China Education Group (SEHK:839) Is Up 9.1% After Earnings Jump Highlights Sharply Higher Profitability

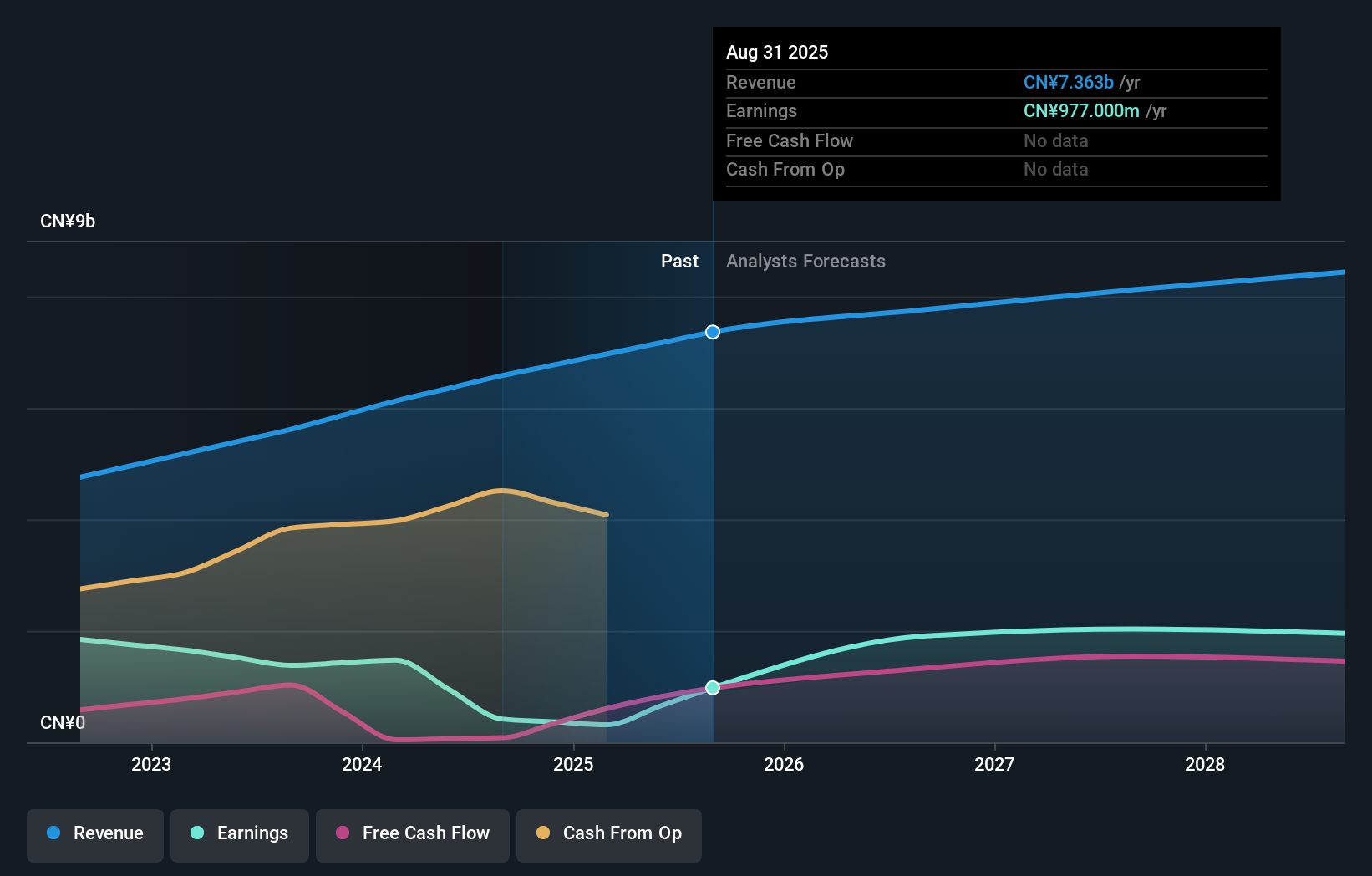

- China Education Group Holdings Limited has released its full-year results for the year ended August 31, 2025, reporting sales of CNY 7,363 million, up from CNY 6,579 million, and net income of CNY 977 million compared with CNY 418 million a year earlier.

- The sharp improvement in net income, alongside higher basic earnings per share from continuing operations rising to CNY 0.3551, points to stronger profitability and more efficient operations across the group’s education portfolio.

- With this stronger profitability profile now on record, we’ll explore how the earnings surge reshapes China Education Group Holdings’ broader investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

What Is China Education Group Holdings' Investment Narrative?

To own China Education Group Holdings, you really need to believe in the resilience of its core higher-education platform and its ability to convert enrollment and tuition growth into durable cash flows, despite policy and competitive pressures. The latest full-year numbers, with revenue up and net income rebounding strongly, help to reset the near-term narrative after a period defined by large one-off impairments and weaker margins. In the short term, the key catalysts are management’s execution on improving profitability at underperforming campuses and any clarity from the AGM on dividends or capital allocation, both of which now look more credible with higher reported earnings and a stronger profit margin. The main risk is that the recent earnings surge is partly optical, flattered by lapping prior-year write-downs, while structural issues in regions like Hainan, Guangdong and Henan still weigh on long-run returns.

However, one risk around those regional impairments is worth understanding in more detail. China Education Group Holdings' shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Two Simply Wall St Community fair value views span about HK$3.40 to HK$6.99, reflecting very different expectations around the earnings rebound. Set that against the recent one-off impairment and still-low return on equity, and it is clear you are weighing cleaner near-term profits against questions about long-term asset productivity and capital efficiency.

Explore 2 other fair value estimates on China Education Group Holdings - why the stock might be worth over 2x more than the current price!

Build Your Own China Education Group Holdings Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your China Education Group Holdings research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free China Education Group Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate China Education Group Holdings' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal