 versus a narrative fair value near $15, the gap between market excitement and modeled upside is already wide.

The analysts have a consensus price target of $7.737 for Fluence Energy based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $12.0, and the most bearish reporting a price target of just $2.0.

Curious what kind of revenue surge, margin lift, and future earnings multiple are needed to support this richer fair value story? The narrative leans on aggressive growth compounding, a step change in profitability, and a valuation usually reserved for established winners. Want to see which specific forecasts are doing the heavy lifting behind that target price?

Result: Fair Value of $14.97 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, lingering tariff uncertainty and potential delays in large project bookings could still derail revenue momentum and challenge the optimistic fair value narrative.

Find out about the key risks to this Fluence Energy narrative.

Another View: Market Pricing Looks More Cautious

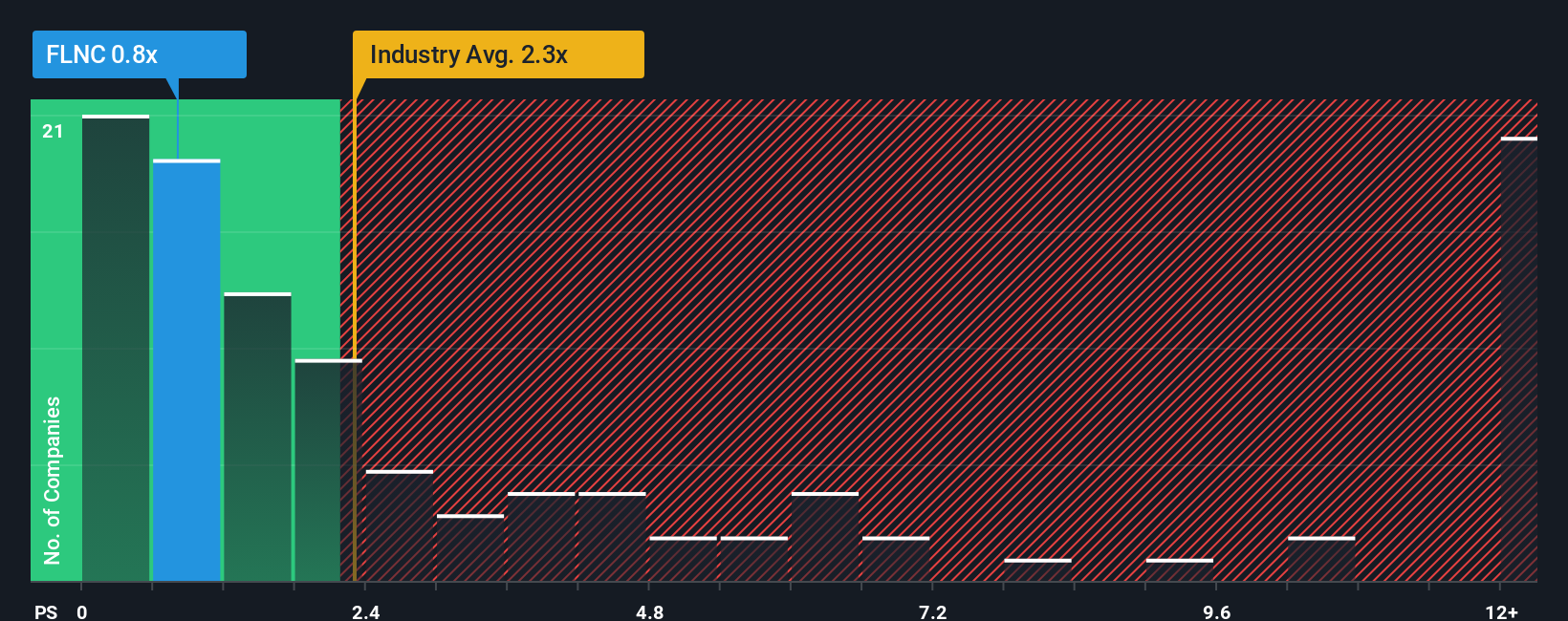

While the narrative fair value suggests Fluence Energy is 60% overvalued, the current price to sales ratio of 1.4 times paints a softer picture. It is well below peers at 4.2 times and under a 2.2 times fair ratio that the market could eventually move toward.

This gap implies investors may be paying up versus narrative fair value, but still getting a relative discount versus the sector. That could cap downside if sentiment cools, or fuel upside if execution keeps surprising. Which scenario do you think is more likely?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Fluence Energy Narrative

If you see the story differently or want to test your own assumptions against the numbers, you can build a custom narrative in minutes: Do it your way.

A great starting point for your Fluence Energy research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more high conviction ideas?

Before you move on, lock in your next edge by scanning focused stock shortlists built from hard numbers, not hype, so you are never guessing alone.

- Target long term wealth potential by focusing on reliable income streams through these 15 dividend stocks with yields > 3% with yields that can steadily reinforce your portfolio.

- Capture transformative innovation early by zeroing in on companies powering breakthroughs in automation and data with these 27 AI penny stocks.

- Strengthen your margin of safety by concentrating on attractively priced opportunities using these 899 undervalued stocks based on cash flows before the broader market catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal