Has Cisco’s Strong 2025 Runway and Software Shift Already Been Priced Into the Stock?

- If you have been wondering whether Cisco Systems is still a value play after its long run, you are not alone. This article aims to unpack exactly what the market might be missing.

- Cisco's share price has pushed up to around $77.97, with returns of 1.3% over the last week, 8.1% over the past month, and a strong 31.9% gain year to date, building on 33.5% over 1 year and more than doubling over 5 years.

- Recent headlines have focused on Cisco's continued push into software and recurring revenue, including expanding its security and networking platforms and integrating past acquisitions more deeply into its portfolio. At the same time, the market has been debating how these strategic shifts position Cisco against both cloud native competitors and traditional hardware peers. This helps explain some of the renewed interest in the stock.

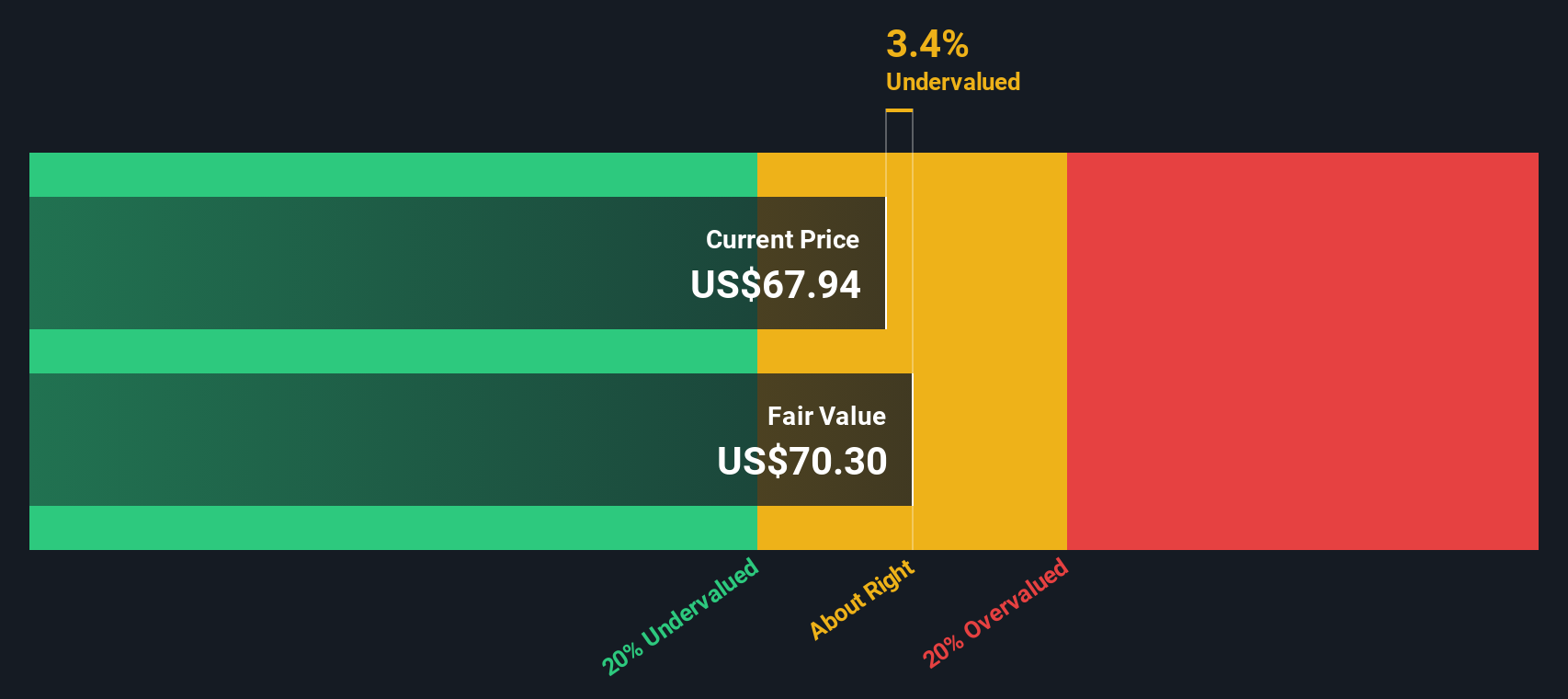

- On our framework, Cisco scores a 4/6 valuation score, suggesting it screens as undervalued on most, but not all, of our checks. In the next sections we will walk through each valuation lens before finishing with a more holistic way to think about what the stock is really worth.

Approach 1: Cisco Systems Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model takes Cisco Systems projected future cash flows and discounts them back to today, aiming to estimate what the business is worth in $ right now. Cisco currently generates about $12.9 billion in free cash flow, and analysts see this rising steadily as the company grows its software and recurring revenue base.

Using a 2 Stage Free Cash Flow to Equity model, analyst estimates and Simply Wall St extrapolations point to free cash flow of roughly $19.1 billion by 2030, with further moderate growth expected beyond that horizon. When all those future cash flows are discounted back, the intrinsic value per share is estimated at $82.36.

With the stock currently trading around $77.97, the DCF suggests Cisco is about 5.3% undervalued, placing it in a range where the market is close to, but not fully reflecting, its cash generation potential.

Result: ABOUT RIGHT

Cisco Systems is fairly valued according to our Discounted Cash Flow (DCF), but this can change at a moment's notice. Track the value in your watchlist or portfolio and be alerted on when to act.

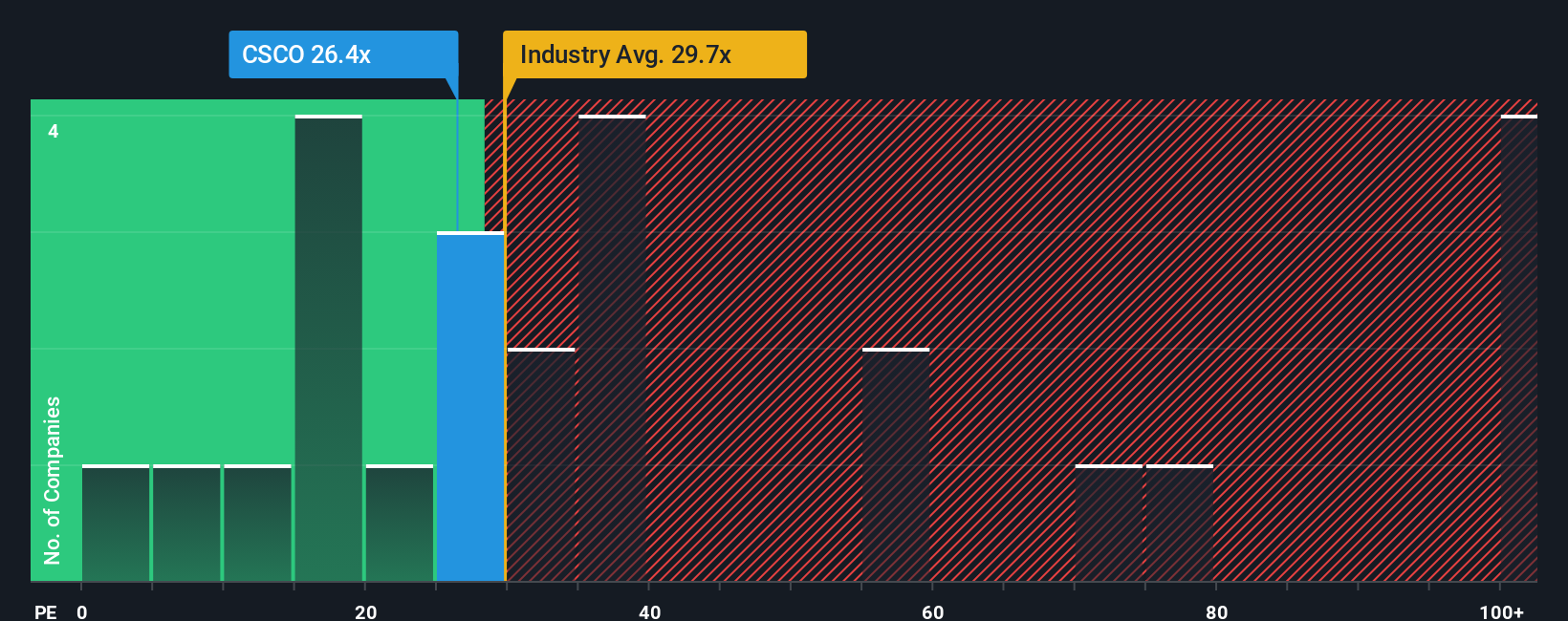

Approach 2: Cisco Systems Price vs Earnings

For profitable, mature businesses like Cisco, the price to earnings (PE) ratio is a practical way to gauge whether investors are paying a reasonable price for each dollar of current profit. A higher PE can be justified when a company is expected to grow faster or is seen as less risky, while slower growth or higher uncertainty usually calls for a lower, more conservative multiple.

Cisco currently trades on a PE of about 29.83x, slightly below the Communications industry average of 31.94x and meaningfully under the peer group average of 35.67x. On the surface, that makes the stock look modestly cheaper than comparable names, but those simple comparisons do not fully adjust for Cisco specific characteristics.

Simply Wall St addresses this with a proprietary Fair Ratio of 30.21x, which estimates the PE Cisco should command after accounting for its earnings growth outlook, profitability, risk profile, industry positioning and size. Because this Fair Ratio reflects Cisco own fundamentals rather than just broad peer averages, it offers a more tailored yardstick. With the current PE of 29.83x sitting very close to the Fair Ratio, the market appears to be valuing Cisco broadly in line with its underlying profile.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1440 companies where insiders are betting big on explosive growth.

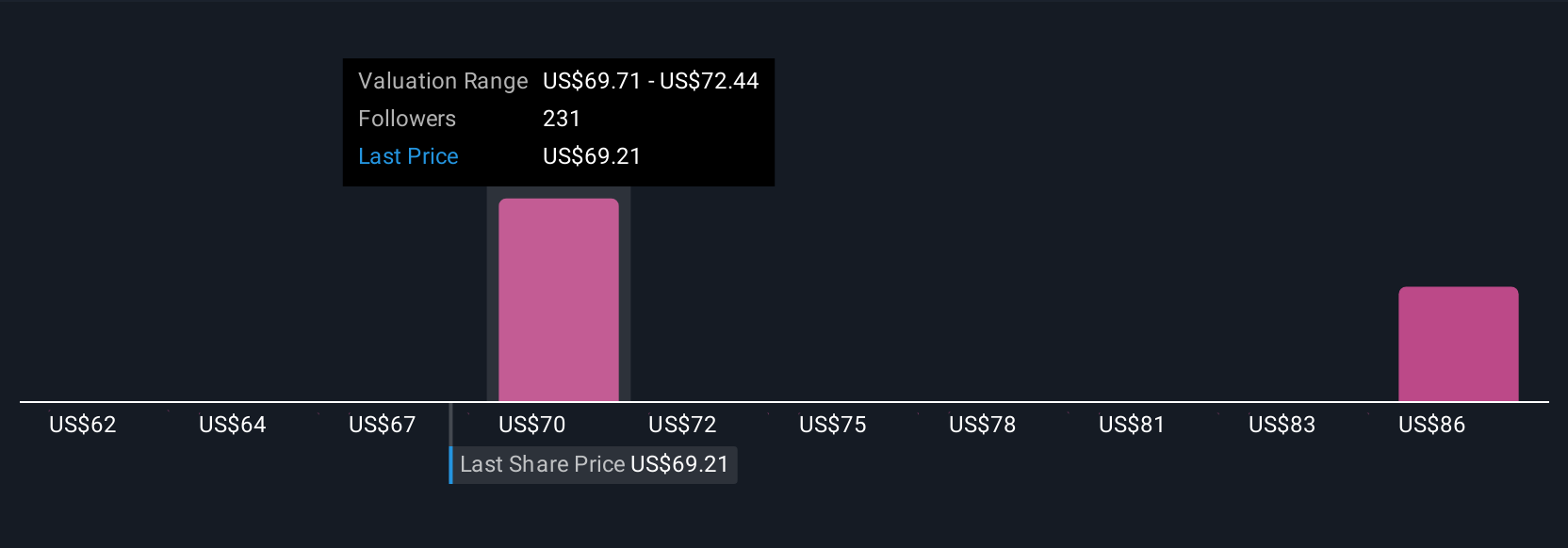

Upgrade Your Decision Making: Choose your Cisco Systems Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives, a simple way to connect your view of Cisco Systems' story with your own forecast for its future revenues, earnings and margins. You can then turn that into a Fair Value you can compare against today’s share price, all inside Simply Wall St’s Community page where millions of investors share dynamically updated Narratives that automatically refresh when news or earnings arrive. For example, one Cisco Narrative might lean into a strong AI networking cycle and robust subscription growth to justify a Fair Value closer to the most bullish target of about $87. A more cautious Narrative might emphasise security and execution risks to land nearer the most bearish target of roughly $61. This can help you decide whether Cisco looks like a buy, hold or sell based on which story and Fair Value best fits your own expectations.

Do you think there's more to the story for Cisco Systems? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal