Bass Oil And 2 Other ASX Penny Stocks To Consider

As the Australian market navigates a period of uncertainty, with telecoms leading and materials facing challenges, investors are keenly watching economic indicators like the RBA's rate decisions. In this context, penny stocks—though considered a niche area—remain an intriguing option for those looking to uncover potential growth opportunities in smaller or newer companies. These stocks can offer significant returns when backed by strong financial health, and we will explore three such examples that combine balance sheet resilience with promising potential.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Alfabs Australia (ASX:AAL) | A$0.385 | A$110.34M | ✅ 4 ⚠️ 4 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.56 | A$73.59M | ✅ 2 ⚠️ 2 View Analysis > |

| Dusk Group (ASX:DSK) | A$0.79 | A$49.19M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.88 | A$442.63M | ✅ 4 ⚠️ 2 View Analysis > |

| MotorCycle Holdings (ASX:MTO) | A$3.25 | A$240.05M | ✅ 4 ⚠️ 1 View Analysis > |

| Veris (ASX:VRS) | A$0.074 | A$38.98M | ✅ 3 ⚠️ 2 View Analysis > |

| West African Resources (ASX:WAF) | A$2.76 | A$3.15B | ✅ 4 ⚠️ 2 View Analysis > |

| Service Stream (ASX:SSM) | A$2.22 | A$1.36B | ✅ 3 ⚠️ 2 View Analysis > |

| Perenti (ASX:PRN) | A$2.80 | A$2.63B | ✅ 3 ⚠️ 3 View Analysis > |

| GWA Group (ASX:GWA) | A$2.47 | A$647.83M | ✅ 5 ⚠️ 1 View Analysis > |

Click here to see the full list of 416 stocks from our ASX Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Bass Oil (ASX:BAS)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Bass Oil Limited, with a market cap of A$21.40 million, engages in the exploration, development, and production of oil and gas in Australia and Indonesia.

Operations: The company's revenue is derived from its operations in Australia (A$3.51 million) and Indonesia (A$4.99 million), along with a corporate segment contributing A$0.13 million.

Market Cap: A$21.4M

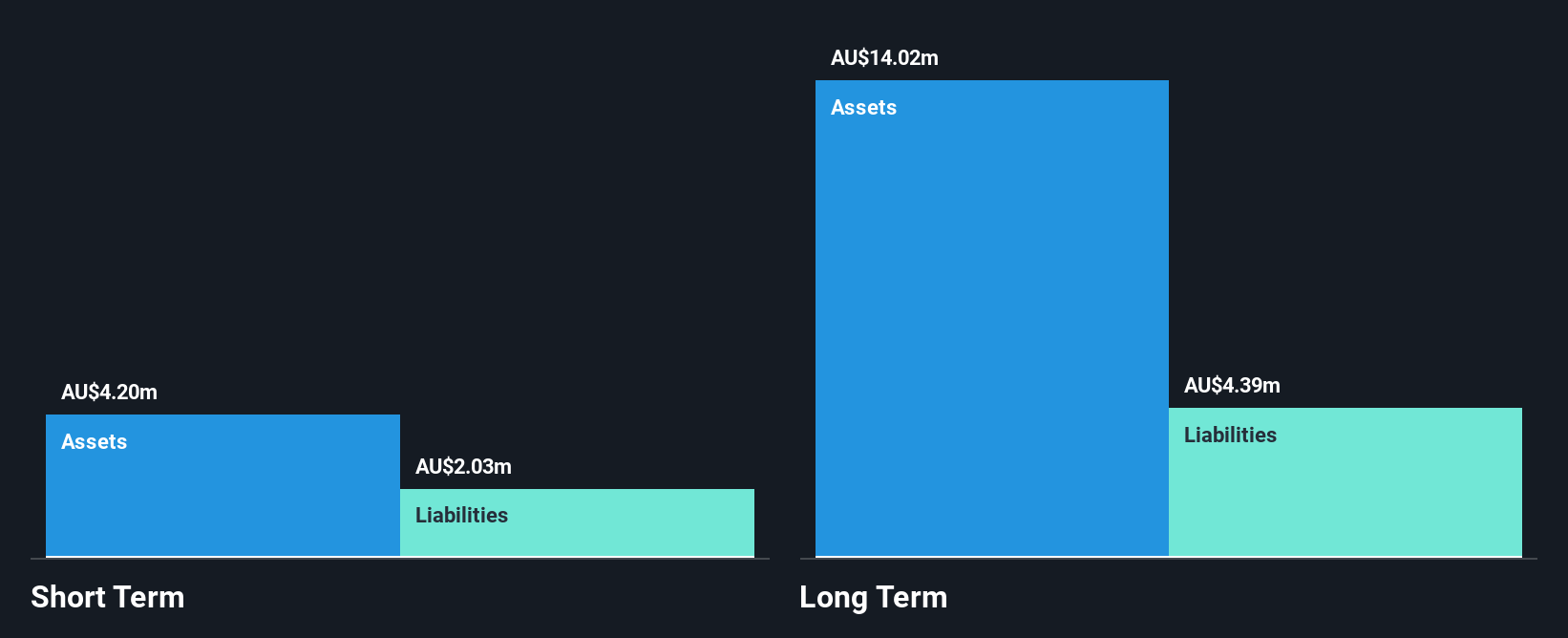

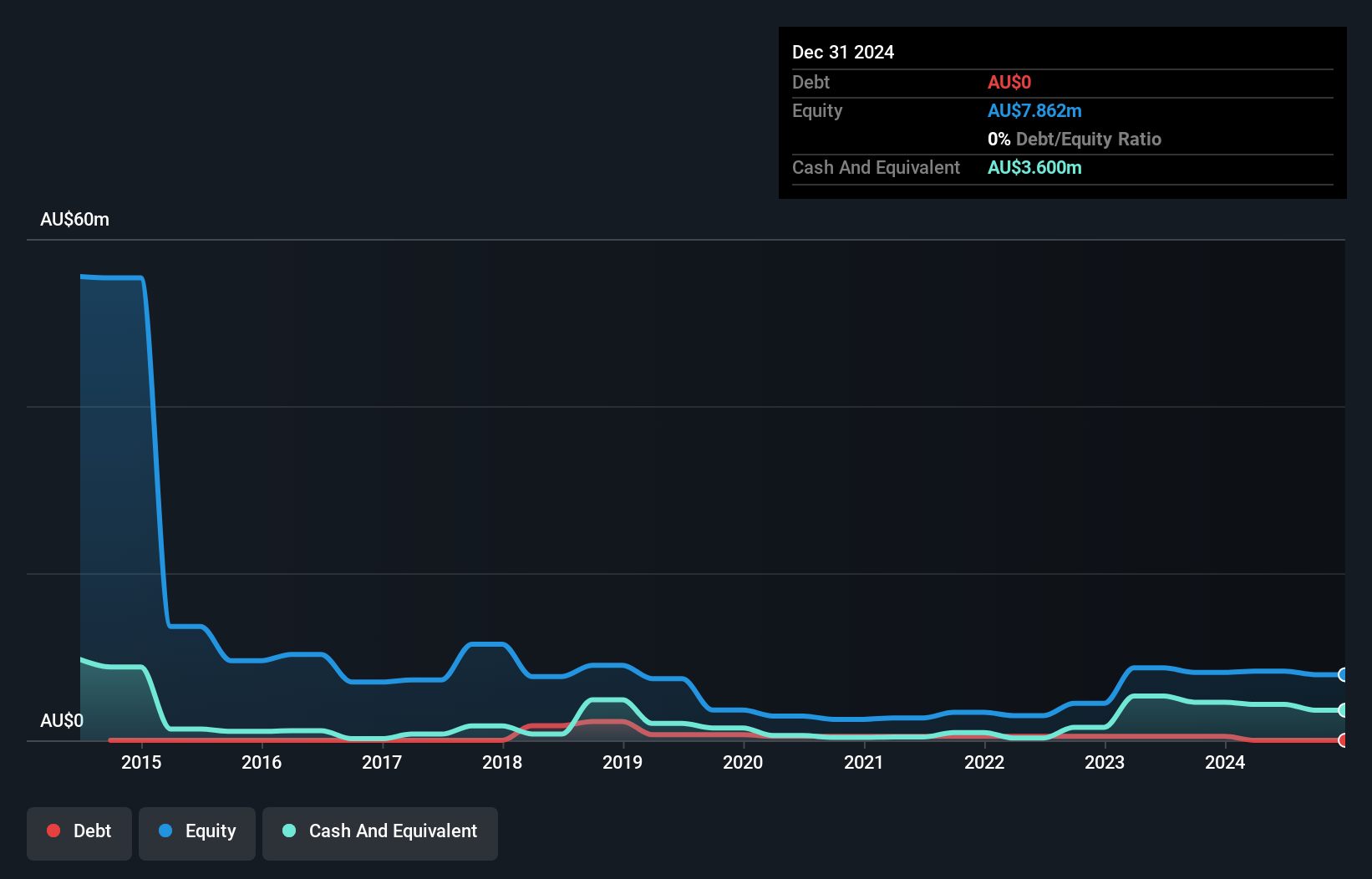

Bass Oil Limited, with a market cap of A$21.40 million, operates in the oil and gas sector in Australia and Indonesia. Despite being unprofitable, the company has reduced its losses over five years by 16.4% annually, indicating some progress towards financial stability. Recent earnings reported a net loss of A$0.14 million for the half-year ending June 2025, showing improvement from previous periods. The company's share price remains highly volatile, with weekly volatility rising to 31%. Bass Oil is debt-free but faces challenges as short-term assets slightly fall short of covering long-term liabilities while maintaining sufficient cash runway for over three years if free cash flow continues to reduce at historical rates.

- Dive into the specifics of Bass Oil here with our thorough balance sheet health report.

- Assess Bass Oil's previous results with our detailed historical performance reports.

Brisbane Broncos (ASX:BBL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Brisbane Broncos Limited manages and operates the Brisbane Broncos Rugby League Football teams in Australia, with a market cap of A$150.98 million.

Operations: The company's revenue is primarily derived from its Sports Management and Entertainment segment, which generated A$65.79 million.

Market Cap: A$150.98M

Brisbane Broncos Limited, with a market cap of A$150.98 million, has demonstrated solid financial health and stability. The company's earnings have grown significantly by 36.3% annually over the past five years, although recent growth at 21.2% lags behind its historical performance and the broader Entertainment industry. Its short-term assets of A$36.7 million comfortably cover both short-term (A$14.1M) and long-term liabilities (A$2.8M), highlighting strong liquidity management without any debt burden to manage interest payments or cash flow coverage concerns. Despite a relatively low return on equity at 14.4%, Brisbane Broncos maintains high-quality earnings with stable weekly volatility at 13%.

- Navigate through the intricacies of Brisbane Broncos with our comprehensive balance sheet health report here.

- Evaluate Brisbane Broncos' historical performance by accessing our past performance report.

Pancontinental Energy (ASX:PCL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Pancontinental Energy NL is involved in the exploration of oil and gas properties mainly in Namibia and Australia, with a market cap of A$82.86 million.

Operations: The company has not reported any revenue segments.

Market Cap: A$82.86M

Pancontinental Energy NL, with a market cap of A$82.86 million, is currently pre-revenue and unprofitable, reporting a net loss of A$1.91 million for the year ended June 30, 2025. The company has no debt and short-term assets of A$2.6 million exceed both its short-term (A$588.1K) and long-term liabilities (A$82.1K), reflecting solid financial management despite its volatile share price and high weekly volatility at 19%. While earnings have declined by 9% annually over the past five years, Pancontinental benefits from an experienced board with an average tenure of nearly 17 years.

- Get an in-depth perspective on Pancontinental Energy's performance by reading our balance sheet health report here.

- Examine Pancontinental Energy's past performance report to understand how it has performed in prior years.

Next Steps

- Dive into all 416 of the ASX Penny Stocks we have identified here.

- Curious About Other Options? These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal