How Bobcat’s IP Lawsuits and Potential Import Ban Risk Could Impact Caterpillar (CAT) Investors

- In recent days, Doosan Bobcat’s North American unit filed multiple patent infringement lawsuits against Caterpillar and dealer Holt Texas, alleging that certain dozers, excavators, and other machines misuse Bobcat’s machine control and manoeuvrability technology and seeking damages plus an import ban on the contested equipment.

- This legal challenge introduces fresh uncertainty around Caterpillar’s intellectual property exposure and the availability of key products that underpin its heavy equipment franchise.

- We’ll now assess how the threat of import restrictions on specific equipment lines may influence Caterpillar’s longer-term investment narrative.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Caterpillar Investment Narrative Recap

To own Caterpillar, you generally need to believe its global heavy equipment and services platform can keep generating solid cash flows despite cyclical and geopolitical pressures. The Bobcat patent suits introduce an extra legal and import-risk layer, but at this stage they do not clearly alter the main near term drivers, which remain tariff impacts on margins and customer demand across construction and mining.

The company’s Q3 2025 update, where management raised full year revenue guidance to modest growth versus 2024, is an important backdrop to this legal development. Investors now have to weigh that improving top line outlook against the possibility that any import restrictions or damages related to the Bobcat claims could incrementally pressure profitability or product availability in key categories.

Yet the bigger risk investors should be aware of is how rising trade barriers and tariff structures could eventually...

Read the full narrative on Caterpillar (it's free!)

Caterpillar's narrative projects $74.0 billion revenue and $13.5 billion earnings by 2028. This requires 5.5% yearly revenue growth and a roughly $4.1 billion earnings increase from $9.4 billion today.

Uncover how Caterpillar's forecasts yield a $587.67 fair value, a 3% downside to its current price.

Exploring Other Perspectives

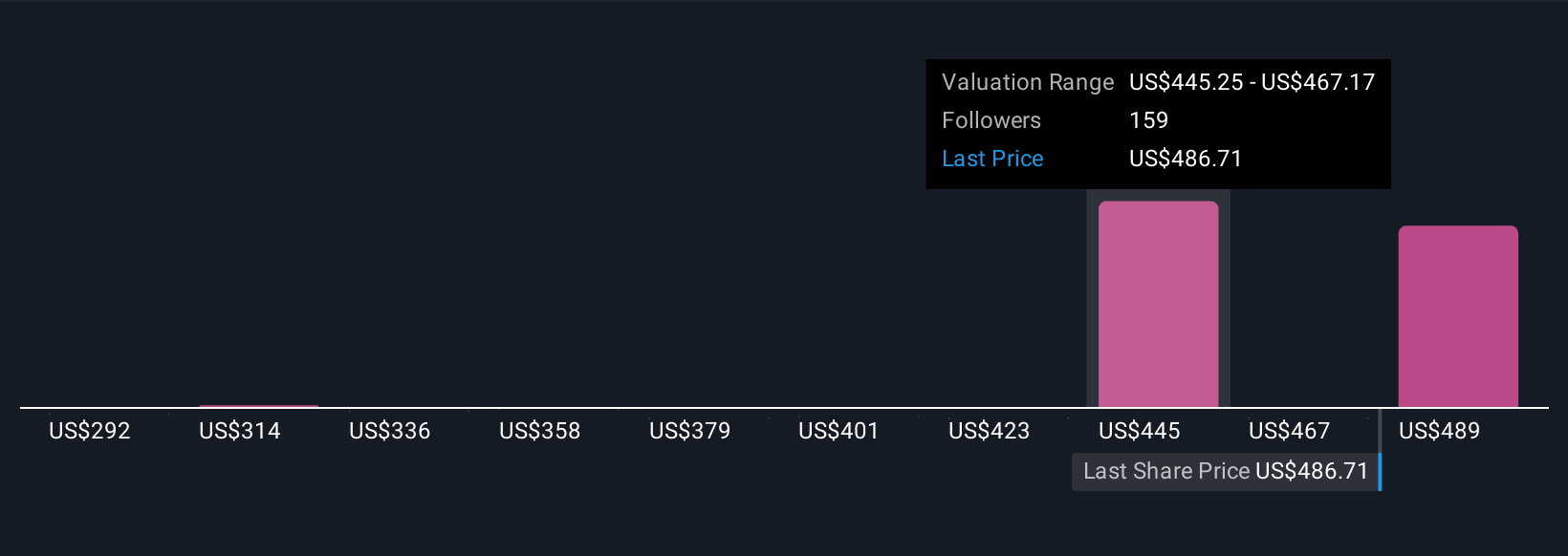

Eighteen fair value estimates from the Simply Wall St Community span roughly US$292 to US$588 per share, showing a wide spread in expectations. You can set those views against the risk that new or prolonged tariffs might add a structural US$1.3 billion to US$1.5 billion pre tax headwind to Caterpillar’s margins, with clear implications for future performance.

Explore 18 other fair value estimates on Caterpillar - why the stock might be worth as much as $587.67!

Build Your Own Caterpillar Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Caterpillar research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Caterpillar research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Caterpillar's overall financial health at a glance.

Contemplating Other Strategies?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal