How Investors Are Reacting To Super Group (SGHC) (SGHC) Boosting 2025 Dividend Payout To US$0.16

- On 3 December 2025, Super Group (SGHC) declared a US$0.04 per-share dividend, bringing its total 2025 payout to US$0.16 and underscoring strong cash generation and a balanced approach to capital allocation.

- This latest dividend, supported by consistent revenue and cash flow growth and progress on regional and product initiatives, underlines how Super Group’s operational execution is increasingly translating into direct shareholder returns.

- We’ll now look at how this fresh dividend declaration, backed by strong cash generation, may reshape Super Group’s investment narrative.

The latest GPUs need a type of rare earth metal called Neodymium and there are only 36 companies in the world exploring or producing it. Find the list for free.

Super Group (SGHC) Investment Narrative Recap

To own Super Group, you need to believe in its ability to turn a focused, ex U.S. online betting and gaming footprint into durable earnings and cash generation, despite regulatory and competitive pressures in key regions. The new US$0.04 dividend supports the near term catalyst of cash returns to shareholders, but does not materially change the biggest risk, which remains regulatory tightening and growth limits in core markets such as Europe and Africa.

The most relevant backdrop to this dividend is Super Group’s repeated guidance upgrades in 2025, lifting full year revenue expectations to US$2.17–2.27 billion. That pattern, combined with rising net income and regular quarterly dividends through the year, gives context to the payout as part of a broader story of monetizing growth into cash, even as the company reallocates capital away from U.S. iGaming and contends with stricter rules elsewhere.

But while higher dividends can look attractive, investors should also be aware of how tightening regulations and marketing restrictions could...

Read the full narrative on Super Group (SGHC) (it's free!)

Super Group (SGHC)'s narrative projects $2.6 billion revenue and $453.0 million earnings by 2028. This requires 10.3% yearly revenue growth and an earnings increase of about $317 million from $136.2 million today.

Uncover how Super Group (SGHC)'s forecasts yield a $17.75 fair value, a 59% upside to its current price.

Exploring Other Perspectives

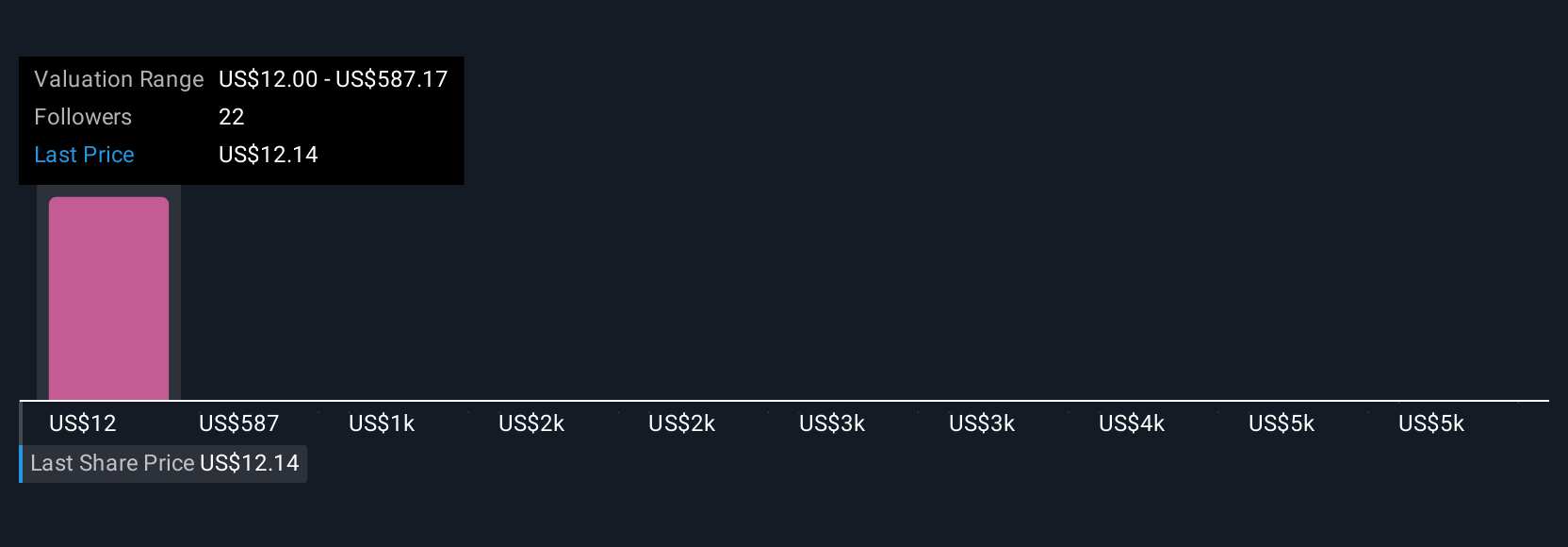

Four fair value estimates from the Simply Wall St Community span from US$12 to over US$5,700 per share, showing how far apart individual views can be. Against that backdrop, the focus on exiting unprofitable U.S. iGaming and reinvesting in core markets may prove central to how Super Group’s actual performance lines up with these very different expectations.

Explore 4 other fair value estimates on Super Group (SGHC) - why the stock might be worth just $12.00!

Build Your Own Super Group (SGHC) Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Super Group (SGHC) research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Super Group (SGHC) research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Super Group (SGHC)'s overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our top stock finds are flying under the radar-for now. Get in early:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal