Will Williams' New US$250 Million Term Loan and Tighter Covenants Change Williams Companies' (WMB) Narrative?

- Williams Companies recently announced that its subsidiary Northwest Pipeline LLC entered into a new Credit Agreement effective December 1, 2025, securing a US$250 million term loan to refinance senior notes and fund working capital, acquisitions, capital expenditures, and other corporate needs.

- This refinancing move, paired with covenant constraints on financial and operational activities, highlights management’s focus on balancing funding flexibility with disciplined balance sheet risk management.

- Next, we’ll examine how this new US$250 million term loan and tighter covenants might influence Williams Companies’ existing investment narrative.

Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Williams Companies Investment Narrative Recap

To own Williams Companies, you need to believe in the resilience of U.S. natural gas infrastructure and contracted pipeline cash flows, particularly tied to LNG export and power demand. The new US$250 million Northwest Pipeline term loan is largely a balance sheet housekeeping item, so it does not materially change the near term growth catalyst around network expansions, but it does sit alongside the existing risk that higher leverage and funding costs could constrain future flexibility.

The recent US$1.5 billion senior notes issuance in June 2025 is the most relevant backdrop for this new term loan, as both moves point to an active period of refinancing and funding for Williams’ multi year capital program. Together, they frame a business where the key upside remains execution on contracted expansion projects, while the key watchpoint is how cumulative debt and interest costs interact with its substantial capex and M&A commitments.

Yet even with contracted growth projects, investors should be aware that concentrated capex and higher leverage could...

Read the full narrative on Williams Companies (it's free!)

Williams Companies' narrative projects $14.5 billion revenue and $3.3 billion earnings by 2028.

Uncover how Williams Companies' forecasts yield a $67.70 fair value, a 8% upside to its current price.

Exploring Other Perspectives

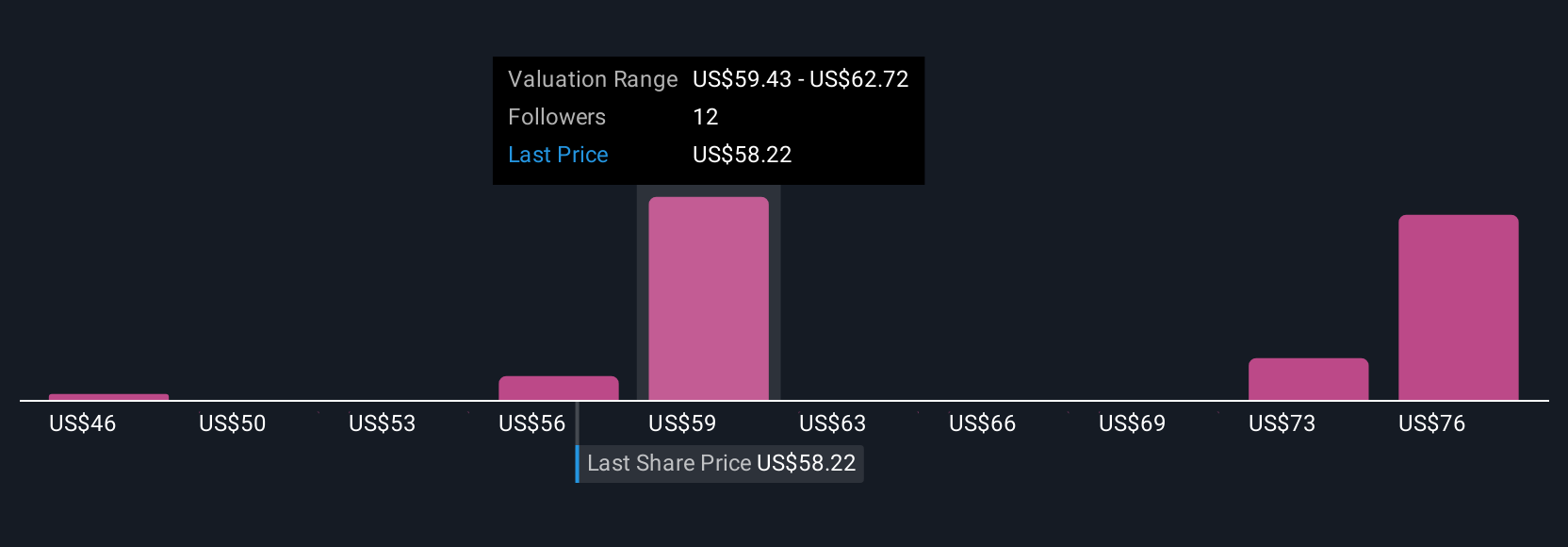

Six fair value estimates from the Simply Wall St Community span roughly US$49 to US$74 per share, showing how far opinions can stretch. Against this spread, the ongoing need to fund large, long dated gas infrastructure projects reminds you that financing risk and capital allocation choices could have broad implications for Williams’ future performance, so it is worth comparing several viewpoints before deciding what you think the stock is worth.

Explore 6 other fair value estimates on Williams Companies - why the stock might be worth as much as 18% more than the current price!

Build Your Own Williams Companies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Williams Companies research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Williams Companies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Williams Companies' overall financial health at a glance.

Seeking Other Investments?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal