Do RDW’s Revenue Misses Undermine the Credibility of Its Long-Term Space Growth Story?

- In its recently reported third quarter, Redwire posted revenues of US$103.4 million, a 50.7% year-over-year increase that nonetheless came in 21.7% below analyst expectations and was paired with full-year revenue guidance that lagged aerospace peers.

- The results reinforced long-running concerns about Redwire’s execution, as management again blamed delayed, but not lost, contracts amid a history of missed promises and questions around the quality of recent growth at Edge.

- We’ll now explore how Redwire’s weaker-than-expected revenue and guidance affect its previously optimistic investment narrative built on space demand.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Redwire Investment Narrative Recap

To own Redwire, you have to believe its exposure to growing space and defense demand will eventually translate into more predictable growth and a path toward smaller losses. The latest revenue miss and weaker full year guidance directly undercut the near term catalyst of backlog converting to sales and heighten the biggest current risk, which is management’s ability to execute on complex contracts without repeated delays.

Among recent announcements, the US$250 million at the market equity program stands out in this context, because it sits alongside wider than expected losses and softer revenue guidance. While fresh capital can support delivery of contracts like DARPA’s Otter VLEO and other programs in the backlog, it also raises questions about future dilution and how much incremental funding Redwire may need before its growth ambitions start to meaningfully improve financial outcomes.

Yet beneath the optimistic space demand story, there is growing concern investors should be aware of around...

Read the full narrative on Redwire (it's free!)

Redwire’s narrative projects $887.3 million revenue and $73.2 million earnings by 2028. This requires 50.3% yearly revenue growth and a $322.7 million earnings increase from -$249.5 million today.

Uncover how Redwire's forecasts yield a $13.22 fair value, a 115% upside to its current price.

Exploring Other Perspectives

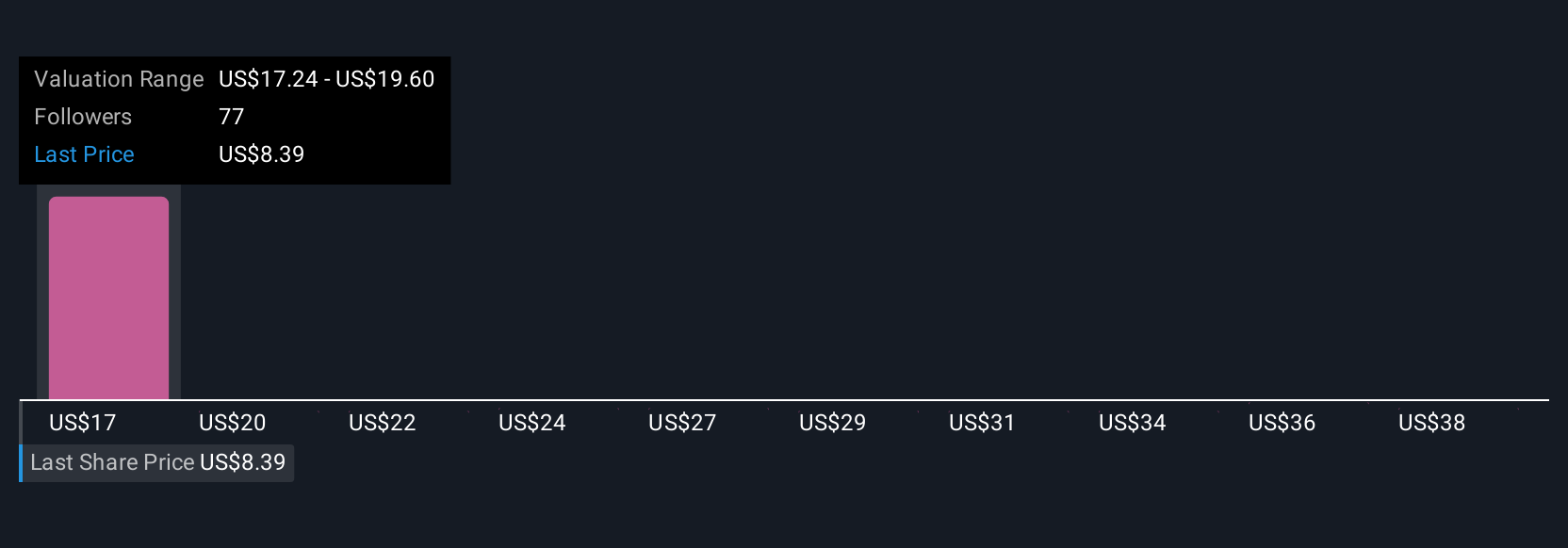

Thirteen fair value estimates from the Simply Wall St Community range from about US$0.52 to US$38.41 per share, showing how far opinions can be apart. Against this wide spread, Redwire’s weaker than expected 2025 revenue guidance and continued losses remind you to weigh contract execution risk and earnings visibility before leaning toward any single view.

Explore 13 other fair value estimates on Redwire - why the stock might be worth over 6x more than the current price!

Build Your Own Redwire Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Redwire research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Redwire research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Redwire's overall financial health at a glance.

Seeking Other Investments?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Find companies with promising cash flow potential yet trading below their fair value.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal