Hovnanian (HOV) Q3: Net Margin Compression Reinforces Bearish Profitability Narratives

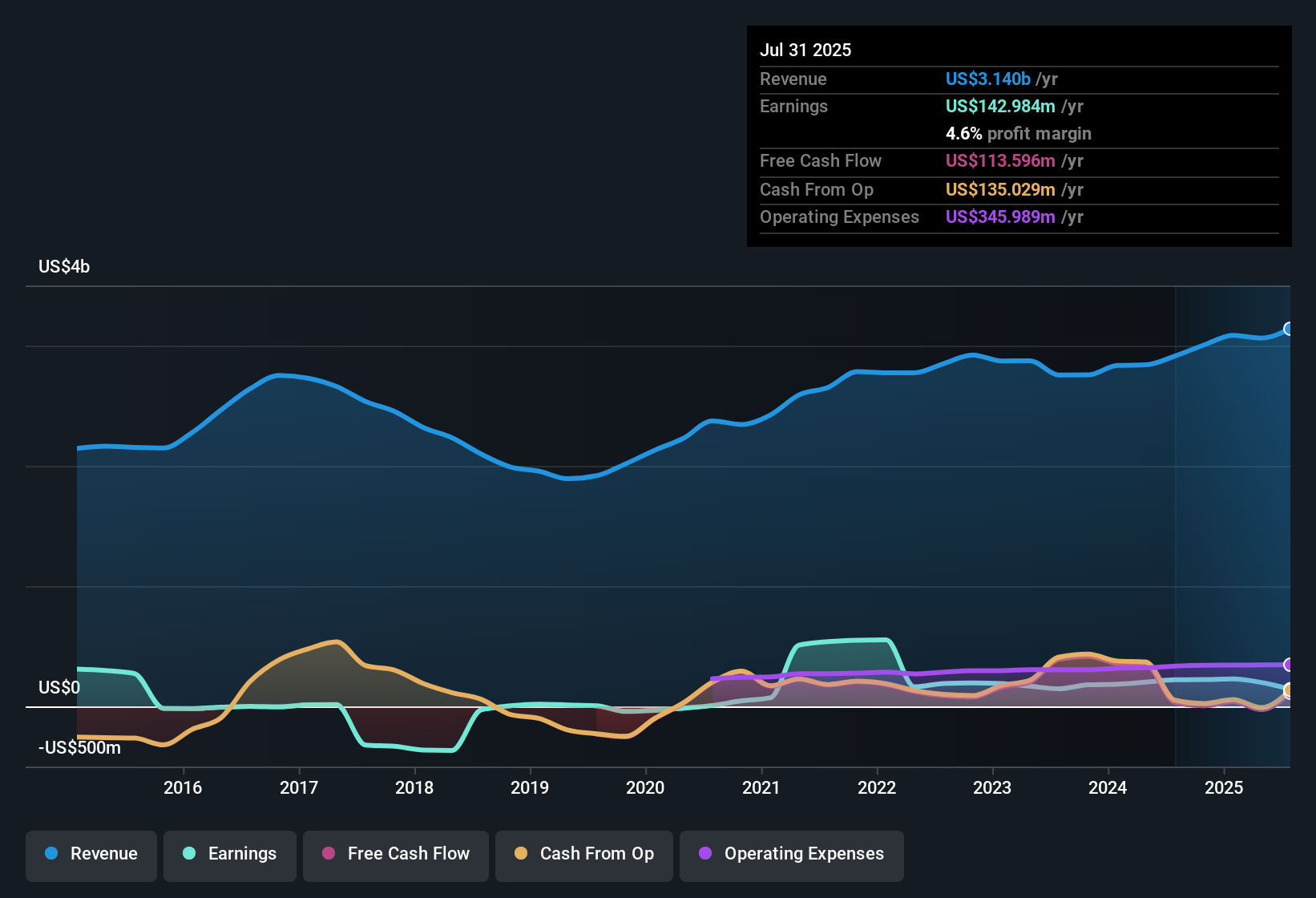

Hovnanian Enterprises (HOV) just posted its FY 2025 third quarter numbers, with revenue of about $800.6 million and EPS of $2.14, while trailing twelve month revenue came in at roughly $3.1 billion with EPS of $22.16. The company has seen revenue move from $2.8 billion and EPS of $31.63 over the trailing twelve months at Q2 2024 to $3.1 billion and EPS of $22.16 by Q3 2025. This sets up a mixed backdrop of growth at the top line but softer profitability, putting the spotlight firmly on margins and how durable they really are for investors.

See our full analysis for Hovnanian Enterprises.With the headline numbers on the table, the next step is to see how this earnings profile lines up with the dominant narratives around Hovnanian, and where the latest margin trends might start to shift investor expectations.

See what the community is saying about Hovnanian Enterprises

Margins Shrink as Net Income Falls to $13.7 Million

- Net income excluding extra items dropped to $13.7 million in Q3 FY 2025 from $68.7 million in Q3 FY 2024, while the latest trailing net margin is 4.6 percent versus 7.6 percent a year earlier.

- Consensus narrative watchers worry that high mortgage rates and incentives could keep pressure on these thinner margins even as revenue grows,

- They point to the 13.7 percent average annual earnings decline over five years alongside that margin slide from 7.6 percent to 4.6 percent as evidence that profitability has been getting squeezed.

- At the same time, they note that resilient sales and an efficient land strategy are intended to offset some of this pressure, so the key question is whether those tactics can stabilize margins at or above current levels.

Trailing EPS Down One Third in a Year

- On a trailing twelve month basis, EPS has fallen from $34.40 at Q4 FY 2024 to $22.16 by Q3 FY 2025, a drop of roughly one third in less than a year.

- Bears argue that this multiyear earnings decline, averaging 13.7 percent per year, validates concerns about long term demand and leverage,

- They connect the lower EPS and shrinking net margin to worries about high leverage and limited operating cash flow coverage of debt, seeing these as constraints on future earnings growth.

- They also highlight demographic and regulatory headwinds as potential drivers of continued pressure on earnings if profitability does not recover from current levels.

4.3x P/E Versus 12x Industry

- Hovnanian trades at a trailing P E of 4.3 times versus about 12.1 times for the US Consumer Durables industry and 12.7 times for peers, and roughly 55.5 percent below a DCF fair value of $233.53 at a $103.82 share price.

- Bullish investors see this discount as a potential opportunity despite thinner margins,

- They point out that trailing earnings are still categorized as high quality and that the company has reduced net debt to net capital from 146.2 percent in 2020 to 47.9 percent in 2025, which they believe supports the case for eventual multiple expansion.

- They also lean on Hovnanian’s land light approach, with 86 percent of lots optioned and strong sales pace per community, as reasons why earnings could stabilize and justify a higher valuation than the current 4.3 times P E.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Hovnanian Enterprises on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

See the numbers from a different angle and think the story should read another way: shape your own view in just minutes, Do it your way.

A great starting point for your Hovnanian Enterprises research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Explore Alternatives

Hovnanian’s shrinking margins, falling EPS and heavy debt burden suggest its earnings power is increasingly vulnerable to interest rates, incentives and softer housing demand.

If that kind of pressure makes you uneasy, use our solid balance sheet and fundamentals stocks screener (1939 results) to quickly zero in on financially stronger businesses built to better withstand the next downturn.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal