Does Record A&D Momentum And CEO Stock Sale Change The Bull Case For nLIGHT (LASR)?

- In early December 2025, nLIGHT reported third-quarter results that exceeded analyst expectations, with revenue rising nearly 19% year on year and record aerospace and defense sales, while President and CEO Scott H. Keeney sold about US$873,000 of stock under a prearranged plan partly to cover tax obligations.

- The combination of strong aerospace and defense momentum and management’s continued substantial ownership base has reinforced investor confidence despite the stock sales.

- We’ll now examine how nLIGHT’s record aerospace and defense revenue and upbeat guidance influence the company’s broader investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

nLIGHT Investment Narrative Recap

To own nLIGHT, you have to believe its growing aerospace and defense laser business can eventually support a path toward profitability, despite current losses and high reliance on U.S. defense programs. The latest beat in third quarter results and stronger guidance appear to reinforce the near term growth catalyst in directed energy, while not materially changing the key risk that any shift in government priorities or funding could quickly pressure revenue.

The most relevant recent development is nLIGHT’s upbeat guidance for the fourth quarter of 2025, with projected revenue of US$72 million to US$78 million, which underscores management’s confidence in continued aerospace and defense momentum after a record third quarter. This guidance, combined with strong analyst reactions, sits squarely against the backdrop of a revenue mix that is now heavily tilted toward defense programs and still weak commercial and industrial demand.

But while the growth story looks appealing, investors should be aware that nLIGHT’s dependence on a handful of large U.S. defense programs means...

Read the full narrative on nLIGHT (it's free!)

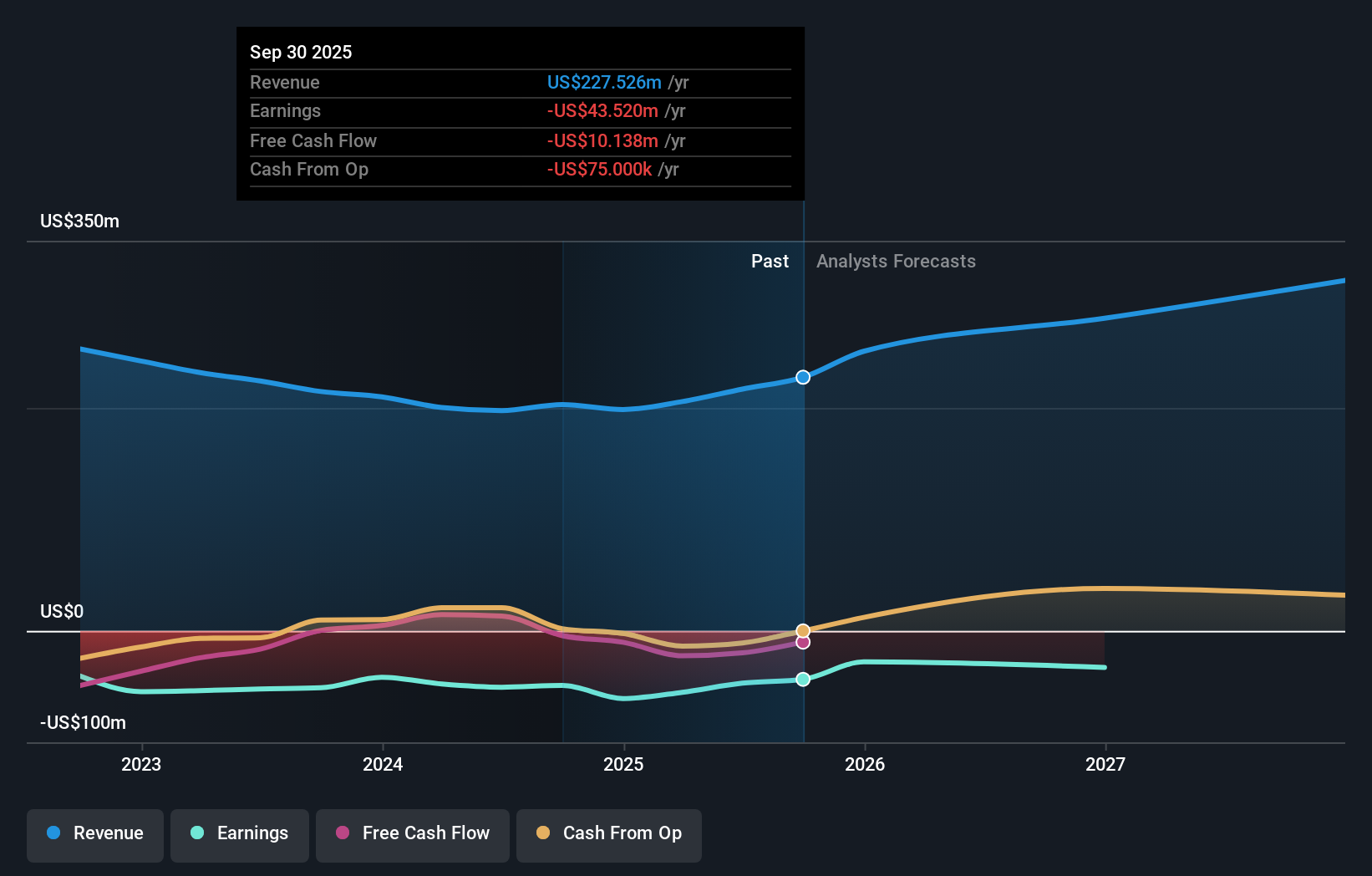

nLIGHT's narrative projects $310.5 million revenue and $28.1 million earnings by 2028.

Uncover how nLIGHT's forecasts yield a $41.50 fair value, a 14% upside to its current price.

Exploring Other Perspectives

Two fair value estimates from the Simply Wall St Community span US$22.83 to US$41.50, showing how far apart individual views can be. When you weigh those opinions against nLIGHT’s heavy exposure to U.S. defense spending, it underlines why checking several perspectives on the company’s prospects can matter.

Explore 2 other fair value estimates on nLIGHT - why the stock might be worth 37% less than the current price!

Build Your Own nLIGHT Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your nLIGHT research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free nLIGHT research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate nLIGHT's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal