EastGroup Properties (EGP) Valuation After New ATM Equity Program, Shelf Registration and Fresh Term Loans

EastGroup Properties (EGP) just rolled out a new at the market equity program and shelf registration alongside fresh term loans, giving the industrial REIT more flexibility to fund projects, manage debt, and respond to mixed analyst sentiment.

See our latest analysis for EastGroup Properties.

The new equity program and term loans land after a solid run, with EastGroup’s 90 day share price return of 9.09% and five year total shareholder return of 55.86% suggesting momentum remains constructive despite recent mixed analyst calls.

If these capital moves have you thinking about where else growth and confidence might line up, it could be worth exploring fast growing stocks with high insider ownership next.

With shares already near record highs and trading at only a modest discount to analyst targets, the key question now is whether EastGroup still offers hidden value or if the market has fully priced in its next leg of growth.

Most Popular Narrative: 7.2% Undervalued

With EastGroup closing at $179.91 against a narrative fair value of roughly $193.84, the story leans toward moderate upside driven by earnings resilience.

Management's strong balance sheet, ample land bank, and ability to accelerate development starts when demand rebounds ensures the company can capitalize early on secular demand trends, translating to scalable FFO growth and further upside in earnings as market sentiment normalizes.

Want to see what powers this upside case? The narrative leans on steady growth, firmer margins, and a future earnings multiple usually reserved for market darlings. Curious which assumptions really move that valuation?

Result: Fair Value of $193.84 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that upside case could unravel if industrial leasing slows further, or if higher for longer rates squeeze development returns and compress valuation multiples.

Find out about the key risks to this EastGroup Properties narrative.

Another Angle on Valuation

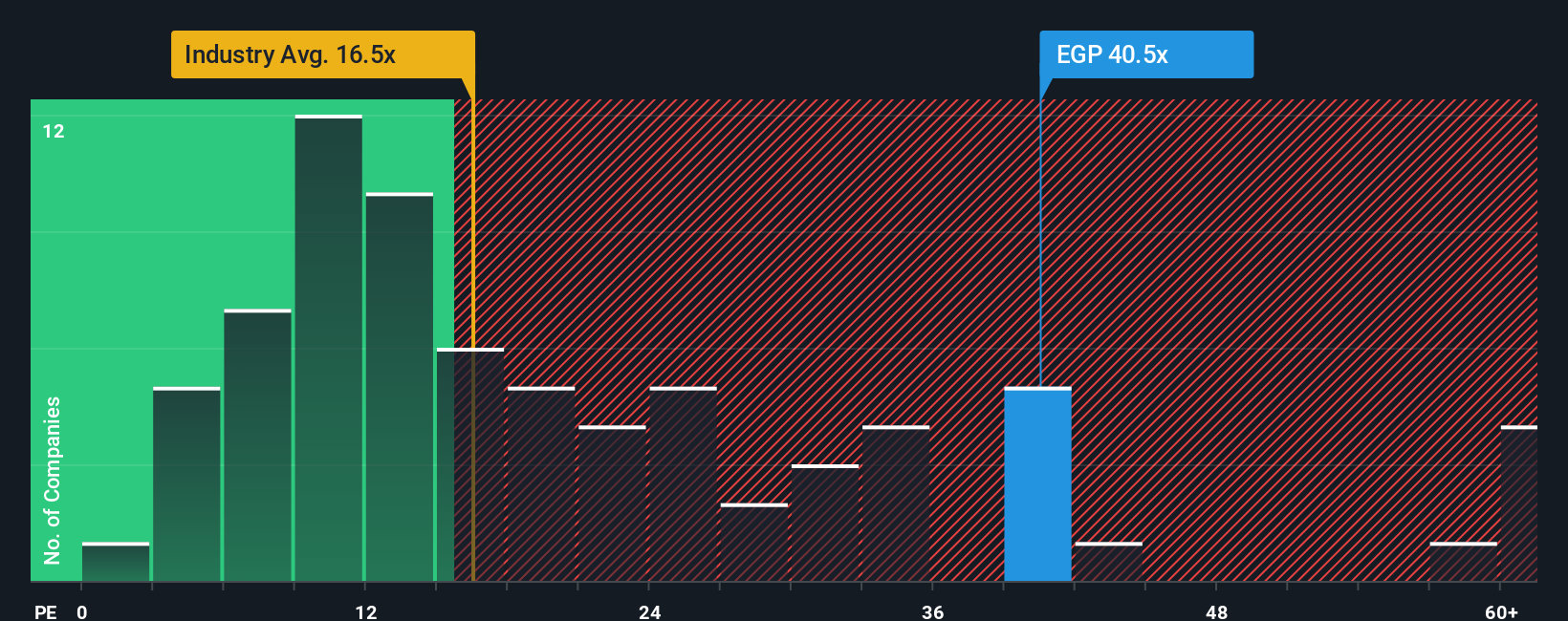

While the narrative fair value pegs EastGroup as roughly 7 percent undervalued, its price to earnings ratio of 38.6 times tells a tougher story. This multiple is well above the global Industrial REITs average of 15.9 times and a fair ratio of 33.5 times, which hints at less margin for error than the upside case suggests.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own EastGroup Properties Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a custom view in minutes with Do it your way.

A great starting point for your EastGroup Properties research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, explore a few additional opportunities by scanning focused stock ideas from the Simply Wall Street Screener, tailored to different strategies and risk levels.

- Look for higher potential returns by targeting out of favor businesses that still generate strong cash flows using these 905 undervalued stocks based on cash flows as your hunting ground for potentially mispriced quality.

- Gain exposure to innovation by reviewing these 26 AI penny stocks, which covers companies using artificial intelligence in ways that may reshape industries and earnings profiles.

- Support your income-focused approach by considering these 15 dividend stocks with yields > 3%, which highlights stocks that combine dividend yields with financial characteristics often associated with more sustainable payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal