How Investors May Respond To Pool (POOL) Stabilizing Margins And Resumed Building Materials Growth

- Pool Corporation’s Q3 2025 results showed past-quarter stabilization through the cyclical downturn, with its building materials segment posting its first year-over-year revenue increase since Q3 2022 and gross margins improving on pricing discipline, supply chain efficiencies, and higher-margin private label growth.

- This combination of recovering remodel and new pool activity, margin expansion, and reaffirmed full-year EPS guidance highlights management’s ability to adjust operations effectively during a challenging demand cycle.

- We’ll now examine how Pool’s return to year-over-year building materials growth and margin improvement may reshape its longer-term investment narrative.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Pool Investment Narrative Recap

To own Pool, you have to believe that its large installed base of pools and recurring maintenance demand can offset a sluggish backdrop for new construction. The latest Q3 stabilization in building materials and margin gains supports the near term catalyst of a remodel recovery, but does little to reduce the biggest current risk: prolonged pressure from high interest rates and weak housing turnover that could constrain discretionary pool spending.

Among recent announcements, the reaffirmed full year 2025 EPS guidance of US$10.81 to US$11.31 stands out alongside Q3’s first year over year building materials growth since 2022. This pairing suggests the company is managing the ongoing housing and interest rate headwinds with tighter operations and a richer private label mix, which matters if investors are focused on margins rather than a quick rebound in new pool permits.

Yet even with better margins and steady guidance, investors should be aware that persistent high interest rates could still...

Read the full narrative on Pool (it's free!)

Pool’s narrative projects $5.8 billion revenue and $475.4 million earnings by 2028. This requires 3.5% yearly revenue growth and about a $66.6 million earnings increase from $408.8 million today.

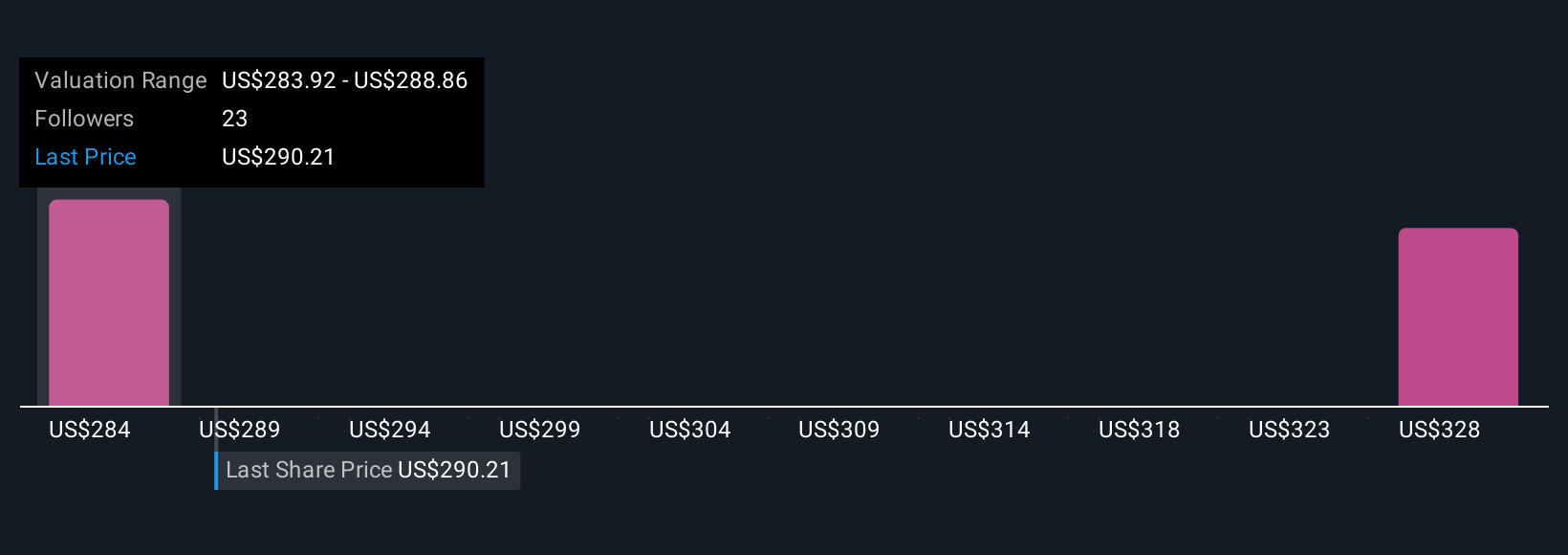

Uncover how Pool's forecasts yield a $333.27 fair value, a 39% upside to its current price.

Exploring Other Perspectives

Two fair value estimates from the Simply Wall St Community cluster between US$302.89 and US$333.27, suggesting some see meaningful upside from current prices. You can weigh those views against the risk that prolonged housing and rate headwinds keep Pool’s recovery more reliant on remodel and maintenance demand than on a bounce in new pool construction.

Explore 2 other fair value estimates on Pool - why the stock might be worth as much as 39% more than the current price!

Build Your Own Pool Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Pool research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Pool research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Pool's overall financial health at a glance.

No Opportunity In Pool?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal