Ulta Beauty (ULTA) Valuation Check as Earnings, Analyst Upgrades and Holiday Momentum Focus Investor Attention

Ulta Beauty (ULTA) heads into its December 4 earnings report with the wind at its back, as upbeat Wall Street commentary, brisk holiday promotions, and expanding international operations all converge to shape expectations.

See our latest analysis for Ulta Beauty.

Investors have largely leaned into that story, with Ulta’s share price delivering a strong year to date share price return of 26.9 percent and a one year total shareholder return of 38.6 percent, suggesting momentum is still building as promotions and international expansion ramp up.

If Ulta’s holiday playbook has you thinking about where else growth and loyalty are driving upside, now is a good time to explore fast growing stocks with high insider ownership.

With shares near record highs, analyst targets edging higher, and value models flashing rich, investors face a tougher call than ever: is Ulta still a buy ahead of earnings, or is the market already baking in the next leg of growth?

Most Popular Narrative: 5.2% Undervalued

Compared with Ulta Beauty’s last close of $544.52, the most popular narrative sees modest upside from a higher fair value anchored in steady growth and resilient margins.

The analysts have a consensus price target of $574.565 for Ulta Beauty based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $680.0, and the most bearish reporting a price target of just $405.0.

Want to see what is really powering that upside case? The narrative leans on disciplined revenue growth, firm margins, and a future earnings multiple that assumes enduring category leadership. Curious how those threads tie together into that price tag?

Result: Fair Value of $574.57 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising wage and rent pressures, alongside the wind down of the Target partnership, could squeeze margins and test how durable Ulta’s growth story really is.

Find out about the key risks to this Ulta Beauty narrative.

Another View: Rich on Market Ratios

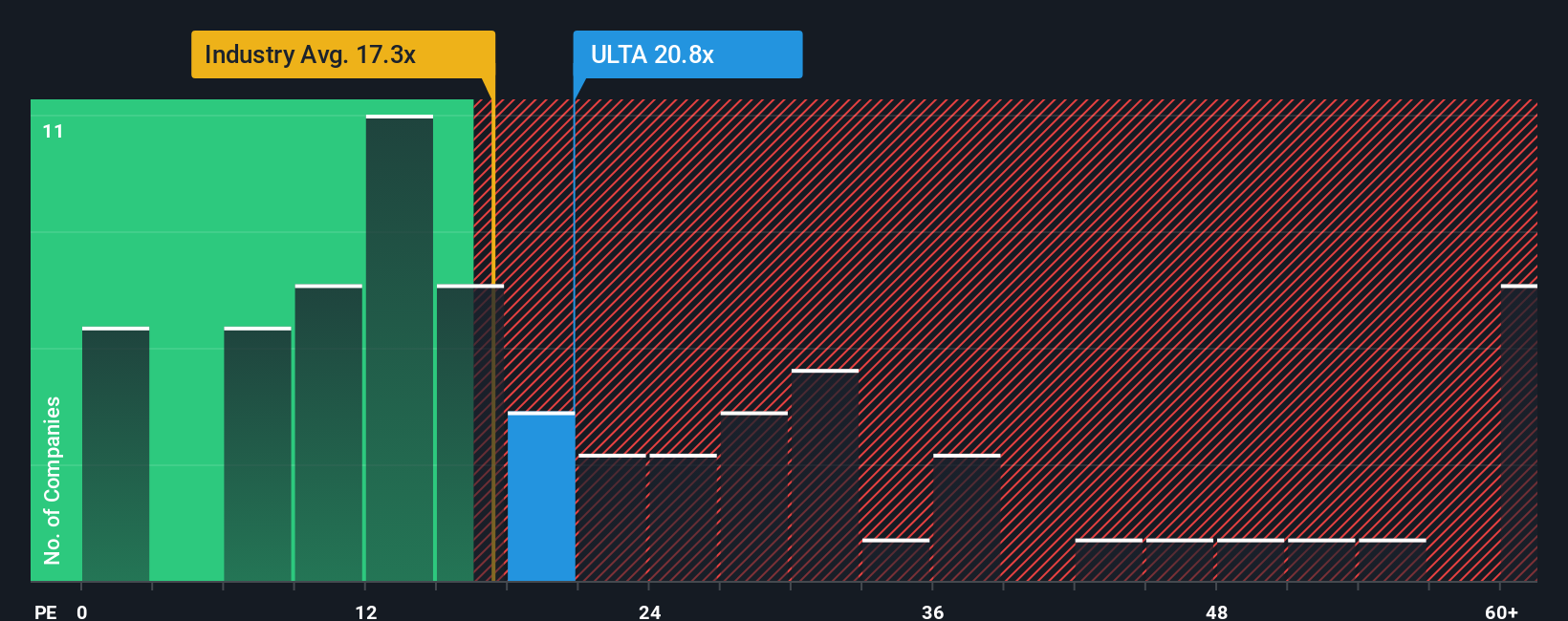

Market based signals tell a different story. Ulta trades on a price to earnings ratio of 20.3 times, which is above the US Specialty Retail average of 17.9 times and its own fair ratio of 17.1 times. This suggests limited margin of safety if growth or margins disappoint from here.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ulta Beauty Narrative

If your perspective diverges, or you would rather dig into the numbers yourself, you can easily craft a personalized view in just minutes, Do it your way.

Prefer to form your own view? Our platform makes it easy to explore a stock's fundamentals and create your own narrative in minutes.

Ready for your next investing move?

Before the market sets the pace without you, put Simply Wall Street’s screener to work and line up your next potential winners in just a few clicks.

- Capture potential bargains early by scanning these 907 undervalued stocks based on cash flows that the market may be overlooking despite strong cash flow support.

- Ride powerful innovation trends by targeting these 26 AI penny stocks positioned at the forefront of automation, data, and intelligent software.

- Boost your income strategy by filtering for these 15 dividend stocks with yields > 3% that can help strengthen long term total returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal