Evaluating Nutanix (NTNX) After Earnings Beat, Revenue Miss, and Lower Full-Year Guidance

Nutanix (NTNX) just delivered a classic mixed quarter, hitting earnings but falling short on revenue and trimming its full year outlook, and that combination has clearly pressured sentiment around the stock.

See our latest analysis for Nutanix.

The stock is clearly feeling that tension, with a roughly 32 percent 1 month share price return decline and the latest earnings driven reset weighing on what had been a solid multi year total shareholder return profile.

If this quarter has you reassessing cloud names, it might be worth scanning other software and infrastructure players through high growth tech and AI stocks for fresh ideas beyond Nutanix.

With Nutanix shares now trading at a steep discount to analyst targets despite double digit growth and expanding federal cloud opportunities, is this sell off mispricing the company’s future or fairly discounting its next leg of growth?

Most Popular Narrative: 33.4% Undervalued

Compared to Nutanix’s last close at $47.11, the most popular narrative anchors fair value meaningfully higher, suggesting a sizable gap between price and projected fundamentals.

The fair value estimate has fallen significantly, from approximately $85.78 to $70.70, reflecting lower modeled revenue growth and a slightly higher discount rate.

Revenue growth has been trimmed meaningfully, from an expected 14.83 percent to 13.00 percent, indicating more conservative top line assumptions.

Curious why a more cautious growth outlook still supports a much higher valuation than today’s price? The narrative leans on accelerating earnings power, richer margins, and a future profit multiple that most investors would associate with elite software franchises. Want to see exactly which growth and profitability thresholds this story assumes Nutanix will clear to justify that upside? Dive into the full narrative to uncover the numbers behind this conviction.

Result: Fair Value of $70.70 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, several risks linger, including slower enterprise IT spending and intensifying public cloud competition that could put pressure on Nutanix’s growth, margins, and valuation assumptions.

Find out about the key risks to this Nutanix narrative.

Another Angle on Valuation

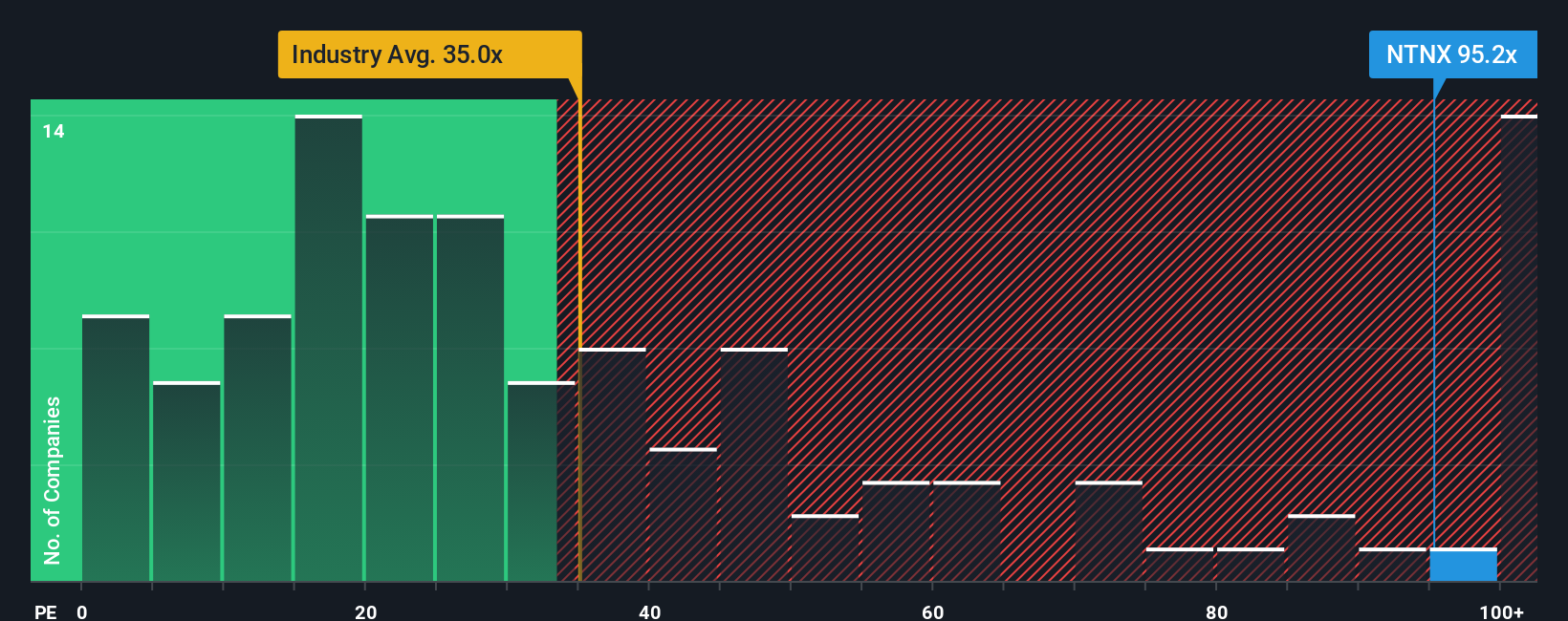

Our SWS fair ratio comparison paints a tougher picture. Nutanix trades on a 57.8 times price to earnings multiple versus 31.4 times for the US software sector and 44.2 times for peers, while our fair ratio sits nearer 43.6 times, implying clear multiple compression risk if sentiment sours further.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Nutanix Narrative

If you see Nutanix differently or want to stress test these assumptions against your own models, build a personalized view in minutes with Do it your way.

A great starting point for your Nutanix research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before markets move on without you, put Simply Wall Street’s Screener to work and line up your next opportunities while others are still reacting.

- Capture early momentum by scanning these 3575 penny stocks with strong financials that pair small share prices with surprisingly resilient financial foundations.

- Position ahead of the next automation wave by targeting these 30 healthcare AI stocks transforming diagnostics, workflows, and patient outcomes.

- Strengthen your income stream by focusing on these 15 dividend stocks with yields > 3% that offer meaningful yields backed by real business performance.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal