Extendicare (TSX:EXE) Valuation After $200 Million Raise for CBI Home Health Acquisition

Extendicare (TSX:EXE) just closed a CA$200 million private placement to help its ParaMed unit buy CBI Home Health. This deal could reshape its home care footprint across Canada and sharpen its growth profile.

See our latest analysis for Extendicare.

The market seems to like this strategic push, with a roughly 38% 1 month share price return and a powerful 1 year total shareholder return of about 120%. This suggests momentum rather than a one off spike.

If this kind of consolidation story has your attention, it could be worth scanning other Canadian and global healthcare stocks for more health focused opportunities riding similar demand trends.

With the stock up sharply, trading near analyst targets and boasting strong multi year returns, investors now face the key question: is Extendicare still undervalued or is the market already pricing in its next leg of growth?

Price-to-Earnings of 20.6x: Is it justified?

Based on a price to earnings ratio of 20.6 times and a last close of CA$22.33, Extendicare screens as modestly valued rather than outright stretched on earnings alone.

The price to earnings multiple compares what investors are paying today for each dollar of current profit, a particularly useful yardstick in mature, income focused healthcare names where cash generation and profit stability matter more than hyper growth.

For Extendicare, this 20.6 times earnings tag sits slightly below the broader North American healthcare average of 22.2 times, yet above the closer peer group at 18.2 times. This positioning suggests the market is prepared to pay a small premium versus direct peers while still applying a discount to the wider sector, likely reflecting its mix of steady revenue growth, high reported return on equity and elevated leverage.

In other words, the multiple is not bargain basement. Its position between peer and industry benchmarks indicates investors are pricing in above market revenue growth and strong earnings momentum without giving the stock the richest sector valuation.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 20.6x (ABOUT RIGHT)

However, regulatory changes or integration challenges with CBI Home Health could compress margins and temper the earnings growth currently underpinning Extendicare’s valuation.

Find out about the key risks to this Extendicare narrative.

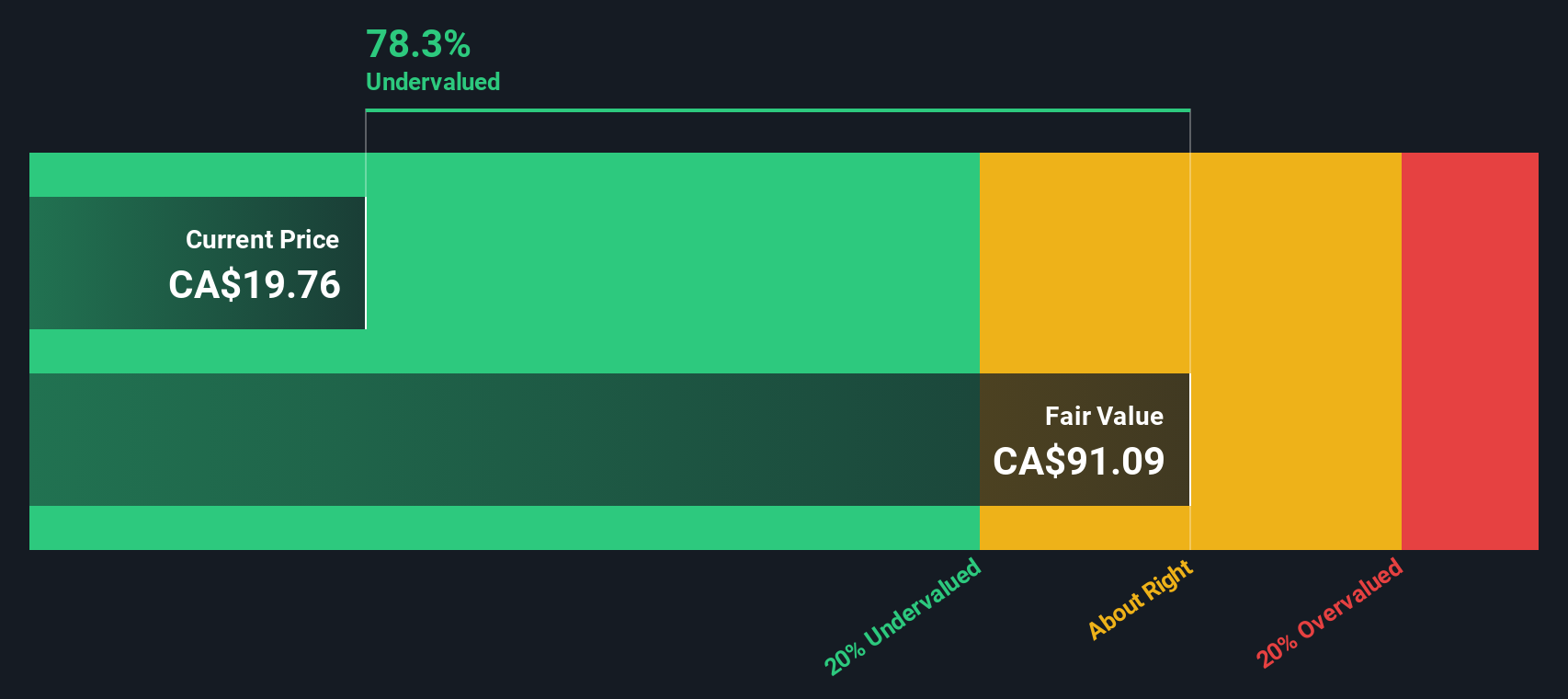

Another View: DCF Points to Deep Upside

While a 20.6 times earnings multiple suggests Extendicare is fairly priced, our DCF model offers a very different perspective. On those cash flow assumptions, fair value sits around CA$151 per share, implying the stock could be heavily undervalued if the inputs prove realistic.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Extendicare for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 905 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Extendicare Narrative

If you see the numbers differently or want to stress test your own assumptions, you can build a custom narrative in just a few minutes: Do it your way.

A great starting point for your Extendicare research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more high conviction ideas?

Before you move on, lock in your edge by using the Simply Wall St Screener to uncover targeted opportunities that match your exact investing playbook.

- Secure a stream of potential income by checking out these 15 dividend stocks with yields > 3%, which can help strengthen the yield side of your portfolio.

- Capitalize on market mispricings with these 905 undervalued stocks based on cash flows, which may offer compelling upside based on solid cash flow fundamentals.

- Step ahead of the crowd by examining these 81 cryptocurrency and blockchain stocks, positioned at the intersection of traditional markets and digital assets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal