US stock outlook | The three major stock index futures rose sharply, then fell after HPE Technology's performance hit September PCE data

Pre-market market trends

1. On December 5 (Friday), the futures of the three major US stock indexes rose sharply before the US stock market. As of press release, Dow futures were up 0.05%, S&P 500 futures were up 0.17%, and NASDAQ futures were up 0.36%.

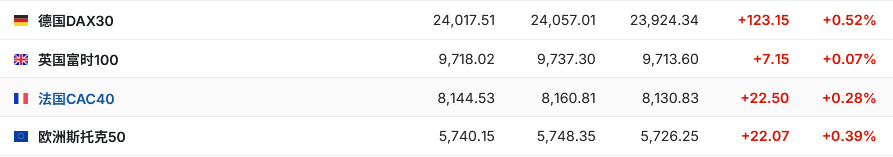

2. As of press release, the German DAX index rose 0.52%, the UK FTSE 100 index rose 0.07%, France's CAC40 index rose 0.28%, and the European Stoxx 50 index rose 0.39%.

3. As of press release, WTI crude oil fell 0.12% to $59.60 per barrel. Brent crude oil fell 0.06% to $63.22 per barrel.

Market news

September PCE data is here! Wall Street's eyes are collectively on the upcoming September Personal Consumption Expenditure (PCE) Price Index. As the Federal Reserve's most popular inflation indicator, this report is not only the first inflation reading officially released since late September, but is also viewed as a “guiding principle” for whether the US stock market can break the recent pattern of shocks and establish future trends. Due to delays in data release due to the previous government shutdown, there is a huge backlog of uncertainty in the market. Investors, analysts, and even the Federal Reserve officials themselves all urgently need this belated report to clarify the economic fog. FactSet and many other institutions predict that inflationary pressure is still stubborn and has even picked up in some dimensions. The market expects the overall PCE index to rise 2.8% year on year and 0.3% month on month in September; the core PCE index will increase 2.9% year on year and 0.2% month on month.

The warm-up battle for the nomination of the Federal Reserve Chairman has begun! Hassett “guided” interest rate cuts as an “associate chairman.” Kevin Hassett, director of the US National Economic Council, said that the Federal Reserve should cut interest rates at next week's meeting and predicted that it would cut interest rates by 25 basis points. Hassett said, “I think interest rates should be cut, and I think they are likely to fall.” He pointed out that recent statements by Federal Reserve directors and regional presidents show that “they seem clearly inclined to cut interest rates now.” He also said he hopes to “lower interest rates to a much lower level” in the long term. Meanwhile, speculation that US President Trump is preparing to nominate a candidate for chairman of the Federal Reserve is heating up. Trump said earlier this week that he plans to announce his candidate for the Federal Reserve Chairman in early 2026, and the final candidate has now been determined. In recent days, he has praised Hassett several times and hinted that he might be nominated.

The hot silver market has raised concerns about a collapse, yet analysts say “this time is different.” The silver market has taken investors on a thrilling journey this year, and the price has almost doubled. However, some analysts are concerned that silver is heading towards a disappointing end. These bearish sentiments are based on historical experience. After all, after hitting record highs twice in 1980 and 2011, silver then plummeted rapidly. However, Sprott Money analyst Craig Hemke doesn't think so. He said the situation was different; “The current economic, monetary, and physical conditions are completely different from 1980 and 2011.” Hemke believes that the price pattern being displayed is more similar to gold's breakthrough market in 2023 and 2024. He said that next year's breakthrough is likely to push silver to a new historical high.

The rise is like a rainbow! Copper prices continued to rise in record numbers, and Citi joined the bullish camp. Copper prices are hot this week. As of press time, copper prices on the London Metal Exchange rose 1.23% to $1,1583.75 per tonne. Citibank analysts pointed out that according to their basic hypothetical scenario, copper inventories are being accumulated in the US, and there is a shortage in non-US regions. The average price of copper will reach 13,000 US dollars in the second quarter of next year. Analyst Max Layton and others said, “We are convinced that copper prices will continue to rise until 2026, supported by multiple bullish catalysts, including gradually improving fundamentals and macro backgrounds.” They predict that global terminal consumption will increase by 2.5% next year, driven by a low interest rate environment and economic growth driven by US fiscal expansion, as well as Europe's restructuring of armaments and energy transition.

Global oversupply alert sounded! The price of Saudi flagship crude oil fell to a five-year low. As the global oil market continues to show signs of oversupply, Saudi Arabia lowered the price of its flagship crude oil to its lowest level in five years. Saudi state-owned producer Saudi Aramco lowered the price of Arabian light crude oil for Asian customers by 60 cents higher than the regional benchmark for delivery in January next year, according to an updated price list. This is the lowest price since January 2021, and the decline is broadly in line with the findings of a survey of refiners and traders. Last weekend, OPEC+ confirmed its previous decision to suspend production increases in the first quarter of next year, citing weak seasonal demand during the winter months in most parts of Asia, Europe and North America.

Individual stock news

Apple experienced a shock wave of “corner digging.” Apple is facing a wave of executive departures. This week, its general counsel and policy director announced that they will all retire next year; a top designer has left and joined Meta; the head of artificial intelligence strategy will retire; the chief operating officer announced his retirement in July, and the chief financial officer has been transferred to a new position. Further down in the organizational structure, dozens of Apple employees have switched to OpenAI and Meta in recent months, as part of a long-term brain drain, causing the company to lose innovators while injecting the expertise they hope to disrupt the king of digital devices. According to a review of LinkedIn profiles, dozens of Apple engineers and designers with expertise in audio, watch design, robotics, etc. have switched to OpenAI in recent months.

Server delivery was delayed due to the AI boom, and the performance of HPE Technology (HPE.US) declined, but the AI computing power narrative is still popular. According to the data, HPE Technology's total revenue for the fourth fiscal quarter increased 14% year over year to US$9.7 billion, falling short of market expectations of about US$9.9 billion; adjusted earnings per share were US$0.62, which was better than analysts' average expectations and significantly higher than US$0.04 in the same period last year. GAAP gross margin was 33.5%, up 270 basis points year on year; non-GAAP gross margin was 36.4%, up 550 basis points year on year. The company expects revenue for the first fiscal quarter ending January next year to be US$9-9.4 billion, falling short of market expectations of US$9.88 billion; adjusted earnings per share are expected to be US$0.57 to 0.61, better than market expectations of US$0.53. Revenue guidance for the first fiscal quarter fell short of expectations. This largely indicates that the company failed to meet the high expectations of the outside world in terms of AI server sales. Mainly due to the fact that some large-scale AI server transactions were postponed to the 2026 calendar year, but overall AI computing power infrastructure orders are still full, and partnerships with AMD and Broadcom are expected to bring strong increases in the future. As of press release, US stocks of HPE Technology fell more than 9% in the premarket on Friday.

The core subscription business continues to grow! DocuSign (DOCU.US) Q3 revenue and profit exceeded expectations, raising full-year results guidance. Driven by increased subscription revenue, electronic signature solution provider DocuSign announced third-quarter earnings that exceeded expectations while raising full-year results guidance. Financial reports show that in the third fiscal quarter ending October 31, DocuSign's adjusted earnings per share were 1.01 US dollars, and revenue increased 8.4% year over year to reach 818.3.5 million US dollars. Analysts generally expect adjusted earnings per share of $0.92 and revenue of $807.1 million. The company also raised its earnings guidance for the current fiscal year: the full-year revenue forecast was raised to US$3.208 billion to US$3.212 billion, compared to the previous forecast of US$3.19 billion to US$3.2 billion; the subscription revenue forecast was raised to US$3.14 billion to US$3.144 billion, compared to US$3.13 billion previously. As of press release, DocuSign's US stocks fell nearly 6% in the premarket on Friday.

Are Hollywood's “nuclear explosions” level mergers and acquisitions close? Rumor has it that Warner Bros. Discovery (WBD.US) and Netflix (NFLX.US) have entered into exclusive negotiations. According to sources familiar with the matter, Warner Bros. Exploration has entered into exclusive negotiations to sell its film and television studio and HBO Max streaming service to Netflix. People familiar with the matter added that if regulators do not approve the deal, Netflix will pay a cancellation fee of 5 billion US dollars. If negotiations don't break down, the two companies may announce the deal as soon as the next few days. This news indicates that Netflix is ahead of others seeking to bid on Paramount Dance (PSKY.US) and Comcast (CMCSA.US), which are seeking to purchase all or part of Warner Bros.'s assets.

SoFi (SOFI.US) added $1.5 billion at a discount, and the stock price fell before the market. Fintech company SoFi Technologies is seeking to raise $1.5 billion through a stock sale to further diversify its development from the loan business to other product areas. According to people familiar with the matter, the stock price offered by SoFi is between $27.50 and $28.50 per share. This price range is up to 7.1% off Thursday's closing price of $29.60. As of press release, SoFi's US stocks fell more than 7% in the premarket on Friday.

Key economic data and event forecasts

At 23:00 Beijing time, the annual rate of the US PCE price index for September

At 23:00 Beijing time, the monthly rate of personal expenses in the US in September

At 23:00 Beijing time, the preliminary value of the US Consumer Confidence Index for the University of Michigan in December

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal