The Bull Case For LivaNova (LIVN) Could Change Following Medicare VNS Boost And New OSA Leader

- LivaNova PLC recently announced that, effective January 2026, U.S. Medicare will very largely increase outpatient reimbursement for its VNS Therapy neuromodulation procedures for drug-resistant epilepsy, while also appointing former ResMed executive Lucile Blaise as Global Head of Commercialization for Obstructive Sleep Apnea from December 1, 2025.

- This combination of materially improved hospital economics for VNS Therapy and the addition of a seasoned sleep-apnea leader could influence how investors view LivaNova’s growth profile across neuromodulation and sleep-disordered breathing.

- We’ll now explore how Medicare’s higher VNS Therapy reimbursement may alter LivaNova’s investment narrative around growth, margins, and access.

The latest GPUs need a type of rare earth metal called Neodymium and there are only 37 companies in the world exploring or producing it. Find the list for free.

LivaNova Investment Narrative Recap

To own LivaNova, you need to believe neuromodulation and sleep-disordered breathing can become larger, more profitable pillars alongside cardiopulmonary, despite current losses and healthcare cost pressure. The 2026 Medicare uplift for VNS Therapy looks like a meaningful short term catalyst for growth and margins, while a key risk remains whether high R&D and commercialization spending in OSA and neuromodulation convert into sustainable, reimbursed procedure volumes.

The Medicare decision to lift VNS Therapy reimbursement by about 48 percent for new implants and 47 percent for replacements directly tackles one of LivaNova’s biggest bottlenecks: hospital economics and access. When paired with the arrival of former ResMed executive Lucile Blaise to lead commercialization in obstructive sleep apnea, investors may see a clearer path for the company to leverage its clinical data into more consistent procedure growth across epilepsy and OSA.

Yet, while reimbursement support improves one hurdle, investors should still be aware that...

Read the full narrative on LivaNova (it's free!)

LivaNova's narrative projects $1.6 billion revenue and $168.9 million earnings by 2028.

Uncover how LivaNova's forecasts yield a $69.10 fair value, a 9% upside to its current price.

Exploring Other Perspectives

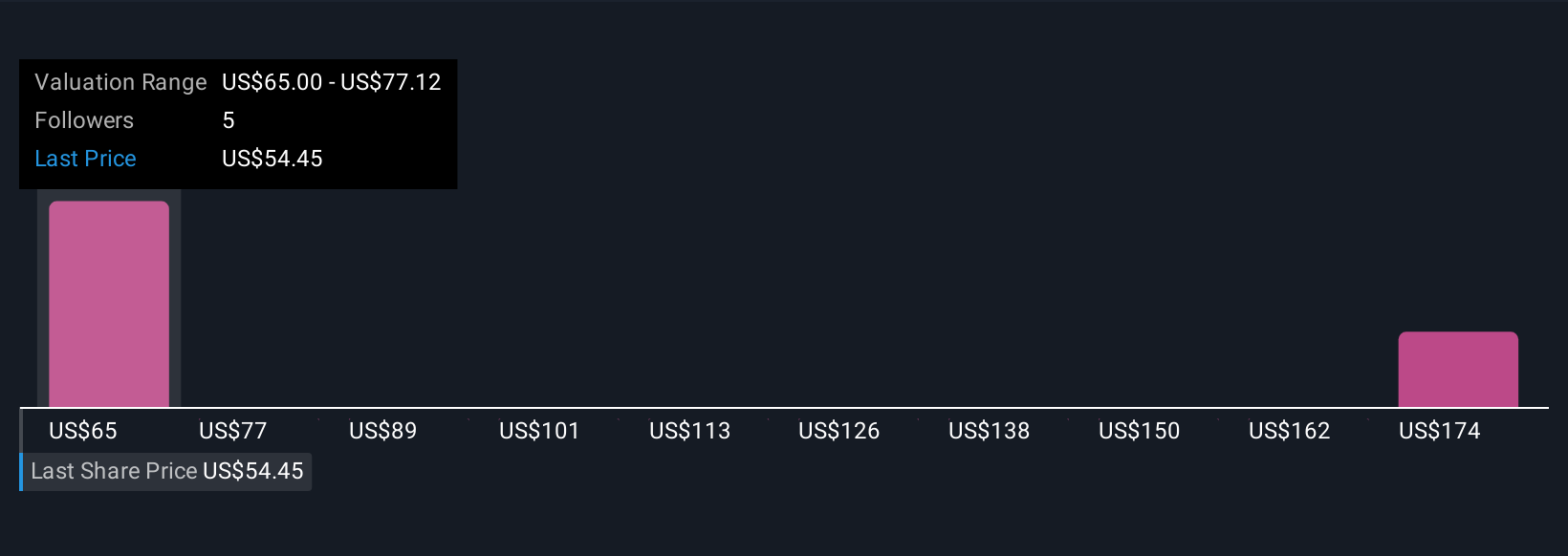

Two Simply Wall St Community fair value estimates for LivaNova span roughly US$69 to almost US$178, highlighting how far opinions can stretch on the same stock. As you weigh these against the recent Medicare reimbursement tailwind for VNS Therapy, it is worth considering how much growth and margin improvement you think higher paid procedure volumes can realistically support over time.

Explore 2 other fair value estimates on LivaNova - why the stock might be worth over 2x more than the current price!

Build Your Own LivaNova Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your LivaNova research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free LivaNova research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate LivaNova's overall financial health at a glance.

Interested In Other Possibilities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal