Vulcan Energy Resources (ASX:VUL) Valuation After €2.2b Lionheart Project Funding Secures Execution Phase

Vulcan Energy Resources (ASX:VUL) has just locked in a €2.2 billion financing package to fully fund Phase One of its Lionheart lithium and renewable energy project in Germany, pushing the business firmly into execution mode.

See our latest analysis for Vulcan Energy Resources.

The hefty equity raise at a discount has clearly weighed on sentiment, with a 30 day share price return of minus 30.55 percent and 1 year total shareholder return of minus 25.27 percent. However, the positive 90 day share price return of 10.25 percent and 5 year total shareholder return of 54.90 percent suggest longer term investors are still backing the Lionheart growth story.

If Vulcan’s latest move has you thinking more broadly about future facing materials and growth stories, it could be worth exploring fast growing stocks with high insider ownership.

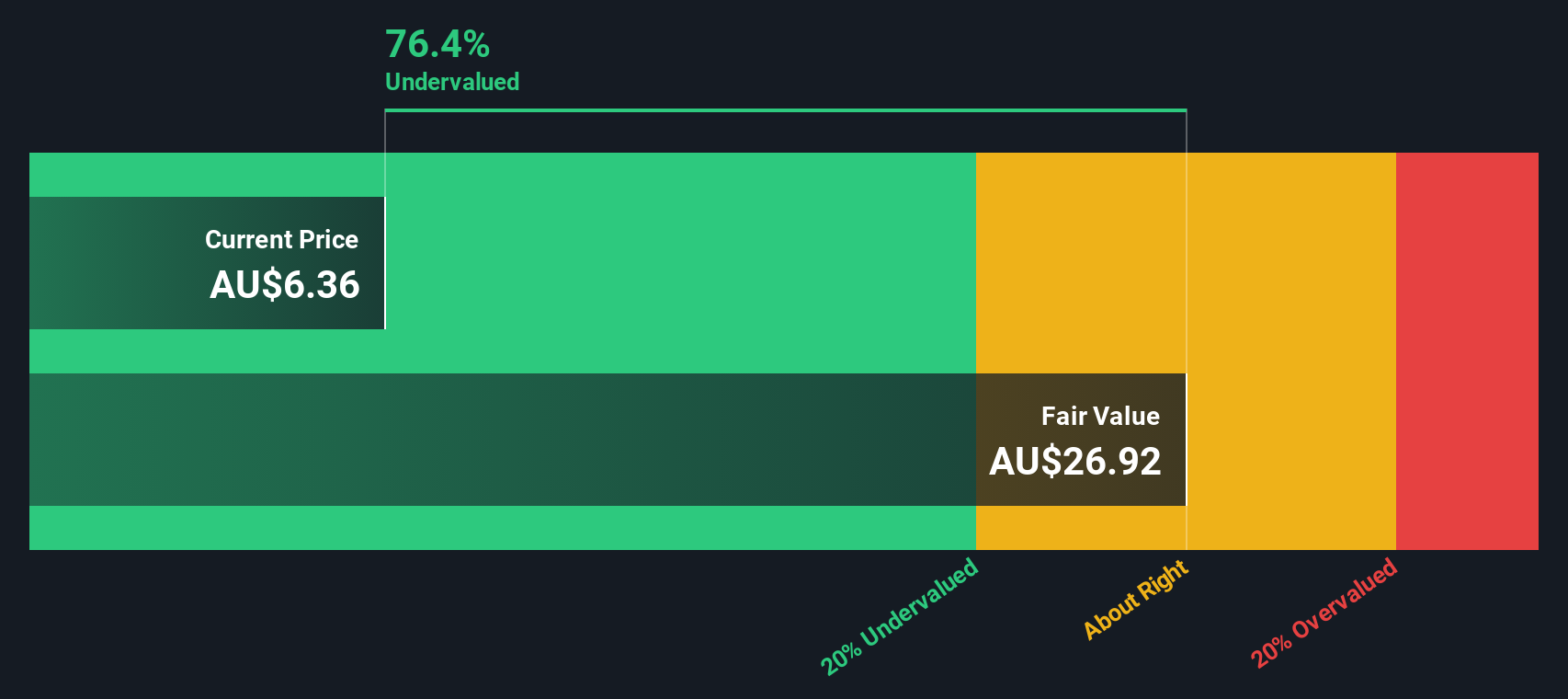

With the stock now trading at a steep discount to analyst targets and a fully funded flagship project about to break ground, is Vulcan quietly undervalued, or is the market already pricing in the Lionheart growth runway?

Price-to-Sales of 28x: Is it justified?

Based on a Price to Sales ratio of roughly 28 times against a last close of A$4.41, Vulcan looks richly priced versus close peers but cheaper than the broader sector.

The price to sales multiple compares the company’s market value to its current revenues, a useful lens for high growth, pre profit businesses in materials and energy transition themes.

For Vulcan, this elevated multiple implies investors are already assigning meaningful value to the Lionheart project’s future cash generation, even though the company remains loss making today. Yet, relative to the much higher industry average multiple and an estimated fair ratio, the current level could still understate what the market might ultimately pay if growth unfolds as expected.

That contrast is stark, with Vulcan’s 28 times price to sales sitting far below the Australian Metals and Mining industry’s 123.4 times, and also below an estimated fair price to sales of 58.5 times that the market could converge toward over time.

Explore the SWS fair ratio for Vulcan Energy Resources

Result: Price-to-Sales of 28x (UNDERVALUED)

However, investors must weigh execution risk on Germany’s ambitious Lionheart build out, as well as the possibility of weaker lithium prices compressing those assumed future cash flows.

Find out about the key risks to this Vulcan Energy Resources narrative.

Another View: Our DCF Model Paints a Sharper Discount

While the 28 times sales multiple hints at upside, our DCF model is far more aggressive and suggests fair value closer to A$22.66 per share, around 80.5 percent above today’s A$4.41 price. If the cash flows materialise, is the market mispricing Vulcan’s whole story?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Vulcan Energy Resources for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 906 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Vulcan Energy Resources Narrative

If this perspective does not quite fit your view, or you would rather dive into the numbers yourself, you can build a personalised narrative in just a few minutes, Do it your way.

A great starting point for your Vulcan Energy Resources research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Ready for your next investing move?

Do not stop at Vulcan. Secure your edge by using the Simply Wall St Screener to uncover fresh, data driven opportunities before the crowd catches on.

- Target reliable income now by scanning for these 15 dividend stocks with yields > 3% that can strengthen your portfolio’s cash flow in changing markets.

- Ride structural growth trends by zeroing in on these 26 AI penny stocks positioned at the forefront of intelligent automation and data driven disruption.

- Capitalize on mispriced opportunities by focusing on these 906 undervalued stocks based on cash flows where cash flow strength is not yet fully reflected in current share prices.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal