How PayPal’s AI Shopping Integration With Perplexity, Ashley and Newegg At PayPal Holdings (PYPL) Has Changed Its Investment Story

- In late November 2025, Ashley and Newegg announced they had embedded PayPal’s payment technology into Perplexity’s AI-powered shopping interface, allowing customers to search, receive recommendations, and complete purchases in a single conversational flow.

- This move highlights how PayPal is extending its reach into emerging AI commerce channels even as its core branded checkout business faces slowing growth.

- We’ll now examine how PayPal’s push into AI-powered shopping, alongside softening branded checkout growth, reshapes the company’s investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

PayPal Holdings Investment Narrative Recap

To own PayPal today, you need to believe it can evolve from a pure payments processor into an AI-enabled commerce platform while defending its core checkout franchise. The new Perplexity integrations showcase that ambition in real time, but they do not change the near term picture where slowing branded checkout growth and competitive pressure remain the key catalyst and the main risk to watch.

Among recent announcements, PayPal’s partnership with OpenAI’s Agentic Protocol stands out as most relevant. Together with the Ashley and Newegg launches on Perplexity, it reinforces the idea that AI-driven, conversational shopping could become an important new surface area for PayPal transactions, partly offsetting softness in traditional online checkout if these channels continue to gain traction.

Yet even as AI commerce expands, investors should be aware of the risk that branded checkout growth could slow further in the face of...

Read the full narrative on PayPal Holdings (it's free!)

PayPal Holdings' narrative projects $38.1 billion revenue and $5.4 billion earnings by 2028. This requires 5.6% yearly revenue growth and about a $0.7 billion earnings increase from $4.7 billion today.

Uncover how PayPal Holdings' forecasts yield a $82.22 fair value, a 33% upside to its current price.

Exploring Other Perspectives

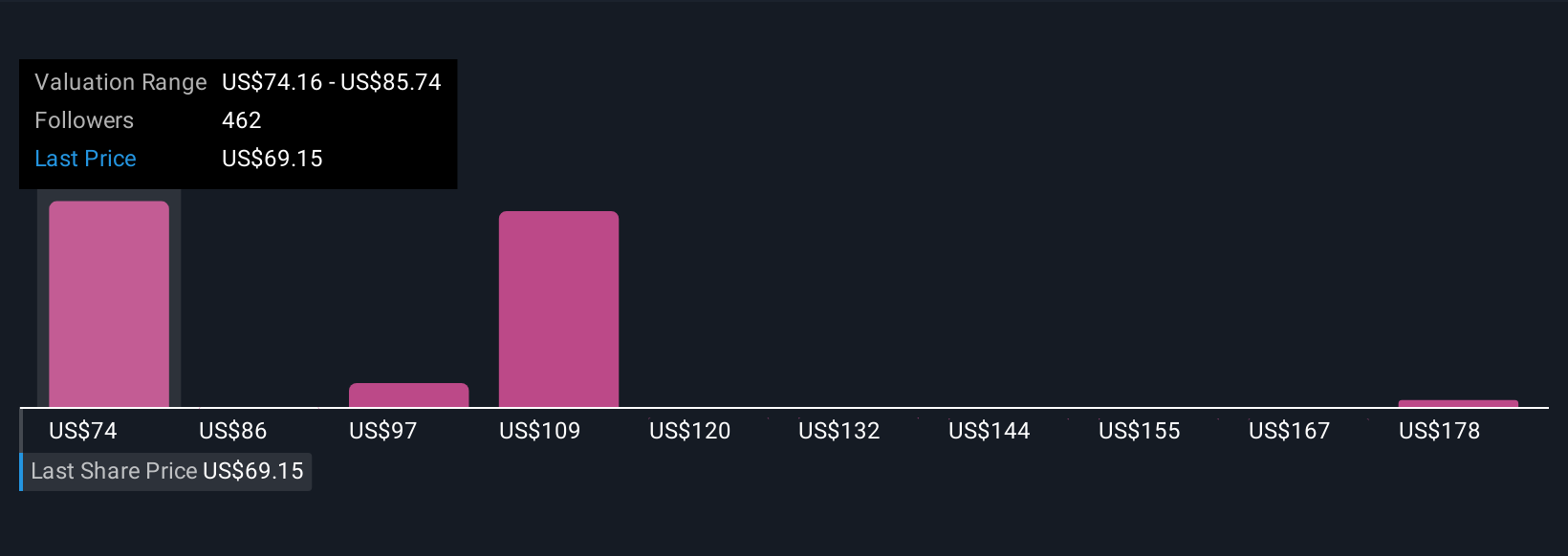

Simply Wall St Community members see PayPal’s fair value spread across 45 views, from about US$75 to US$121, underlining how far opinions can differ. Against that backdrop, the tug of war between AI driven commerce catalysts and softening branded checkout growth will likely shape how you interpret those valuations and which scenarios you choose to explore further.

Explore 45 other fair value estimates on PayPal Holdings - why the stock might be worth just $75.46!

Build Your Own PayPal Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your PayPal Holdings research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free PayPal Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate PayPal Holdings' overall financial health at a glance.

Searching For A Fresh Perspective?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal