EQB (TSX:EQB) Q3: Net Interest Margin Squeeze Challenges Tech-Efficiency Bull Narrative

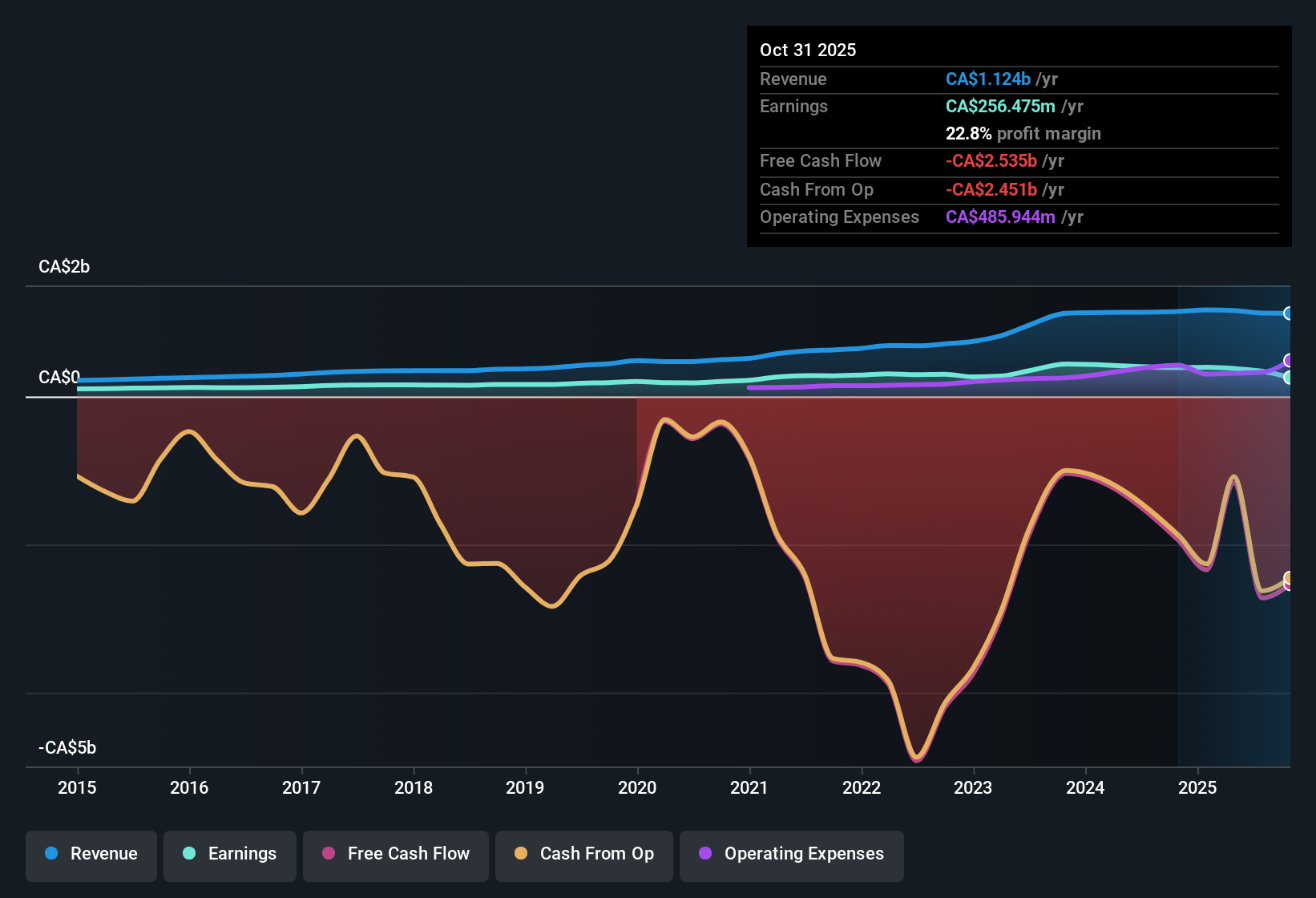

EQB (TSX:EQB) has just posted its FY 2025 third quarter scorecard, with revenue of about CAD 272.2 million and EPS of CAD 1.91 setting the tone for investors sifting through the latest numbers. Over the past few quarters, the bank has seen revenue move from CAD 305.9 million in Q3 2024 to CAD 303.96 million in Q1 2025 and CAD 285.72 million in Q2 2025 before landing at this quarter's CAD 272.16 million. At the same time, trailing twelve month EPS has eased from CAD 11.60 in Q4 2023 to CAD 8.89 by Q3 2025, leaving the spotlight firmly on how sustainable its current profit engine really looks as margins come under scrutiny.

See our full analysis for EQB.With the headline results on the table, the next step is to pit these figures against the prevailing narratives around EQB to see which stories hold up and where investor expectations might need a reset.

See what the community is saying about EQB

Margins Slip as Costs Outrun Income

- EQB's net interest margin eased from 2.2% in Q2 2025 to 1.92% in Q3 2025 while the cost to income ratio climbed from 49.3% to 53.4%, showing that funding and operating costs are taking a bigger slice of revenue.

- Consensus narrative expects digital innovation and automation to restore best in class efficiency. However, the recent move from a 44.5% cost to income ratio in Q3 2024 to 53.4% now highlights that expense discipline has not flowed through to the bottom line recently.

- Net profit margin on a trailing basis has also eased from 35.2% to 30.3%, which sits awkwardly beside the story of technology driven efficiency and improved profitability.

- With Q3 2025 net income at CAD 73 million versus CAD 109.5 million in Q3 2024, investors have to weigh the long term efficiency ambitions against a clear period of softer profitability.

Non Performing Loans Double in Two Years

- Non performing loans have risen from CAD 379.6 million at Q4 2023 on a trailing basis to CAD 815.3 million by Q3 2025, while the allowance for bad loans is flagged as low at 21%, underlining growing credit risk on a larger loan book of about CAD 47.2 billion.

- Bears worry about rising credit losses in concentrated lending segments, and the combination of higher non performing loans and a relatively low allowance gives that concern solid numerical backing.

- The bearish narrative highlights exposure to uninsured residential mortgages and alternative credit, and the step up in non performing loans since 2023 aligns with that focus on riskier portfolios.

- With net profit margin already down to 30.3% from 35.2% over the last year, any further credit deterioration could pressure earnings even before considering growth investments.

Cheap Valuation Versus Growth Outlook

- At a share price of CAD 98.01, EQB trades on a 10.8x P/E versus 11.7x for the North American banks industry and 14.9x for peers, while analysts see revenue growing about 12.1% per year and DCF fair value at roughly CAD 192.70, almost double the current price.

- Consensus narrative talks about multi year earnings expansion from digital banking and diversification, and the valuation gap gives numbers to that upside story but also reflects investor caution around more modest forecast earnings growth of roughly 3.6% per year.

- The forecast move in earnings from about CAD 341.3 million today to CAD 455.1 million by 2028 suggests steady progress, yet the expected margin drift from 30.3% to 29.2% tempers how much of that growth will translate into higher profitability.

- A 2.24% dividend yield adds income support, so if the growth and margin plans play out as expected, today's discount to DCF fair value of CAD 192.70 could offer meaningful long term upside.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for EQB on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

See the numbers differently? Take a moment to dive into the data, frame your own long term view, then share it in minutes, Do it your way.

A great starting point for your EQB research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

EQB's shrinking margins, rising non performing loans, and modest earnings growth expectations highlight execution risk and balance sheet pressure that could constrain future returns.

If this combination makes you uneasy, use our solid balance sheet and fundamentals stocks screener (1940 results) to quickly focus on financially stronger businesses with healthier buffers and more resilient earnings power today.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal