Transocean (RIG): Valuation Check After New Contracts, Backlog Growth and Credit Upgrade-Driven Rally

Transocean (NYSE:RIG) has been back on traders dashboards after landing roughly $332 million in new contracts and extensions, a clear boost to its multi year backlog and earnings visibility.

See our latest analysis for Transocean.

The stock has climbed to around $4.43 per share after a strong run, with a 90 day share price return of 44.3 percent. This suggests momentum is building as new contracts, backlog growth, and a better credit outlook reshape how investors view its risk and recovery potential.

If Transocean’s contract wins have you thinking about where else capital is lining up behind energy and infrastructure, it could be a smart moment to explore aerospace and defense stocks.

With the shares already near 52 week highs and trading slightly above some analyst targets, the key question is whether Transocean’s improving backlog and credit profile still leave room for upside, or if the market is already pricing in the next leg of growth.

Most Popular Narrative: 6.4% Overvalued

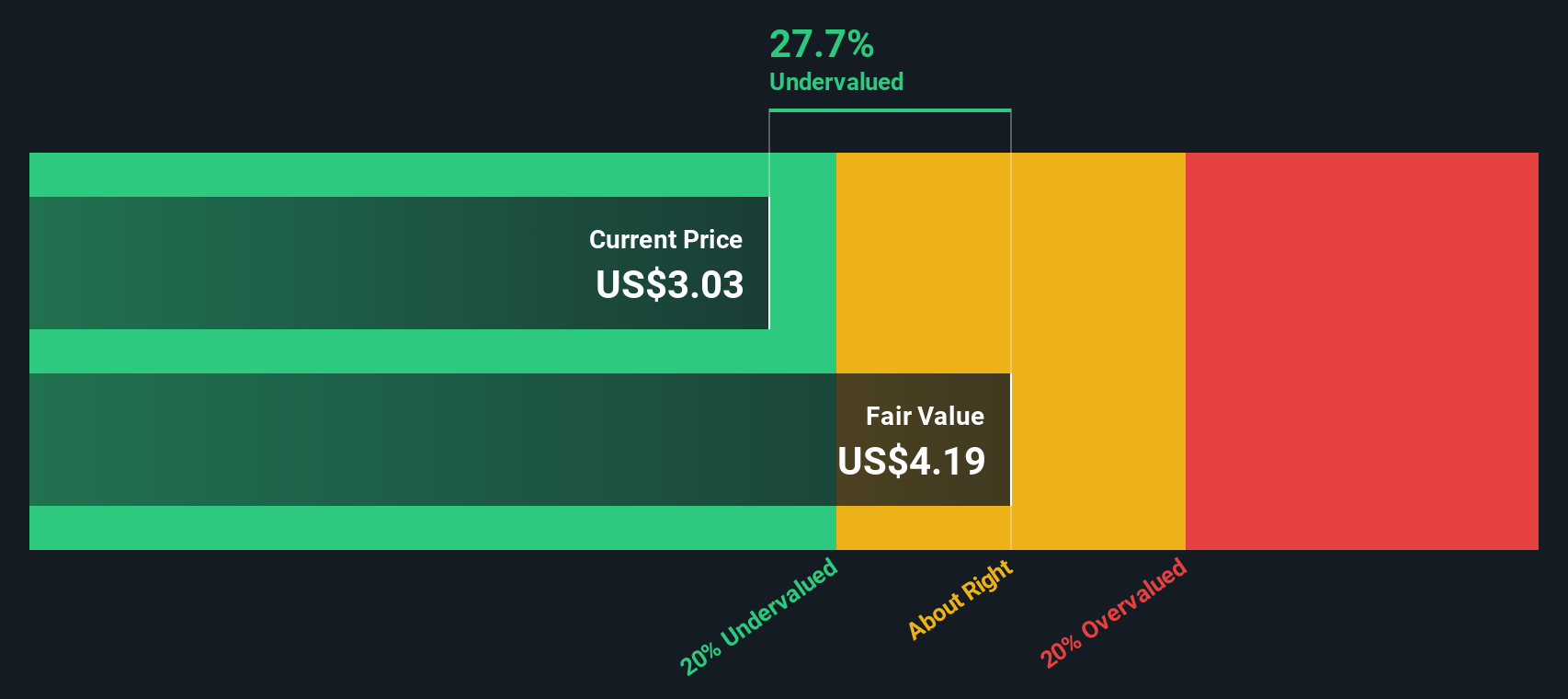

Based on the most popular narrative, Transocean’s fair value of $4.17 sits just below the recent $4.43 close, suggesting expectations may be running ahead of fundamentals.

Transocean's industry-leading backlog (~$7 billion) with major E&P clients provides strong revenue visibility and cash flow stability. This enables efficient conversion of backlog into revenue and supports rapid deleveraging, which will positively impact net debt levels and interest expense.

Curious how a shrinking top line can still justify a higher valuation? The narrative leans on margin expansion, future profitability, and a richer earnings multiple. Want to see how those moving parts fit together?

Result: Fair Value of $4.17 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that constructive setup could crack if dayrates soften or debt refinancing gets tougher, which would squeeze margins just as investors are pricing in recovery.

Find out about the key risks to this Transocean narrative.

Another View: Big Gap To Our Fair Value

While the popular narrative pegs Transocean as 6.4 percent overvalued around $4.17 per share, our DCF model paints a very different picture, with a fair value near $9.27. That implies the stock trades at roughly a 52 percent discount. The key question is whether that discount represents a potential opportunity or a warning sign for investors.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Transocean for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 914 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Transocean Narrative

If you see the story differently, or want to stress test the assumptions yourself, you can build a fresh narrative in minutes using Do it your way.

A great starting point for your Transocean research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more high conviction opportunities?

If Transocean has sharpened your appetite for opportunity, do not stop here. Use the Simply Wall St Screener to uncover your next smart move today.

- Capture potential mispricing by targeting quality companies trading below intrinsic value through these 914 undervalued stocks based on cash flows, before the wider market catches on.

- Position yourself at the frontier of innovation by scanning these 26 AI penny stocks that could reshape entire industries over the coming years.

- Lock in stronger income potential by filtering for dependable payers using these 15 dividend stocks with yields > 3% with yields that can meaningfully support long term returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal