KNOT Offshore Partners (NYSE:KNOP) Profit Rebound Tests Bear Narratives on Earnings Quality

KNOT Offshore Partners (NYSE:KNOP) has just laid out another steady quarter, with Q2 2025 revenue of about $86 million and EPS of $0.15 setting the tone for its latest update. The business has seen revenue move from roughly $74 million in Q2 2024 to $86 million in Q2 2025, while EPS has swung from a loss of about $0.42 a year ago to positive territory across recent quarters, signaling a very different earnings backdrop for unitholders to digest. With that shift in profitability now clearer and margins looking more resilient than they did a year ago, investors will be focusing on how durable this earnings profile really is.

See our full analysis for KNOT Offshore Partners.With the latest numbers on the table, the next step is to line them up against the dominant narratives around KNOP to see which stories hold up and which ones the results quietly undermine.

See what the community is saying about KNOT Offshore Partners

Profitability Back After Volatile Five Years

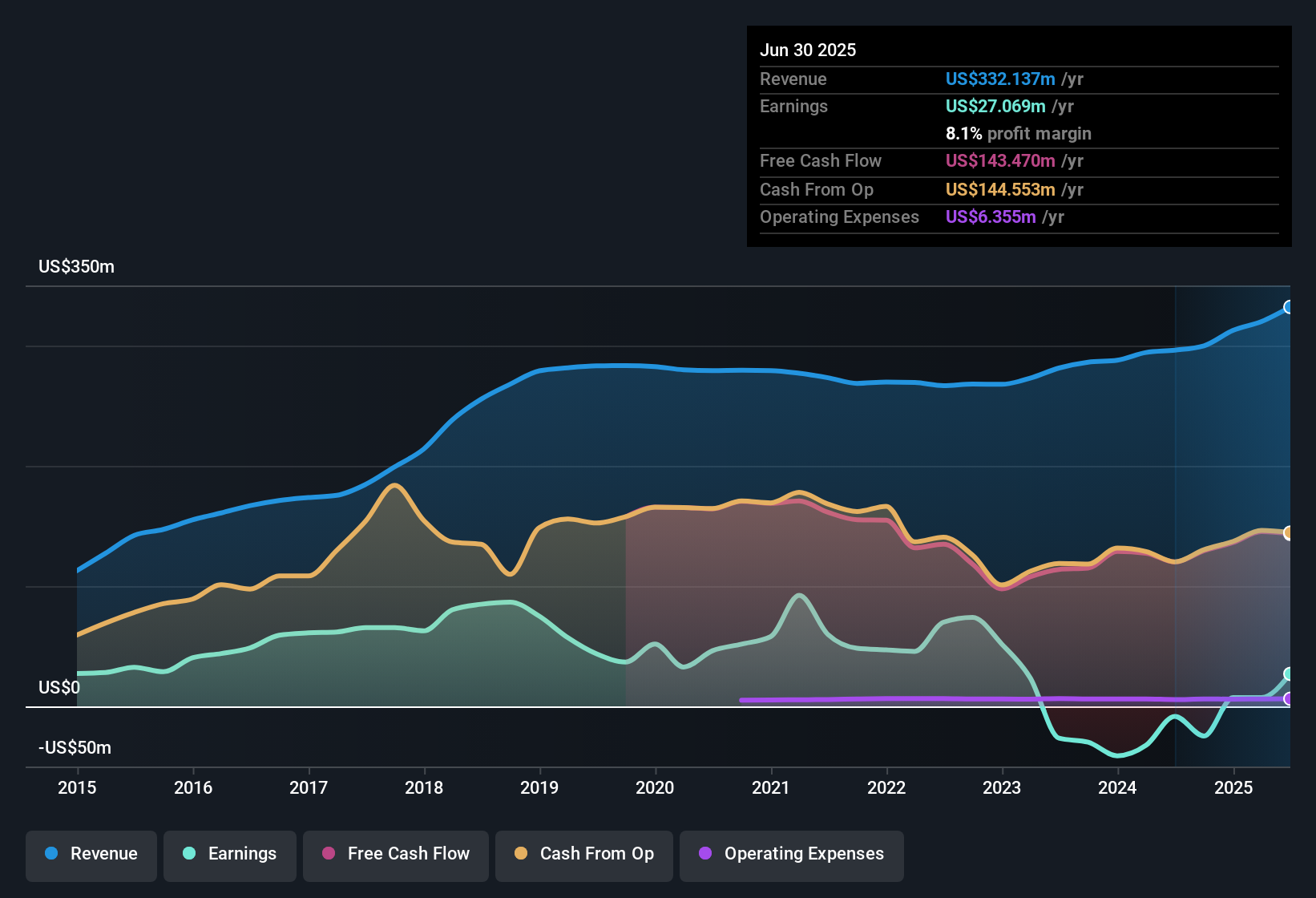

- Over the last 12 months, KNOP generated about $27.1 million of net income and $0.77 in basic EPS, a sharp contrast to five year earnings that have fallen by roughly 47.1 percent per year.

- Consensus narrative points to stable demand from long term shuttle tanker contracts and high vessel utilization, yet that steady backdrop sits alongside historically weak profitability, which

- highlights how recent positive EPS of $0.15 in Q2 2025 and $0.47 in Q4 2024 still sit on top of a much bumpier multi year track record

- suggests investors need to separate one year profitability from the longer term earnings decline before assuming those contracts translate into durable profit growth

One Off Gain Distorts Recent Trend

- Trailing 12 month earnings include a single $8.5 million gain, which is a meaningful slice of the $27.1 million net income and inflates the $0.77 EPS figure.

- Bears argue that KNOP’s cash generation is vulnerable once one off items and higher financing costs are stripped out, and the current numbers give them some support because

- a large $8.5 million non recurring gain is boosting reported profit, so underlying earnings would have been notably lower without it

- interest payments are not well covered by earnings, so any step down from that one off boost makes debt servicing look even tighter

Valuation Gap Versus DCF Fair Value

- At a share price of $10.72, KNOP trades on a trailing P/E of 13.8 times, roughly in line with the US oil and gas average but far below a DCF fair value of about $50.13 per unit.

- Bullish investors point to forecast earnings growth of roughly 15.2 percent per year and the wide spread between price and DCF fair value, but the data also reminds them that

- revenue is expected to decline by about 0.4 percent per year even as profits grow, so margin expansion has to do most of the heavy lifting

- the current P/E discount to peers sits beside weak interest coverage, meaning the apparent bargain could partly reflect the balance sheet and earnings quality risks already priced in

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for KNOT Offshore Partners on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

See the numbers differently? Use the same data to build your own view in just a few minutes and share it with others: Do it your way.

A great starting point for your KNOT Offshore Partners research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Explore Alternatives

Despite the recent earnings rebound, KNOP’s reliance on one off gains, weak interest coverage, and shrinking long term profitability leaves its balance sheet looking fragile.

If that financial strain makes you uneasy, use our solid balance sheet and fundamentals stocks screener (1941 results) to quickly zero in on companies with stronger cushions, healthier leverage, and earnings built to withstand tougher conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal