Bitcoin once again fell below the $90,000 mark. Traders are betting on short-term or continuing sideways trading

The Zhitong Finance App learned that the Bitcoin options market shows that traders are betting that the world's largest cryptocurrency will continue to fluctuate in the short term. The previous continuous pullback has caused the overall market value of crypto assets to evaporate more than 1 trillion US dollars. On Friday, the price of Bitcoin once fell by more than 4% to $88,069. Currently, Bitcoin still accounts for nearly 60% of the total market capitalization of the entire crypto market.

Options data shows that recent contract holdings that expire in late December are significantly higher than long-term contracts, reflecting that traders are actively selling short-term options to earn royalties and are betting that volatility will remain low in the near future. Wintermute strategist Jasper De Maere said that the trading structure of Bitcoin options clearly reflects expectations of short-term range fluctuations. Volatility is constantly being sold off, while demand on both sides (bullish/bearish) is weak. At the same time, investors are still increasing their long-term option positions, which means that the market believes that it is stable in the short term, but there may be greater price fluctuations in the medium to long term.

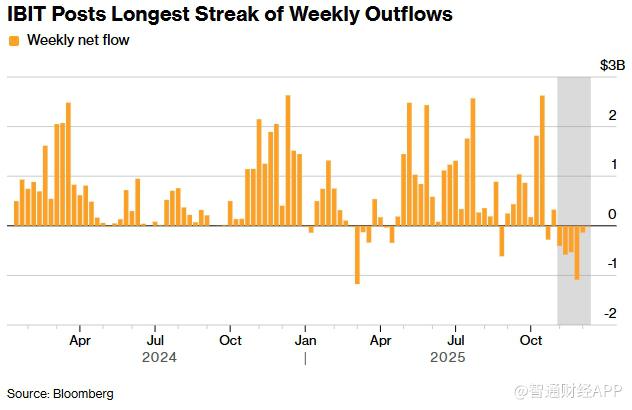

Earlier this year, Bitcoin hit a record high of $126,000, but a sharp decline over the next two months (driven by factors such as forced liquidation and declining retail popularity) caused the entire crypto market to fully recover. At the same time, institutional funds did not return during the sideways period. BlackRock's iShares Bitcoin Trust is experiencing the longest outflow period since its listing, with a cumulative outflow of more than 2.7 billion US dollars over the past five weeks. Based on an additional $113 million redemption on Thursday, the ETF is moving towards the sixth consecutive week of net outflows, indicating that institutional demand is still weak.

Bitcoin's performance this year also lags behind the S&P 500 index. This is the first time this has happened in more than a decade. There is a clear divergence in the trend of cryptocurrencies and other risky assets, even when compared to the “crypto winter” period in the past. This trend has also disappointed the market's previous expectations that Trump's favorable regulatory environment will bring about an accelerated inflow of institutional capital after his return to the White House.

The structure of the derivatives market also showed an increasingly pessimistic sentiment. According to Coinglass's data, the funding rate for Bitcoin perpetual contracts has turned negative, which means that bearish parties need to pay fees to bulls to maintain short positions, indicating that the expected price in the market is weak. The altcoin market is also under pressure. Ethereum options traders continue to increase their downside protection positions while remaining cautious about betting on the rise.

At the same time, the trading activity of decentralized trading platforms has also shrunk markedly. Altcoin trading volume on platforms such as Hyperliquid has not recovered since the historic liquidation event worth around $19 billion on October 10. Open positions on mainstream tokens such as Solana and XRP also showed no significant recovery, indicating that investors' confidence in altcoins is still weak.

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal