Does Venture Global (VG) Prioritize Long-Term LNG Contracts Over Cash Returns With Its New Dividend?

- Venture Global, Inc. recently announced a cash dividend of US$0.017 per share payable on December 31, 2025, and secured new 20-year liquefied natural gas Sales and Purchase Agreements with Tokyo Gas and Naturgy starting in 2030.

- Together, these long-term contracts lift Venture Global’s committed LNG volumes to 7.75 million tonnes per annum, underlining the company’s role as a key supply partner to major Asian and European buyers.

- Next, we’ll look at how securing 7.75 million tonnes per annum of long-term LNG contracts reshapes Venture Global’s investment narrative.

We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is Venture Global's Investment Narrative?

For Venture Global, the core investment belief is that liquefied natural gas will remain central to global energy systems and that the company can convert its growing export footprint into durable cash flows. The latest dividend increase to US$0.017 a share reinforces a message of discipline and shareholder return, even as the share price has slipped close to its 52‑week low. More importantly, the new 20‑year SPAs with Tokyo Gas and Naturgy, lifting committed volumes to 7.75 million tonnes per year, slightly shifts the near term catalyst mix away from pure volume growth and toward contract quality and counterparty strength. These deals do not transform the immediate story, but they do help offset concerns about forecast earnings declines and high leverage by adding clearer long term revenue visibility. However, the combination of a relatively new management team, heavy debt load and volatile share price still sits at the center of the risk discussion.

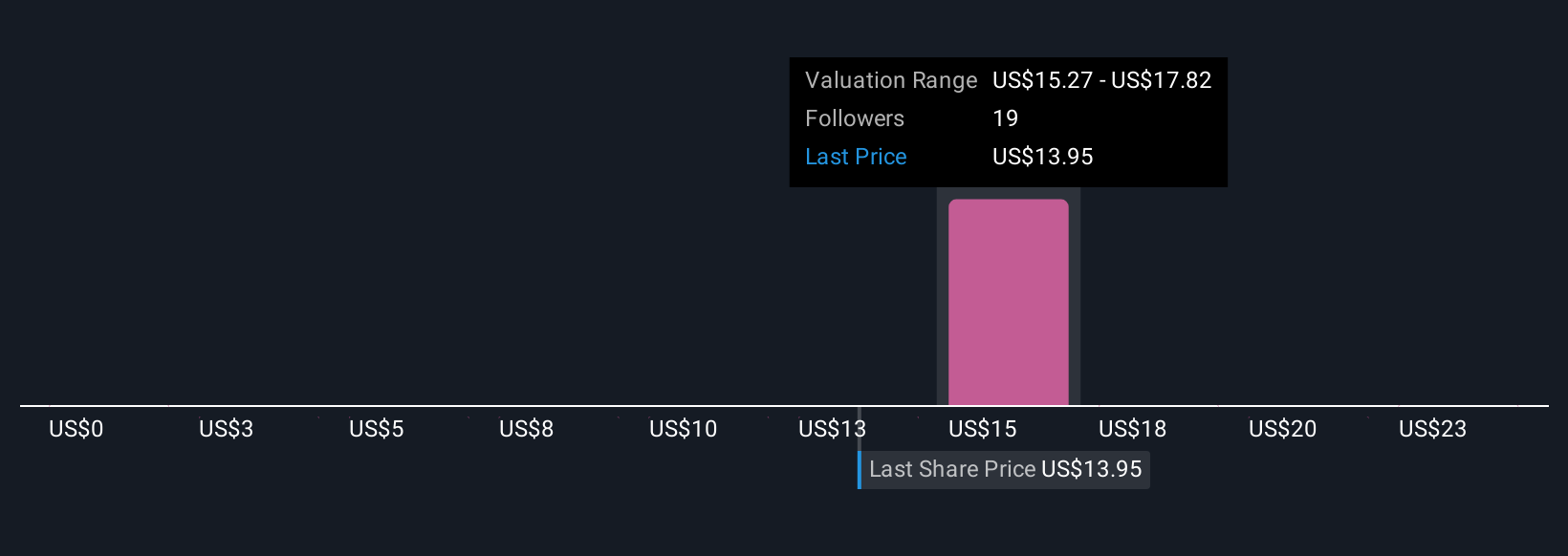

But beneath those long-term contracts, one funding risk in particular stands out that investors should understand. Despite retreating, Venture Global's shares might still be trading above their fair value and there could be some more downside. Discover how much.Exploring Other Perspectives

Explore 9 other fair value estimates on Venture Global - why the stock might be worth over 3x more than the current price!

Build Your Own Venture Global Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Venture Global research is our analysis highlighting 4 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Venture Global research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Venture Global's overall financial health at a glance.

Looking For Alternative Opportunities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal