Block (SQ) Is Down 8.5% After Slower Square Growth And Afterpay Probe - Has The Bull Case Changed?

- In late November, Block used its UBS Global Technology & AI Conference appearance to flag that Square’s gross payment volume growth was slowing to the low double digits, even as it reported over 124 million Black Friday–Cyber Monday transactions and expanded its stock repurchase program by US$5.00 billion.

- At the same time, subsidiary Afterpay came under investigation by attorneys general from seven states over its Buy Now, Pay Later pricing and repayment practices, adding regulatory pressure to Block’s growing consumer finance ecosystem.

- We’ll now examine how Square’s slower growth outlook, alongside fresh regulatory scrutiny of Afterpay’s BNPL model, reshapes Block’s investment narrative.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Block Investment Narrative Recap

To own Block today you need to believe its two-sided ecosystem of Square merchants and Cash App users can still compound earnings, even as Square’s gross payment volume growth moderates and Afterpay faces more regulatory attention. The immediate catalyst remains execution on Cash App engagement and monetization, while the most pressing risk now sits in credit and regulatory exposure around BNPL and lending. The latest news meaningfully sharpens that risk, rather than changing the core long term thesis.

The US$5.0 billion increase to Block’s share repurchase program stands out against the recent share price sell off and softer Square outlook. For investors, this sits alongside management’s reiterated multi year gross profit targets as a key near term swing factor, especially as the market weighs strong holiday transaction data against slowing merchant GPV and a more uncertain regulatory backdrop for Afterpay.

Yet for all the focus on Cash App growth, investors should be aware that expanding BNPL and Borrow products could...

Read the full narrative on Block (it's free!)

Block's narrative projects $32.8 billion revenue and $2.4 billion earnings by 2028.

Uncover how Block's forecasts yield a $84.01 fair value, a 37% upside to its current price.

Exploring Other Perspectives

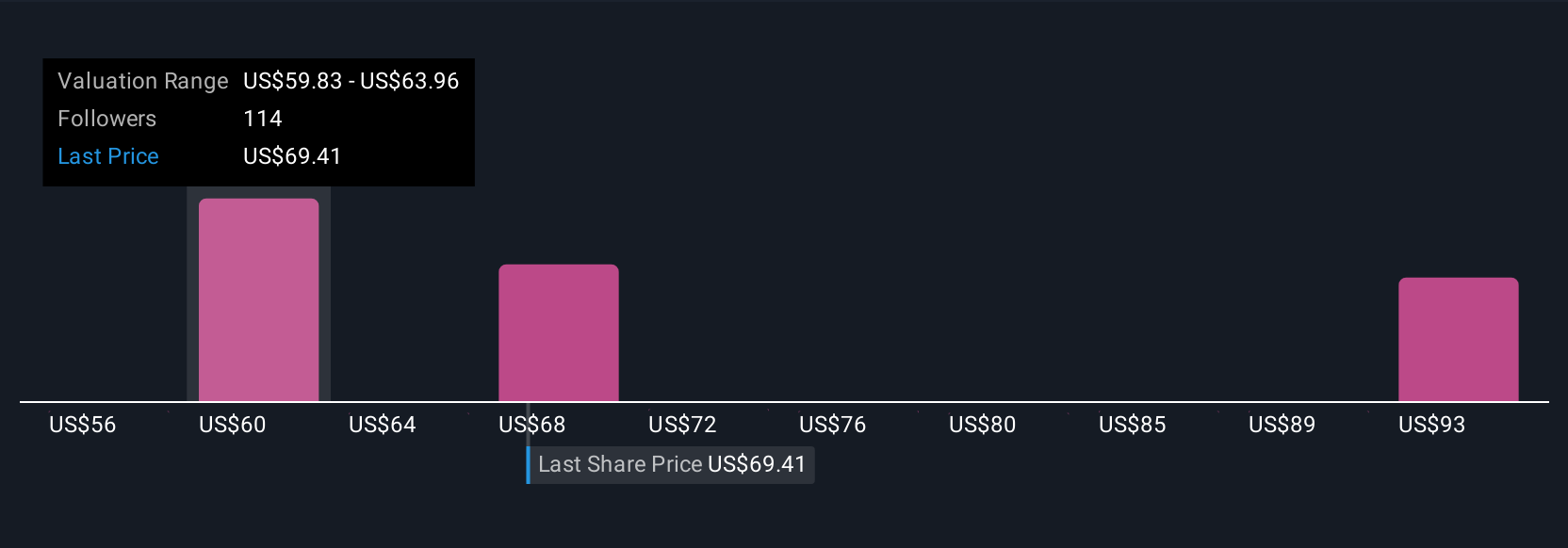

Fifteen members of the Simply Wall St Community currently see Block’s fair value anywhere between about US$56.74 and US$103, underlining how far opinions can stretch. Set that against rising concern over BNPL related credit and regulatory risk, and you can see why it pays to compare several viewpoints before deciding how Block might fit into your portfolio.

Explore 15 other fair value estimates on Block - why the stock might be worth as much as 69% more than the current price!

Build Your Own Block Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Block research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Block research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Block's overall financial health at a glance.

Searching For A Fresh Perspective?

Our top stock finds are flying under the radar-for now. Get in early:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal