Will KeyBanc’s Upgrade and Low Capex Focus Change Curbline Properties' (CURB) Investment Narrative?

- Earlier this week, KeyBanc upgraded Curbline Properties to an Overweight rating, citing projected double-digit AFFO growth and firming REIT sector conditions supported by slower new supply.

- The bank pointed to Curbline’s highly leased convenience shopping center portfolio, broad diversification, and relatively low capital expenditure needs as key strengths underpinning its outlook.

- We’ll now examine how KeyBanc’s confidence in Curbline’s low capital expenditure profile could influence the company’s broader investment narrative.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

What Is Curbline Properties' Investment Narrative?

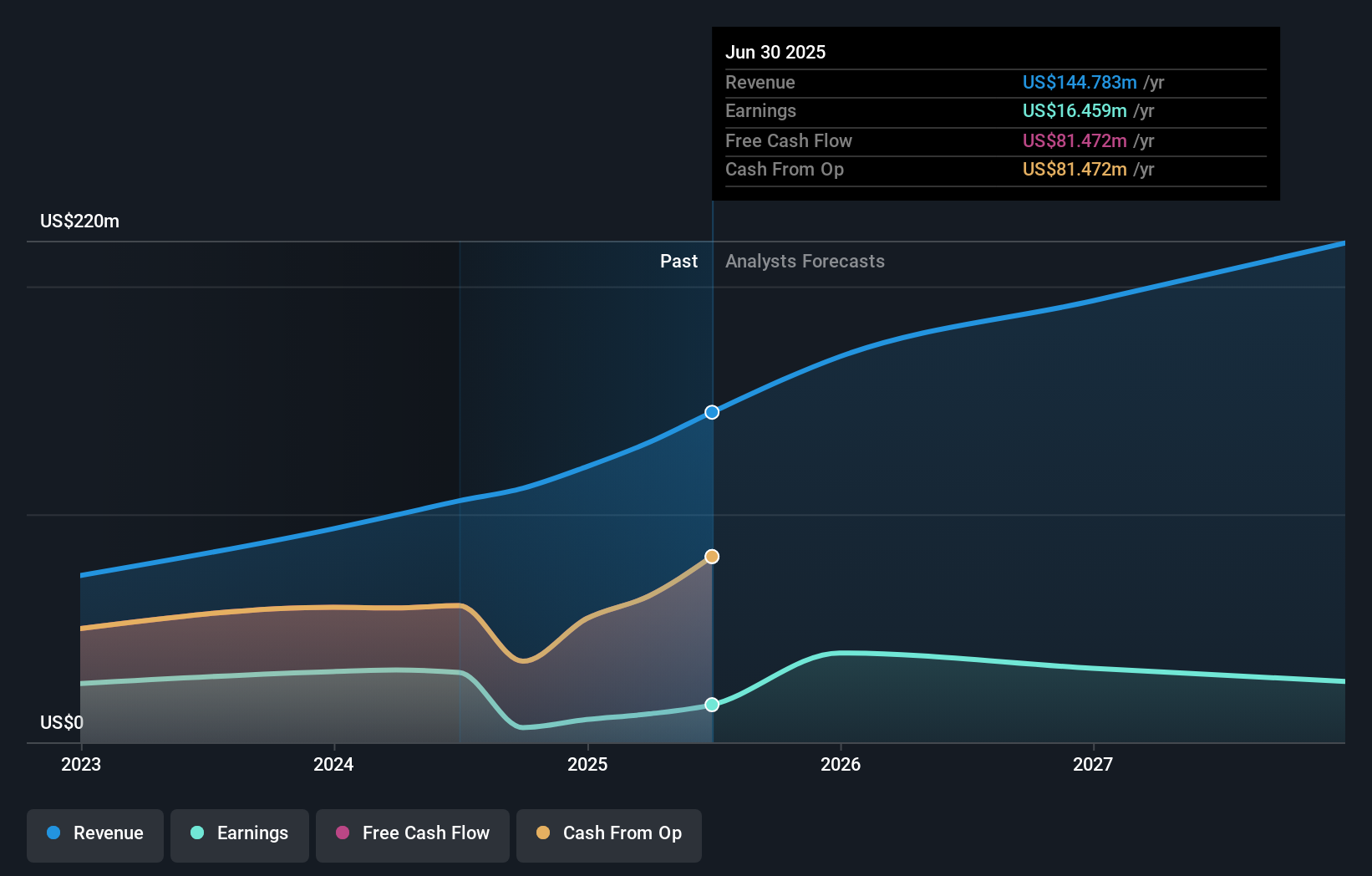

To own Curbline, you have to believe in the appeal of necessity-based, convenience shopping centers, the stickiness of its high occupancy, and management’s ability to turn that into durable AFFO, even as reported net income guidance has been trimmed twice this year. The KeyBanc upgrade reinforces that thesis in the near term, especially around lower capital expenditure needs and the potential to scale via recently arranged unsecured notes without constantly returning to equity markets. That said, the stock already trades on a rich earnings multiple, with consensus expecting revenue expansion but softer earnings ahead, so the rating change alone may not reshape the core risk‑reward. The more immediate swing factors still look like execution on acquisitions funded with higher-cost debt and how a relatively new board steers capital allocation.

However, investors should also weigh how rising leverage could constrain Curbline if conditions weaken. Despite retreating, Curbline Properties' shares might still be trading above their fair value and there could be some more downside. Discover how much.Exploring Other Perspectives

Explore another fair value estimate on Curbline Properties - why the stock might be worth just $56.74!

Build Your Own Curbline Properties Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Curbline Properties research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Curbline Properties research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Curbline Properties' overall financial health at a glance.

Interested In Other Possibilities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal