What Herbalife (HLF)'s Revenue Beat But Margin Squeeze Means For Shareholders

- In its latest quarter, reported before today, Herbalife posted US$1.27 billion in revenue, up 2.7% year on year and ahead of analyst expectations, alongside EBITDA that also surpassed forecasts despite weaker-than-anticipated gross margins.

- This mix of stronger top-line and EBITDA performance but softer profitability metrics highlights how Herbalife’s current business model is balancing growth with cost pressures.

- With revenue and EBITDA beating expectations but gross margins under pressure, we’ll now examine how this earnings mix could influence Herbalife’s investment narrative.

We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Herbalife Investment Narrative Recap

To own Herbalife today, you need to believe its transition toward data-driven wellness, new products and digital tools can offset regulatory, reputational and volume headwinds in key markets. The latest quarter’s revenue and EBITDA beat helps the short term growth catalyst of stabilizing sales, but the ongoing gross margin pressure and modest full year guidance tightening keep the biggest risk focused on profitability resilience rather than a clear inflection in demand.

Against this backdrop, Herbalife’s updated 2025 guidance, with full year net sales now expected to be roughly flat and fourth quarter growth guided to low single digits, is especially relevant. It frames the recent revenue surprise as incremental progress rather than a step change in the company’s growth profile and keeps attention on whether its investments in personalized wellness and distributor technology can eventually translate into sustained volume gains and healthier margins.

Yet while recent numbers look encouraging, the increasing global regulatory scrutiny on multi-level marketing and supplement claims is something investors should be aware of...

Read the full narrative on Herbalife (it's free!)

Herbalife's narrative projects $5.6 billion revenue and $152.6 million earnings by 2028. This implies 4.4% yearly revenue growth and an earnings decrease of $172.4 million from $325.0 million today.

Uncover how Herbalife's forecasts yield a $9.67 fair value, a 21% downside to its current price.

Exploring Other Perspectives

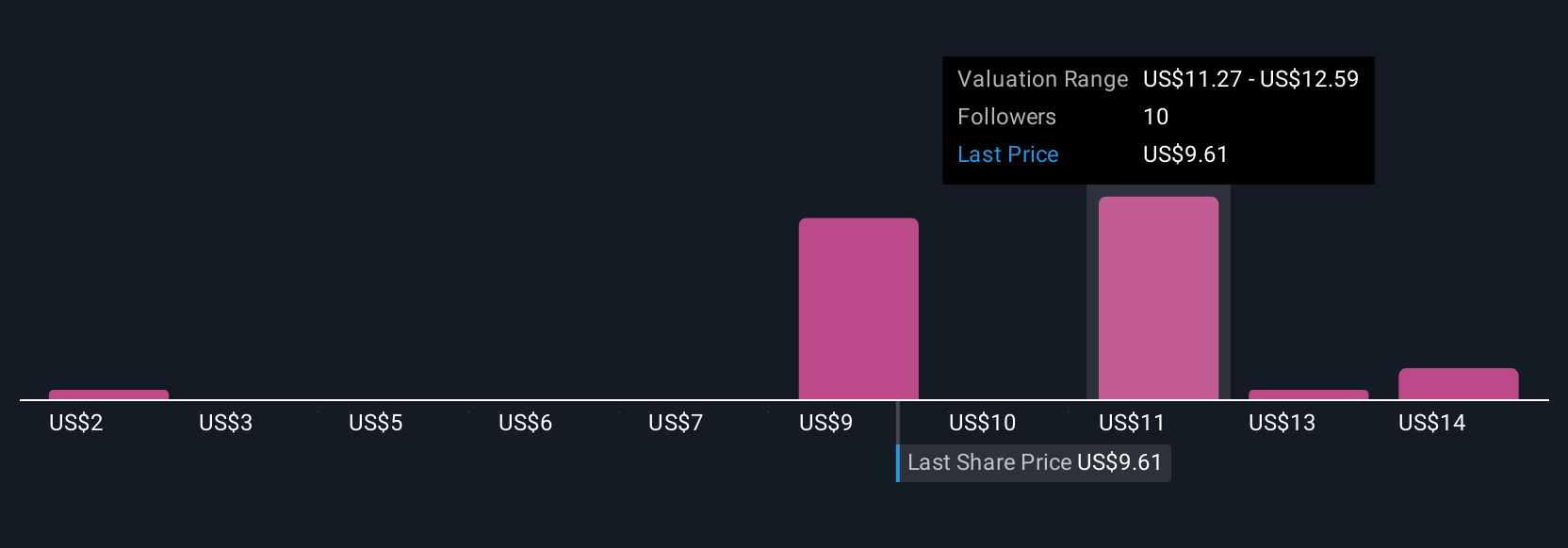

Nine fair value estimates from the Simply Wall St Community span roughly US$2 to US$21 per share, showing how far apart individual views can be. As you weigh these perspectives, keep in mind that rising regulatory scrutiny on multi level marketing models could materially influence Herbalife’s ability to translate revenue resilience into long term earnings stability.

Explore 9 other fair value estimates on Herbalife - why the stock might be worth less than half the current price!

Build Your Own Herbalife Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Herbalife research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Herbalife research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Herbalife's overall financial health at a glance.

Want Some Alternatives?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal