US Stock Outlook | Futures of the three major stock indexes are rising, and the battle is on the “Federal Reserve Week”!

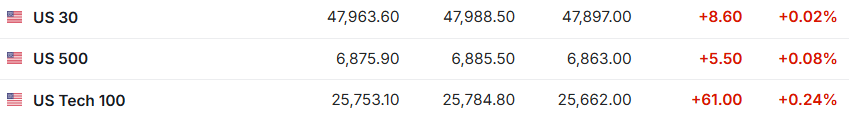

1. On December 8 (Monday), the futures of the three major US stock indexes rose sharply before the US stock market. As of press release, Dow futures were up 0.02%, S&P 500 futures were down 0.08%, and NASDAQ futures were down 0.24%.

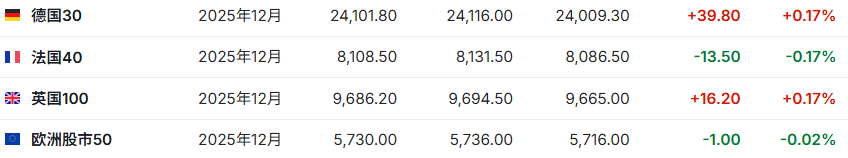

2. As of press release, the German DAX index rose 0.17%, the French CAC40 index fell 0.17%, the British FTSE 100 index rose 0.17%, and the European Stoxx 50 index fell 0.02%.

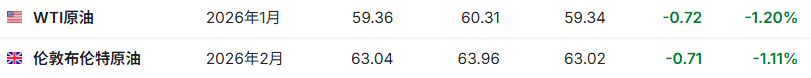

3. As of press release, WTI crude oil fell 1.20% to $59.36 per barrel. Brent crude fell 1.11% to $63.04 per barrel.

Market news

Fight for “Federal Reserve Week”! Are historically high US stocks and a nervous bond market just waiting for Powell to “make up the deal”? As the bond market nervously assessed the outlook, US stocks closed close to record highs last Friday, and the S&P 500 index hovered below 6,900 points. Investors will have a busy schedule this week. The last Federal Reserve policy meeting in 2025 and the press conference of Federal Reserve Chairman Powell after the announcement of the interest rate decision will be the highlight. In terms of corporate earnings, Oracle (ORCL.US) and Adobe (ADBE.US) will release financial reports on Wednesday, and Broadcom (AVGO.US) and Market Opener (COST.US) will announce financial reports on Thursday. In terms of economic data, it will continue last week's labor market theme. The JOLTS job vacancy data for October, which was delayed for some reason, will be released on Tuesday. The data will clarify recruitment, dismissal, and separation.

The Federal Reserve's interest rate meeting is approaching, and internal differences reveal the problems of the next chairman. The Federal Reserve is expected to cut interest rates for the third time in a row this week, but the challenges faced by Chairman Powell in getting support from his colleagues indicate the difficult tests his successor will face in the future. Every rate cut this year has been accompanied by negative votes. It is expected that at the last meeting of the year, three policy makers will once again vote against it. Faced with the only tool to deal with two conflicting goals — excessive inflation and a weak job market — the Federal Reserve leader, known for being able to gather consensus even in difficult times, now finds this task almost impossible to complete. Given that Powell (whose term as chairman expires in May next year) enjoys deep respect in the interest rate setting committee, this bodes ill for the next chairman's ability to unite his 18 colleagues.

Xiaomo warns: After the Fed cuts interest rates this week, it may be difficult for US stocks to continue to rise. The strategist at J.P. Morgan Chase said that after the Federal Reserve is expected to cut interest rates, the recent rise in the stock market may come to a standstill as investors may choose to make a profit settlement. The market currently prices the probability that the Federal Reserve will cut interest rates on Wednesday at 92%. Market bets have been rising steadily over the past few weeks, fueled by dovish rhetoric from policy makers, helping to boost the stock market. “Investors may be tempted to lock in earnings before the end of the year rather than increase directional exposure,” the team led by Mislav Matejka wrote in a report. “Interest rate cuts are now fully reflected in prices, and the stock market has returned to a high point.” J.P. Morgan's strategists are still optimistic about the medium-term outlook, saying that the dovish US Federal Reserve will support the stock market.

“The economic performance was better than expected”! US Treasury Secretary Bezent: The holiday shopping season is strong, and the GDP growth rate will end at 3%! US Treasury Secretary Bessent said the holiday shopping season has performed “very strong” so far and predicts that the US economy will end the year on a solid foundation. In an interview, he said, “The economic performance was better than we expected. We have achieved 4% GDP growth in two quarters. Despite the government shutdown, we will end the year with 3% real GDP growth.” According to data from the US Bureau of Economic Analysis (BEA), the US gross domestic product (GDP) contracted 0.6% year-on-year in the first three months of 2025. The second quarter saw an increase of 3.8%. BEA's preliminary estimate of economic performance for the third quarter will be announced on December 23. The Atlanta Federal Reserve's latest estimate on December 5 shows that the annualized GDP growth rate for the third quarter was 3.5%.

“AI won't replace humans on a large scale next year!” CEO Komo refuted the fear of unemployment, saying that American consumers are still stable. J.P. Morgan CEO Jamie Dimon said on Sunday that although employment has begun to cool down and inflation remains stubborn, the US economy and American consumers are still on a solid foundation because artificial intelligence is reshaping productivity, but it has not immediately triggered a wave of unemployment. In an interview, Dimon said that even with initial signs of weakness in the labor market, consumer spending and corporate profits remain elastic. He said, “In the short term, American consumers seem to be performing well. They are making steady progress. Businesses are making profits, and the stock market is very high. This is likely to continue.” At the same time, he also acknowledged that there are areas of concern, adding: “There are some minor negative factors: employment is weakening, but only slightly, inflation is still there, and it probably won't fall.”

US stocks have gone from a standout in AI to a “cyclical group dance”! Damo is betting on a rolling recovery in 2026, with cyclical stocks leading the second phase of the bull market. Wall Street financial giant Morgan Stanley released a research report saying that the OBBBA (the so-called “big and beautiful” bill) passed by the Trump administration in 2025 will strongly drive economic growth effects starting in 2026. Combined with the price increase brought about by Trump's tariff policy, it was eventually proven to be a temporary inflation disturbance until short-term inflation gradually dissipates, and technology giants such as Google are in full swing. They will jointly drive the US economy to show a moderate macroeconomic growth environment with a “golden girl style soft landing” in 2026 . Therefore, Damo defines 2026 as a “broad-spectrum stock market bull market under rolling recovery,” arguing that the return of “point-to-point” market risk appetite resonates with multiple cyclical industries to rise.

Individual stock news

51Talk (COE.US)'s Q3 revenue grew strongly by 87.5%, and the number of users surged 70%. 51Talk achieved strong revenue growth and user expansion in the third quarter, but profitability faced challenges. Core financial highlights include: total net revenue increased 87.5% year over year to US$26.3 million, and total bill revenue surged 104.6% to US$40.5 million. At the same time, the number of quarterly active students also increased by 71.4% to 112,600. However, due to a significant increase in operating expenses (especially marketing investment), the company's operating loss increased from US$786,000 in the same period last year to nearly US$4.157 million. Despite this, the company recorded an operating cash inflow of $6.6 million this quarter, indicating a healthy cash flow situation.

Is streaming “Big Mac” born and changed? Trump is concerned that Netflix's (NFLX.US) acquisition of Warner (WBD.US) will hit a red line of market share. US President Trump raised potential antitrust concerns about Netflix's plan to acquire Warner Bros. Discovery Channel. He pointed out that the market share occupied by the merged entity may cause problems. When asked about the incident last Sunday, Trump said, “Well, this matter has to go through a series of procedures. We'll wait and see what the results are.” He also confirmed that he recently met Netflix CEO Ted Sarandos and praised the streaming company. Trump said, “But that's a huge market share. This could be an issue. “Netflix's market share is quite large, and once they join forces with Warner Bros., their market share will increase dramatically.”

“America's retail base” Robinhood (HOOD.US) enters Southeast Asia: buying Indonesian brokerage firms and crypto traders, targeting tens of millions of investors. Robinhood said in a blog post last Sunday that it will acquire Indonesian brokerage firm Buana Capital Sekuritas and licensed digital asset trader Pedagang Aset Kripto, marking the retail trading platform's entry into one of Southeast Asia's major cryptocurrency hubs. Robinhood did not disclose the financial terms of the deal. It is expected that the transaction will be completed in the first half of 2026, and is still subject to regulatory approval from the Indonesian Financial Services Authority (OJK). The company said Pieter Tanuri, the majority shareholder of the two Indonesian companies, will continue to serve as Robinhood's strategic advisor.

LY.US (LLY.US), Johnson & Johnson (JNJ.US) and Pfizer (PFE.US) expand the Chinese market: their innovative drugs were included in the first edition of the commercial insurance catalogue. Eli Lilly, Pfizer, and Johnson & Johnson have taken a place in China's first innovative drug catalogue, opening up new market channels and improving sales prospects for expensive cutting-edge treatments. At the 2025 Innovative Drug High Quality Development Conference held in Baiyun District of Guangzhou, a total of 19 innovative drugs were included in the medical insurance reimbursement list. These drugs are too expensive and are not covered by national health insurance, but it is recommended that they be included in commercial health insurance. These medicines cover a wide range of diseases, including cancer, Alzheimer's disease, and rare genetic diseases. As China's population ages, demand for drugs to treat diseases such as cancer, diabetes, and dementia is growing. Incorporating these drugs into the health insurance system may reduce the burden on national health insurance.

The merger and acquisition incentive plan was boycotted by shareholders, and Anglo-American Resources urgently withdrew to pass the TECK.US acquisition case. The day before shareholders voted to acquire Tektronix Resources, Anglo-American Resources announced the cancellation of an executive incentive plan resolution. Last month, the Anglo-American Resources Remuneration Committee proposed that long-term incentive bonuses for 2024 and 2025 should be linked to the Tektronix acquisition. The original assessment metrics of the incentive plan covered return to shareholders, cash flow, return on capital, and environmental, social, and governance (ESG) performance. According to the original plan, at least 62.5% of the incentive share will take effect immediately after the acquisition is completed. Anglo-American Resources said on Monday that in view of objections raised by some shareholders, the company has decided to withdraw the resolution and stressed that the progress of the acquisition transaction is not a prerequisite for approval of the resolution.

Key economic data and event forecasts

00:00 a.m. Beijing time the next day: The US New York Federal Reserve's 1-year inflation forecast for November (%).

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal