Is Vishay (VSH) Quietly Repositioning Around High-Voltage SiC To Defend Its Power Leadership?

- Vishay Intertechnology recently introduced two 1200 V silicon carbide MOSFET power modules in low-profile MAACPAK PressFit packages and a 1500 V Automotive Grade solid-state relay for 800 V battery monitoring, targeting automotive, energy, industrial, and telecom applications with higher efficiency, reliability, and compliance with key isolation standards.

- Together, these launches highlight Vishay’s push into higher-voltage, silicon carbide-based and safety-critical products that can deepen its role in electric vehicles, energy storage, and industrial power systems.

- We’ll now examine how this expansion into high-voltage silicon carbide modules and automotive-grade relays may influence Vishay’s broader investment narrative.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Vishay Intertechnology Investment Narrative Recap

To own Vishay Intertechnology, you need to believe its heavy capacity build-out and push into higher value silicon carbide and automotive products will eventually translate into sustainable profitability despite recent losses and negative free cash flow. These new 1200 V SiC MOSFET modules and 1500 V automotive solid-state relays support key catalysts in EVs, energy storage, and industrial power, but do not materially change the near term risk that margins and cash flows remain under pressure if demand disappoints.

Of the recent announcements, the launch of the 1500 V Automotive Grade VORA1150 solid-state relay stands out, because it targets 800 V battery monitoring in EVs and energy storage, directly tying into Vishay’s aim to grow higher margin, automotive and power management content per system. If design wins scale from products like this relay and the new SiC modules, they could help improve product mix and support the company’s planned earnings recovery.

Yet, while these products expand Vishay’s reach in attractive end markets, investors should be aware that its ongoing heavy capacity expansion could...

Read the full narrative on Vishay Intertechnology (it's free!)

Vishay Intertechnology's narrative projects $3.5 billion revenue and $587.0 million earnings by 2028. This requires 6.6% yearly revenue growth and a $674.7 million earnings increase from $-87.7 million today.

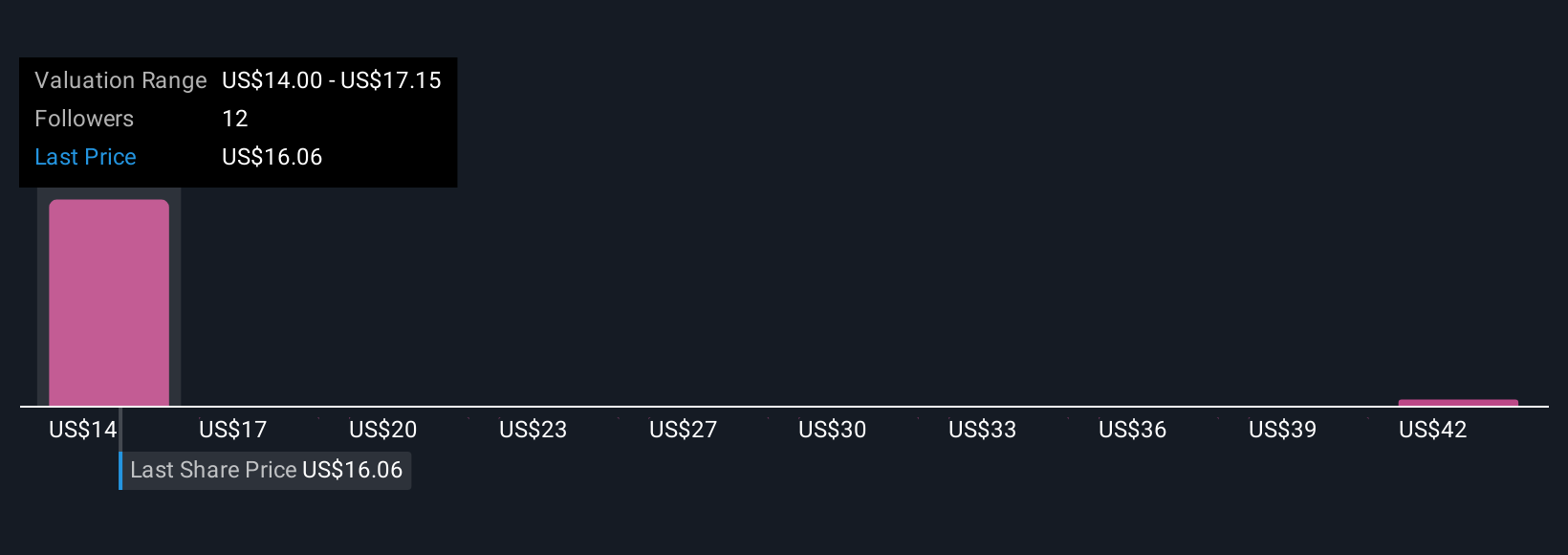

Uncover how Vishay Intertechnology's forecasts yield a $14.00 fair value, a 8% downside to its current price.

Exploring Other Perspectives

Three Simply Wall St Community fair value estimates for Vishay span roughly US$6.87 to US$45.54 per share, underscoring how far opinions can diverge. Against that backdrop, the company’s sizable capacity expansion and recent unprofitable results leave plenty of room for different interpretations of how quickly new SiC and automotive products might improve margins and earnings.

Explore 3 other fair value estimates on Vishay Intertechnology - why the stock might be worth less than half the current price!

Build Your Own Vishay Intertechnology Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Vishay Intertechnology research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Vishay Intertechnology research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Vishay Intertechnology's overall financial health at a glance.

Curious About Other Options?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal