The Bull Case For Jones Lang LaSalle (JLL) Could Change Following JFK Win And New Rent Guarantees

- Recently, RentGuarantor announced a partnership allowing 12 Jones Lang LaSalle offices in London to offer tenants in JLL-managed properties access to professional rent guarantees, while JLL was also selected to provide comprehensive facility maintenance services for JFK Airport’s New Terminal One, part of a US$19.00 billion redevelopment.

- Together with leadership appointments in finance and research, these wins highlight JLL’s push into higher-value, recurring services across aviation infrastructure and residential support.

- We’ll now assess how securing long-term facility management for JFK’s New Terminal One could influence JLL’s investment narrative and earnings mix.

We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Jones Lang LaSalle Investment Narrative Recap

To own JLL, you have to believe it can keep shifting its earnings mix toward higher-margin, recurring service lines while managing exposure to lumpier capital markets and leasing activity. The JFK New Terminal One facilities contract and the RentGuarantor tie-up both support this services tilt, but neither appears likely to change the key near term swing factor, which remains the health of global transaction volumes and the risk of softer leasing demand.

The JFK facilities maintenance win looks most relevant here, because it reinforces JLL’s push into long-duration infrastructure and outsourcing mandates that can partially offset volatility in capital markets and leasing. As this kind of recurring work grows as a share of the overall business, it may help cushion the impact of weaker office leasing growth and any ongoing churn in less profitable property management contracts.

Yet against this, investors should be aware of the risk that prolonged weakness in capital markets and leasing activity could still...

Read the full narrative on Jones Lang LaSalle (it's free!)

Jones Lang LaSalle's narrative projects $31.5 billion revenue and $1.0 billion earnings by 2028. This requires 8.4% yearly revenue growth and about a $436 million earnings increase from $563.9 million today.

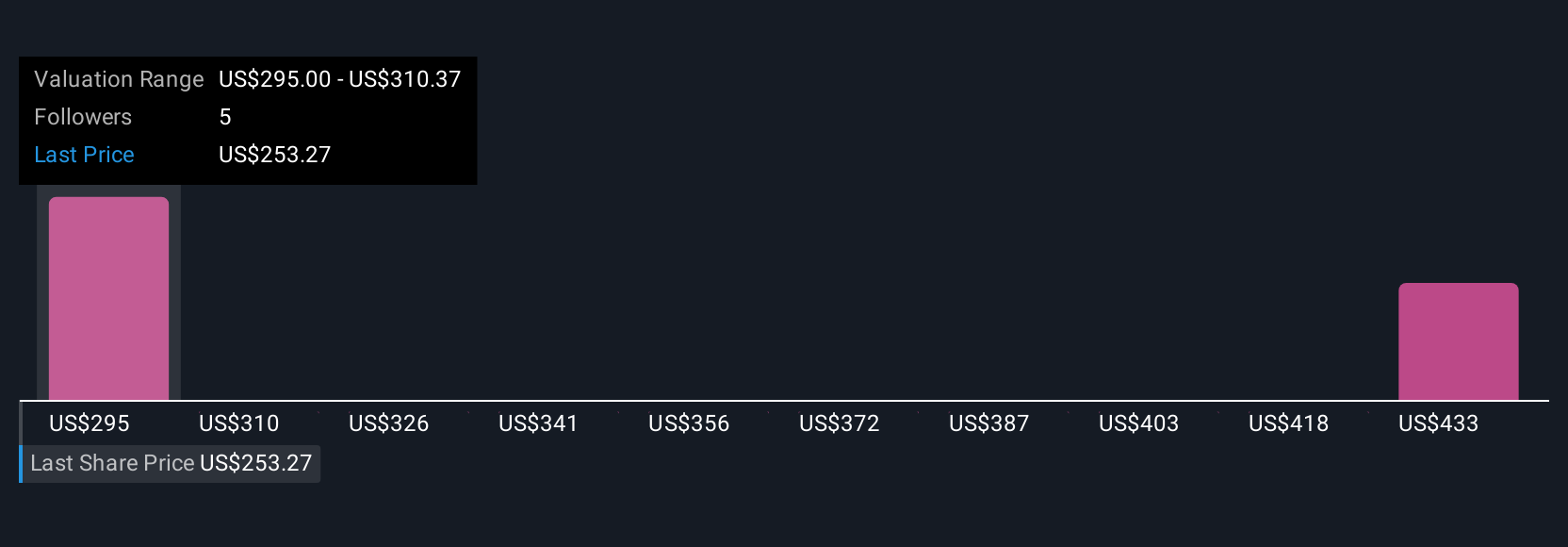

Uncover how Jones Lang LaSalle's forecasts yield a $345.00 fair value, a 5% upside to its current price.

Exploring Other Perspectives

Two members of the Simply Wall St Community currently see fair value for JLL between US$345 and about US$400, highlighting a wide spread of individual expectations. Set against this, JLL’s continued exposure to cyclical capital markets and leasing revenues means readers may want to compare these community views with how they see transaction volumes shaping the company’s performance.

Explore 2 other fair value estimates on Jones Lang LaSalle - why the stock might be worth as much as 22% more than the current price!

Build Your Own Jones Lang LaSalle Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Jones Lang LaSalle research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Jones Lang LaSalle research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Jones Lang LaSalle's overall financial health at a glance.

Contemplating Other Strategies?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal