PVH (PVH) Q3 2026: Margin Compression and EPS Drop Reinforce Profitability Concerns

PVH (PVH) has just posted Q3 2026 results with revenue of $2.3 billion, basic EPS of $0.09, and net income excluding extra items of $4.2 million, setting a cautious tone around profitability. The company has seen quarterly revenue move from $2.3 billion in Q3 2025 to $2.3 billion in Q3 2026, while basic EPS over that span has swung from $2.36 to $0.09, underscoring how volatile the earnings line has been despite relatively stable sales. With trailing 12 month EPS at $6.70 and net margins under pressure, investors will be parsing these numbers closely to judge whether recent margin compression is a bump in the road or a more persistent challenge.

See our full analysis for PVH.With the headline figures on the table, the next step is to line these results up against the prevailing narratives around PVH's growth, profitability, and trajectory to see which storylines hold and which get put to the test.

See what the community is saying about PVH

Margins Hit by One Off Loss

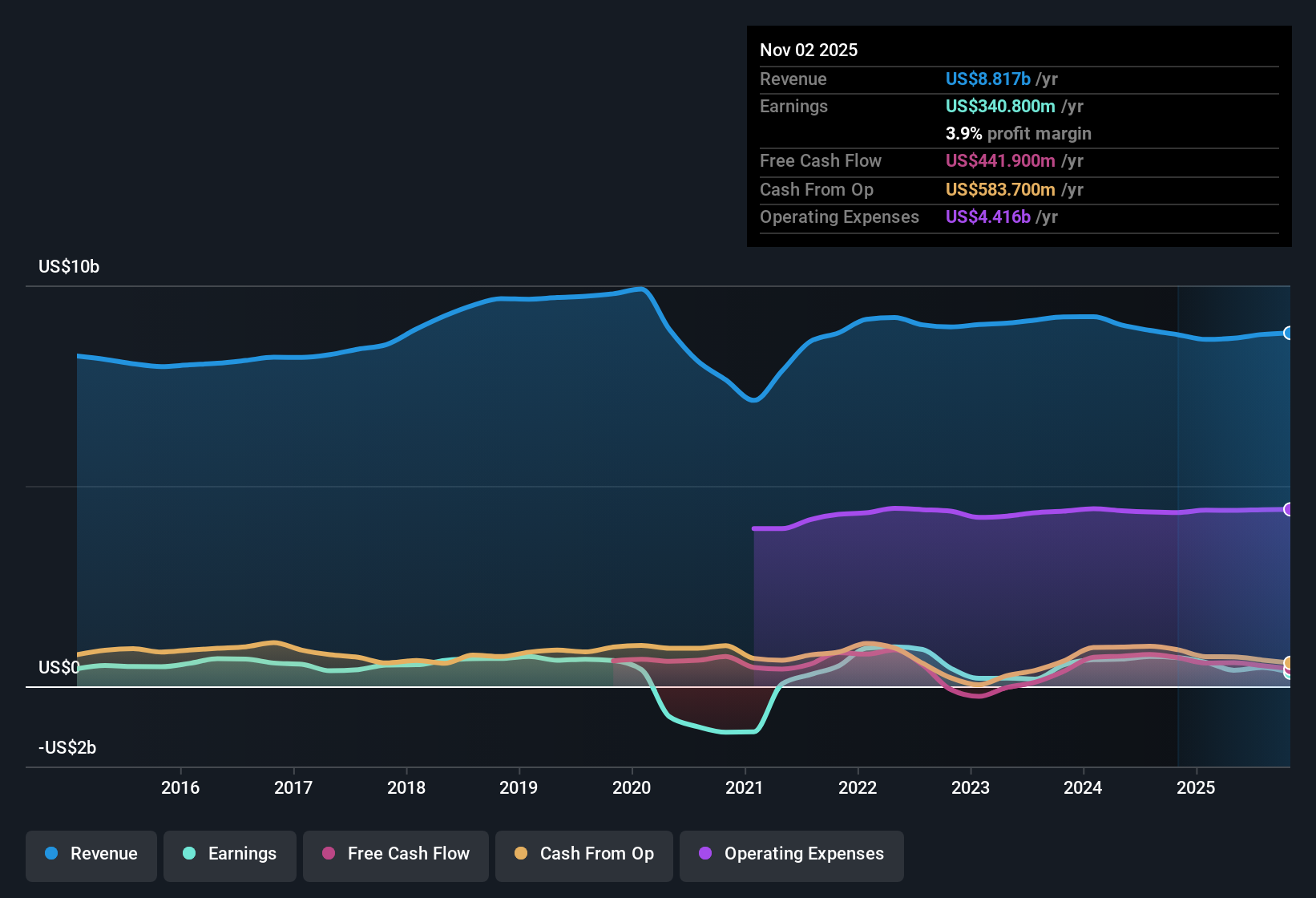

- Trailing 12 month net profit margin is 3.9 percent on $8.8 billion of revenue, down from 8.1 percent a year earlier, with results including a $503.7 million one off loss.

- Critics highlight that dependence on Calvin Klein and Tommy Hilfiger plus operational complexity could keep margins under pressure, and the margin drop to 3.9 percent lines up with that concern.

- APAC plans for revenue to be down mid single digits and recent transition challenges in Calvin Klein's product model both fit with the weaker profitability picture.

- At the same time, ongoing PVH+ efficiency and supply chain initiatives are intended to lift margins toward the 7.5 percent level analysts expect over the next three years.

Slow 2.3 Percent Top Line Growth

- Over the last year, revenue has grown 2.3 percent to $8.8 billion on a trailing 12 month basis, even as quarterly sales in Q3 2026 were roughly flat year on year at about $2.3 billion.

- Analysts' consensus narrative leans on global expansion, digital initiatives, and brand collaborations to drive growth, yet the 2.3 percent revenue pace and planned mid single digit decline in parts of APAC show that these growth levers are still only modestly reflected in the reported numbers.

- Plans for new flagship stores and higher direct to consumer sales are aimed at accelerating this growth beyond the recent 2.3 percent trend.

- Flat direct to consumer revenue and only modest e commerce gains so far support the cautious view that digital execution is lagging faster moving peers.

Cheap Valuation Versus Growth Outlook

- PVH trades on a P E of 10.9 times versus 34.5 times for peers and 21.3 times for the US Luxury industry, while the stock at $77.16 sits below both the $96.79 analyst price target and the $121.84 DCF fair value, even as earnings are forecast to grow about 19.7 percent per year to around $707.7 million by 2028.

- Consensus narrative emphasizes brand strength and efficiency programs as drivers of long term earnings growth, and the combination of 29.1 percent five year earnings growth and the 19.7 percent forward growth forecast fits that bullish angle.

- The valuation gap, with the share price roughly 20 percent below the $96.79 target and about 36.7 percent below DCF fair value, is a key part of the bullish case that the market is not fully pricing in those earnings expectations.

- Elevated debt and the recent $503.7 million one off loss, though, explain why some investors may question whether that growth and margin expansion to about 7.5 percent will materialize as smoothly as projected.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for PVH on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Notice something in PVH's results that others might be missing? Turn that angle into a concise, data backed market view in minutes, Do it your way.

A great starting point for your PVH research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

PVH's compressed margins, one off loss, modest 2.3 percent revenue growth, and balance sheet concerns leave execution risk and financial resilience in question.

If you want businesses with stronger cushions and fewer financial headaches, move quickly and use our solid balance sheet and fundamentals stocks screener (1940 results) to hunt for sturdier, stress ready alternatives.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal