Should Fresh Del Monte’s Southeast Asia Sourcing Push with THACO Agri Reshape FDP Investors’ Expectations?

- In November 2025, Fresh Del Monte Produce Inc. announced a long-term partnership with THACO Agri of Vietnam to source bananas and develop dedicated pineapple cultivation areas across THACO Agri’s large-scale farms in Vietnam and Cambodia, while also collaborating with THACO Industries on mechanization and automation solutions.

- This collaboration extends Fresh Del Monte’s sourcing footprint into Southeast Asia, aiming to strengthen supply-chain resilience and modernize production amid ongoing global banana industry challenges.

- Next, we’ll examine how this expansion into Southeast Asia sourcing could influence Fresh Del Monte’s investment narrative and long-term resilience.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Fresh Del Monte Produce Investment Narrative Recap

To own Fresh Del Monte, you need to believe it can turn modest top line trends into stronger earnings through higher value products, tighter costs, and a more resilient supply chain. The THACO Agri partnership looks supportive of that resilience narrative, but on its own it does not change the near term focus on margin stability and the risk that production or disease disruptions in key banana and pineapple regions could pressure results.

Among recent announcements, the continued US$0.30 per share quarterly dividend stands out alongside the Southeast Asia expansion, as it underlines management’s focus on returning cash while investing in broader sourcing. That combination may appeal to investors who are watching both income generation and how the company responds to industry wide supply challenges, particularly given the recent one off loss that weighed on reported earnings and puts more attention on future cash generation capacity.

Yet against this backdrop, investors should still be aware of how concentrated exposure to banana production risks could...

Read the full narrative on Fresh Del Monte Produce (it's free!)

Fresh Del Monte Produce’s narrative projects $4.6 billion revenue and $127.6 million earnings by 2028. This requires 2.5% yearly revenue growth and a $19.6 million earnings decrease from $147.2 million today.

Uncover how Fresh Del Monte Produce's forecasts yield a $46.00 fair value, a 24% upside to its current price.

Exploring Other Perspectives

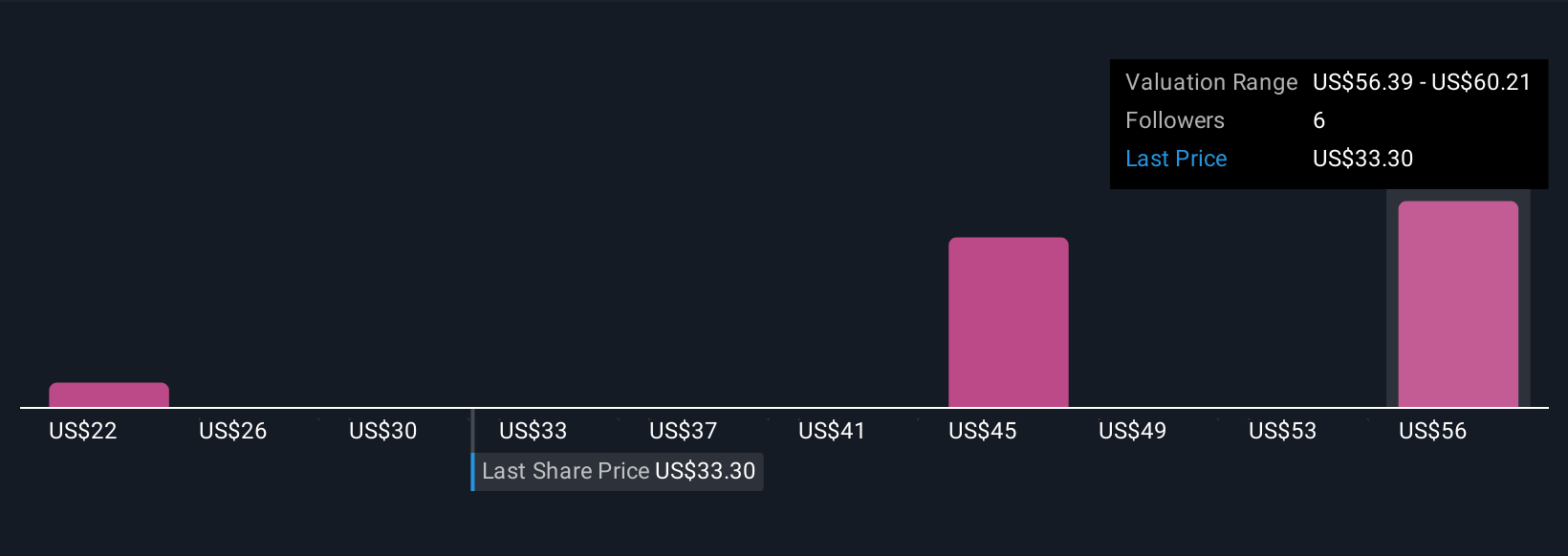

Three Simply Wall St Community fair value estimates span roughly US$46 to about US$66, underlining how differently investors can view Fresh Del Monte’s earnings power. Set against this spread, the focus on supply chain resilience and disease risk in bananas and pineapples gives you more context to weigh these contrasting views on the company’s longer term performance potential.

Explore 3 other fair value estimates on Fresh Del Monte Produce - why the stock might be worth just $46.00!

Build Your Own Fresh Del Monte Produce Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Fresh Del Monte Produce research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Fresh Del Monte Produce research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Fresh Del Monte Produce's overall financial health at a glance.

Ready For A Different Approach?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal