How XPO’s (XPO) 5.4% Tonnage Drop Tests Its Tech-Driven Freight Strategy

- In late November 2025, XPO reported preliminary North American less-than-truckload metrics showing a 5.4% year-over-year drop in tonnage per day, driven by fewer shipments and lighter average loads, highlighting ongoing softness in freight volumes.

- While these weaker operating trends raise fresh questions about near-term demand, they also test how resilient XPO’s technology- and margin-focused freight strategy can be under pressure.

- We’ll now examine how this recent 5.4% tonnage decline fits with, and potentially reshapes, XPO’s existing investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

XPO Investment Narrative Recap

To own XPO, you need to believe its technology driven LTL model can protect margins through freight cycles and convert volume recoveries into stronger earnings. November’s 5.4% tonnage drop underlines softer demand but mainly reinforces the existing near term risk that a weak freight backdrop could keep pressuring volumes and pricing, rather than materially changing the key catalyst around productivity driven margin improvement.

The most relevant recent update alongside the November metrics is XPO’s Q3 2025 result, which showed modest revenue growth but lower net income and margins year over year. That mix of operational pressure and continued profitability frames the current debate: can XPO’s cost discipline, tech investments and pricing mix offset cyclical tonnage declines long enough for volumes to firm and margin gains to show through in earnings.

Yet investors should be aware that XPO’s heavy reliance on cyclical US LTL demand leaves it particularly exposed if freight softness persists...

Read the full narrative on XPO (it's free!)

XPO's narrative projects $9.2 billion revenue and $661.0 million earnings by 2028. This requires 4.7% yearly revenue growth and a $316.0 million earnings increase from $345.0 million today.

Uncover how XPO's forecasts yield a $149.67 fair value, a 6% upside to its current price.

Exploring Other Perspectives

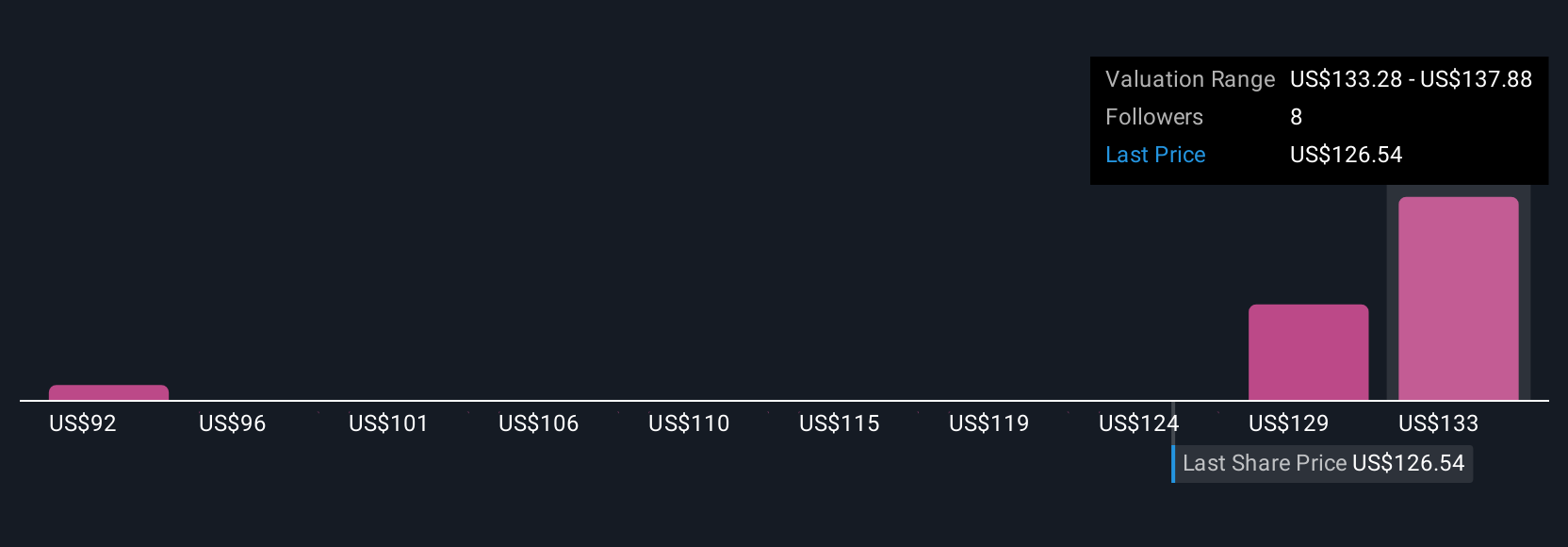

Three fair value estimates from the Simply Wall St Community span roughly US$91.90 to US$157.77, underscoring how far apart individual views can be. Against that backdrop, the recent 5.4% LTL tonnage decline puts XPO’s freight cycle sensitivity and margin ambitions front and center, so it pays to compare several perspectives before forming your own view.

Explore 3 other fair value estimates on XPO - why the stock might be worth as much as 12% more than the current price!

Build Your Own XPO Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your XPO research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free XPO research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate XPO's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal