Should Teleflex’s (TFX) Planned Urology and OEM Spinoff Require Action From Investors?

- In February 2025, Teleflex announced it would spin off its urology, acute care, and OEM businesses into a separate public company within about six months to “unlock shareholder value.”

- The move is intended to create two more focused medical-device companies, with the new entity emphasizing cost optimization while the remaining Teleflex business concentrates on advancing vascular intervention technologies supported by recent acquisitions.

- We’ll now examine how the planned separation of urology, acute care, and OEM reshapes Teleflex’s investment narrative and future focus.

We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Teleflex Investment Narrative Recap

To own Teleflex today, you need to believe that refocusing on higher growth vascular and interventional devices can eventually offset current profitability pressure and past execution hiccups. The planned spin off of urology, acute care, and OEM could sharpen that focus, but it does not remove the near term risk around integration of the BIOTRONIK Vascular Intervention acquisition or the margin pressure already evident in recent impairment driven losses and updated 2025 guidance.

The BIOTRONIK Vascular Intervention acquisition remains central here, because the separation effectively concentrates Teleflex on making that deal work: realizing cross selling opportunities in cath labs, stabilizing earnings after large goodwill impairments, and proving that the new, narrower portfolio can support the company’s revenue growth and profit improvement targets. How well BIOTRONIK is integrated now matters even more as Teleflex prepares to stand on a more vascular focused core.

Yet investors should be aware that if BIOTRONIK integration falls short or synergies take longer to show up, then ...

Read the full narrative on Teleflex (it's free!)

Teleflex's narrative projects $3.9 billion revenue and $553.0 million earnings by 2028. This requires 8.9% yearly revenue growth and about a $361 million earnings increase from $191.9 million today.

Uncover how Teleflex's forecasts yield a $124.14 fair value, a 4% upside to its current price.

Exploring Other Perspectives

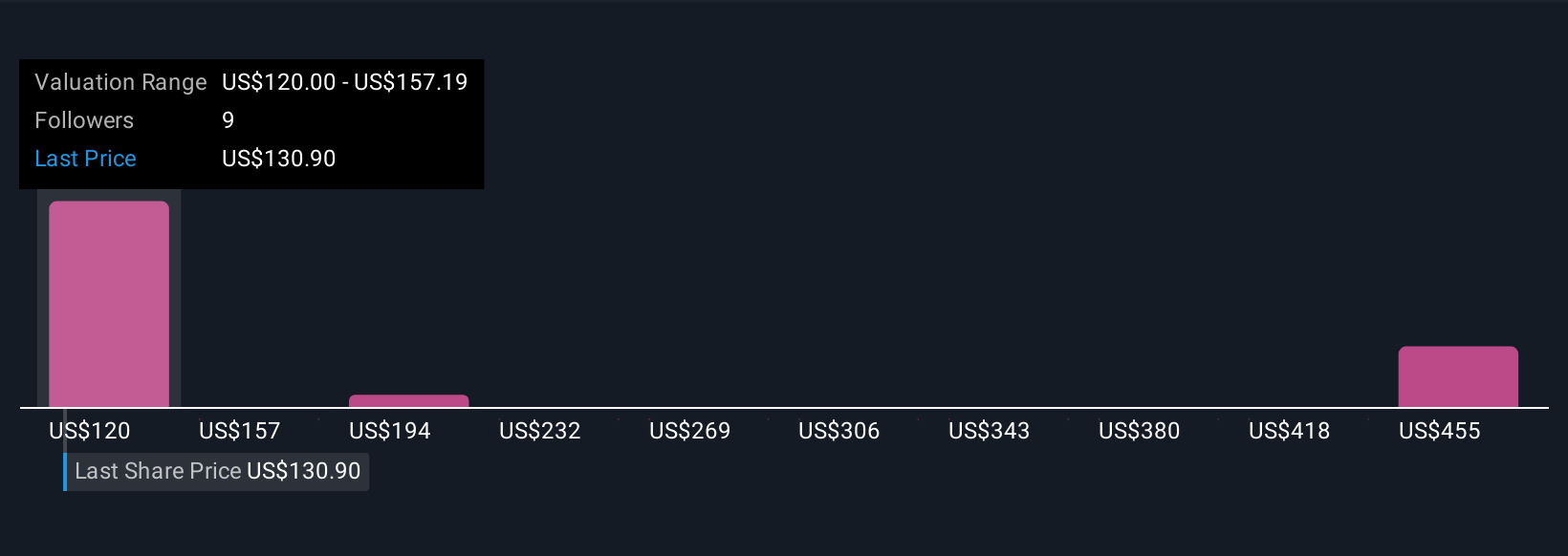

Five Simply Wall St Community fair value estimates span roughly US$120 to US$464 per share, reflecting very different views on Teleflex’s potential. You are weighing those opinions against a company that is reshaping itself around vascular interventions while still carrying integration and margin risks that could influence how quickly any perceived mispricing closes.

Explore 5 other fair value estimates on Teleflex - why the stock might be worth just $120.00!

Build Your Own Teleflex Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Teleflex research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Teleflex research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Teleflex's overall financial health at a glance.

Contemplating Other Strategies?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal