Cadence Design Systems (CDNS): Rethinking Valuation After Renewed Analyst Optimism and Strong Growth Narratives

Cadence Design Systems (CDNS) is back on investors radar after a wave of upbeat research highlighted its solid balance sheet, steady double digit growth, and leadership in electronic design automation and semiconductor software.

See our latest analysis for Cadence Design Systems.

The renewed attention has helped the share price hold near 337.39 dollars, with a 7 day share price return above 10 percent and a 3 year total shareholder return above 100 percent. This suggests that momentum is re accelerating after a recent pause.

If Cadence has you rethinking your tech exposure, this is a good moment to explore other potential winners through high growth tech and AI stocks and see what else fits your strategy.

With revenue and earnings still growing at double digit rates and the stock trading about 14 percent below the average analyst target, investors face a key question: Is Cadence undervalued today or already pricing in years of future growth?

Most Popular Narrative: 11.7% Undervalued

With Cadence shares last closing at 337.39 dollars versus a narrative fair value near 382 dollars, the latest storyline leans toward upside from here.

The expanding partnership with major industry players like NVIDIA and Intel, including initiatives such as 3D IC and data center digital twins, positions Cadence for future competitive advantages and new revenue streams.

Want to see what kind of revenue path and profit upgrade would justify that richer future multiple? The narrative spells out bold assumptions. The details might surprise you.

Result: Fair Value of $382.20 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upbeat scenario could be challenged if geopolitical tensions disrupt Cadence’s China exposure or key AI partnerships stumble and slow expected revenue growth.

Find out about the key risks to this Cadence Design Systems narrative.

Another View: Rich Multiples Signal a High Bar

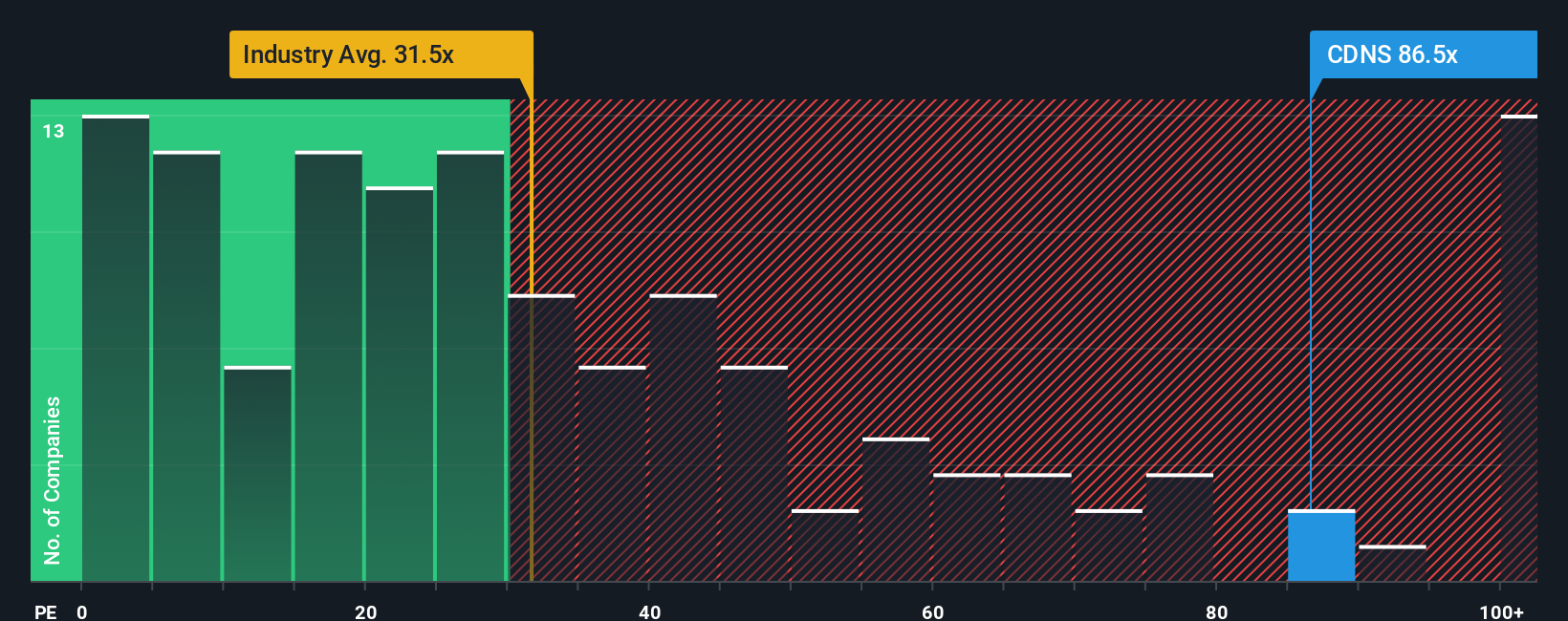

While the narrative fair value points to 11.7 percent upside, Cadence trades on a steep 86.6 times earnings, versus 31.7 times for the US Software industry, 60.6 times for peers, and a 40.6 times fair ratio. If sentiment cools, how much multiple compression could follow?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Cadence Design Systems Narrative

If you see the story differently, or want to stress test the assumptions yourself, you can quickly build a custom view in under three minutes: Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Cadence Design Systems.

Ready for more high conviction ideas?

Cadence might be compelling, but you will miss other standout opportunities if you stop here. Let the Simply Wall Street Screener surface your next moves.

- Capitalize on deep value potential by targeting companies trading at meaningful discounts through these 909 undervalued stocks based on cash flows tailored to strong cash flow profiles.

- Ride the next wave of innovation by focusing on cutting edge automation and intelligence with these 26 AI penny stocks that push the boundaries of data driven growth.

- Lock in reliable portfolio income by scanning for steady-paying businesses via these 15 dividend stocks with yields > 3% that already offer yields above 3 percent.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal