ING’s Expanded VMware Cloud Foundation Deal Might Change The Case For Investing In Broadcom (AVGO)

- In early December 2025, ING and Broadcom announced that ING has extended its collaboration to modernize its private cloud using VMware Cloud Foundation 9.0 across multiple regions to meet stringent security, compliance, and data sovereignty requirements.

- This deepened VMware deployment at a large global bank highlights Broadcom’s growing role in mission-critical financial infrastructure alongside its AI-focused semiconductor momentum.

- Now we’ll examine how this expanded VMware Cloud Foundation rollout at ING might influence Broadcom’s AI-driven, software-enhanced investment narrative.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Broadcom Investment Narrative Recap

To own Broadcom, you need to believe its custom AI chips and VMware-powered infrastructure software can both keep compounding, despite customer concentration and acquisition-integration risk. The expanded VMware Cloud Foundation rollout at ING reinforces Broadcom’s software story, but does not materially change the near term AI demand catalyst or the key risk around dependence on a handful of hyperscale AI customers.

The ING announcement sits alongside Broadcom’s roughly US$10 billion in AI rack orders for its XPUs, which many investors view as the central catalyst today. Together, they highlight how Broadcom is trying to tie high margin infrastructure software more tightly to its AI hardware footprint, so that private cloud and AI adoption can reinforce each other over time.

But while AI racks and VMware deals are driving enthusiasm, investors should also be aware that customer concentration in custom XPUs could...

Read the full narrative on Broadcom (it's free!)

Broadcom's narrative projects $119.6 billion revenue and $50.8 billion earnings by 2028. This requires 25.9% yearly revenue growth and a $32.0 billion earnings increase from $18.8 billion today.

Uncover how Broadcom's forecasts yield a $403.66 fair value, a 3% upside to its current price.

Exploring Other Perspectives

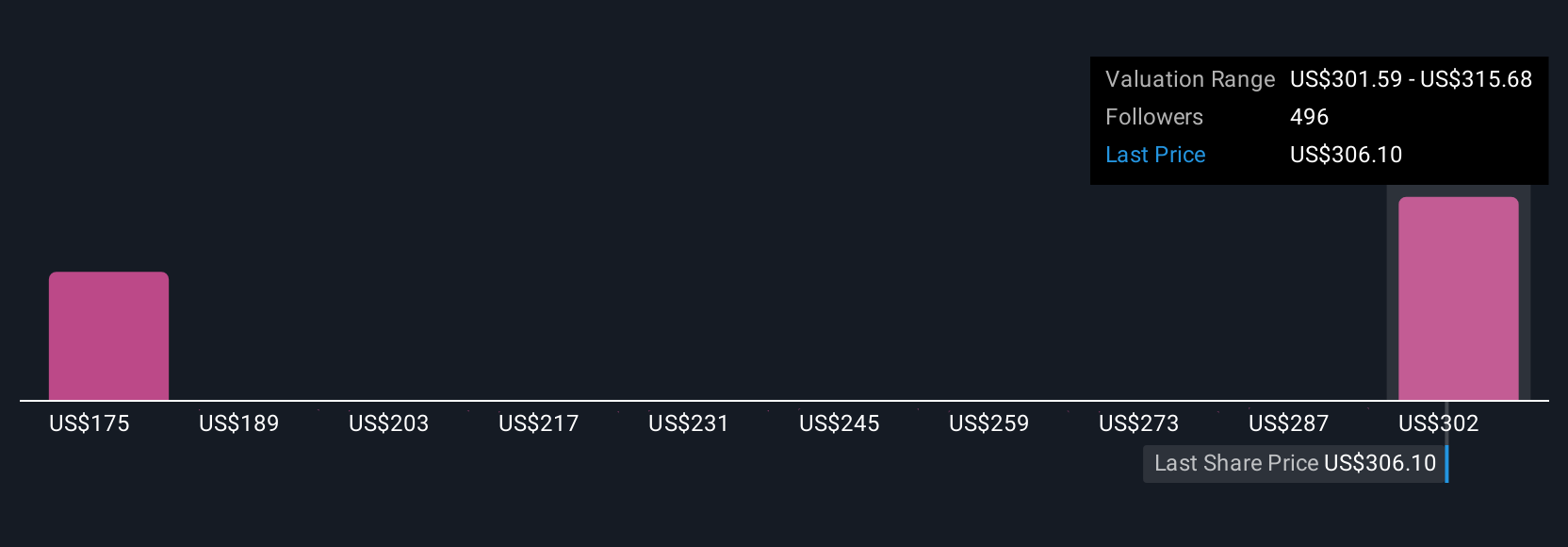

Members of the Simply Wall St Community have published 42 fair value estimates for Broadcom, ranging from US$249 to about US$415 per share. As you weigh those views, it is worth setting them against Broadcom’s reliance on a small group of large AI XPU customers, which could have meaningful implications for how its growth story unfolds.

Explore 42 other fair value estimates on Broadcom - why the stock might be worth 36% less than the current price!

Build Your Own Broadcom Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Broadcom research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Broadcom research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Broadcom's overall financial health at a glance.

Searching For A Fresh Perspective?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 36 companies in the world exploring or producing it. Find the list for free.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal