Inditex (BME:ITX) Margin Resilience Supports Bullish Narratives Despite Slower EPS Growth

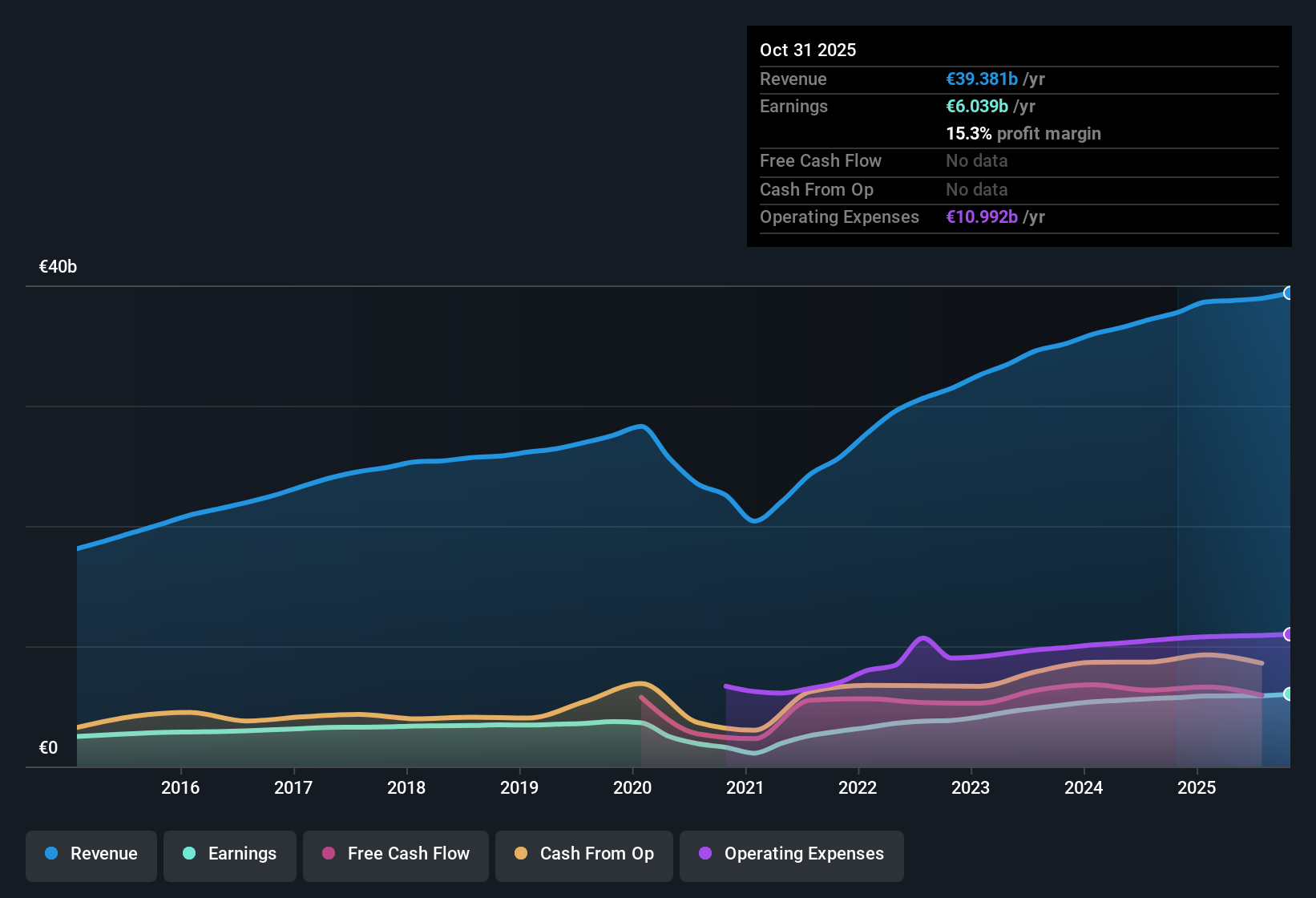

Industria de Diseño Textil (BME:ITX) has posted Q3 2026 revenue of about €9.8 billion with EPS of €0.59, alongside trailing twelve month revenue of roughly €39.4 billion and EPS of €1.94 that reflects 5.4% earnings growth over the past year. The company has seen quarterly revenue move from about €9.4 billion in Q3 2025 to €9.8 billion in Q3 2026 and EPS shift from €0.54 to €0.59. This sets up a picture of steadily scaling sales and earnings supported by broadly steady margins.

See our full analysis for Industria de Diseño Textil.With the latest numbers on the table, the next step is to see how this earnings profile lines up with the big narratives investors have been telling about Industria de Diseño Textil and where those stories might need a reset.

See what the community is saying about Industria de Diseño Textil

Margins Hold Firm Around 15%

- On a trailing basis, net profit margin is 15.3%, just above last year’s 15.2%. Net income over the last twelve months is about €6.0 billion on €39.4 billion of revenue.

- Analysts' consensus view expects operational upgrades to keep supporting these margins, and the recent numbers give some backing but also highlight limits:

- The logistics and technology push is aimed at lifting profitability, and the slight net margin uptick to 15.3% lines up with that story, although the improvement versus 15.2% is modest.

- At the same time, quarterly revenue dipped from €10.1 billion in Q2 2026 to €9.8 billion in Q3 2026. The margin resilience therefore appears to come more from efficiency than from an accelerating top line in the latest period.

Earnings Growth Slows From Five Year Pace

- Over the last twelve months, earnings grew 5.4%, well below the strong 22.8% average annual growth seen over the past five years, even though trailing twelve month EPS has edged up to about €1.94.

- Bears argue that this slowdown questions how long the high growth phase can last, and the data partly supports their caution:

- Quarterly net income has moved from €1.68 billion in Q3 2025 to €1.83 billion in Q3 2026, but that increase is much smaller than the historic growth pace, suggesting a cooler trajectory than the past five year average.

- Forecasts still call for earnings to grow about 8.2% per year, ahead of the wider Spanish market at 7%. Expectations therefore remain upbeat compared to local peers even as reported growth has downshifted.

Premium Valuation Versus DCF And Sector

- The shares trade at €54.86, above the DCF fair value of €37.59, and on a 28.3 times P/E that is richer than the 18.5 times European Specialty Retail average, though below the 31.7 times peer average.

- Critics highlight that this premium leaves less room for error, and the current forecasts illustrate why the debate is sharp:

- Revenue is expected to grow about 6.4% per year compared with 4.6% for the Spanish market. The valuation premium is therefore being justified by faster but not explosive growth.

- The dividend record is flagged as unstable while earnings growth has recently slowed to 5.4% year over year. This means investors are paying up despite a minor income risk and more moderate recent growth trends.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Industria de Diseño Textil on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

See the numbers differently? In just a few minutes you can turn that perspective into a full narrative and put your own stamp on the story: Do it your way.

A great starting point for your Industria de Diseño Textil research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Inditex’s premium valuation, slower earnings growth, and patchy dividend record mean investors are paying up despite moderating momentum and potential income uncertainty.

If you want to sidestep those trade offs and focus on more reasonably priced opportunities with stronger upside potential, use our these 909 undervalued stocks based on cash flows today to hunt for companies where expectations and valuation are better aligned.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal