America's Car-Mart (CRMT) Same-Store Sales Slide Undercuts Profitability Turnaround Narrative in Q1 2026

America's Car-Mart (CRMT) kicked off Q1 2026 with revenue of $339.6 million and a basic EPS loss of $0.69, alongside a net loss of $5.7 million and a 4.1% same-store sales decline, setting a cautious tone for the new fiscal year. The company has seen quarterly revenue move from $346.6 million in Q1 2025 to $368.8 million in Q4 2025 before landing at $339.6 million this quarter, while EPS swung from a $0.15 loss in Q1 2025 to $1.29 in Q4 2025 before reverting to a loss in Q1 2026, leaving investors focused squarely on how margins are holding up through these shifts.

See our full analysis for America's Car-Mart.With the latest numbers on the table, it is worth setting them against the dominant stories around growth, profitability and risk to see which narratives hold up and which ones the results start to challenge.

See what the community is saying about America's Car-Mart

Profitability Swings Around Recent Turnaround

- On a trailing basis, net income over the last 12 months was $13.1 million versus a $36.6 million loss in the year to Q1 2025, even though Q1 2026 itself slipped back to a $5.7 million loss.

- Consensus narrative points to more stable margins from better credit analytics and collections, yet the sharp move from a $17.9 million trailing profit at Q4 2025 to $13.1 million at Q1 2026 shows that recent profitability is still sensitive.

- The five year backdrop of roughly 47.3% annual earnings decline contrasts with the latest 42.5% annual growth forecast, so the bullish case leans heavily on this recent turn holding.

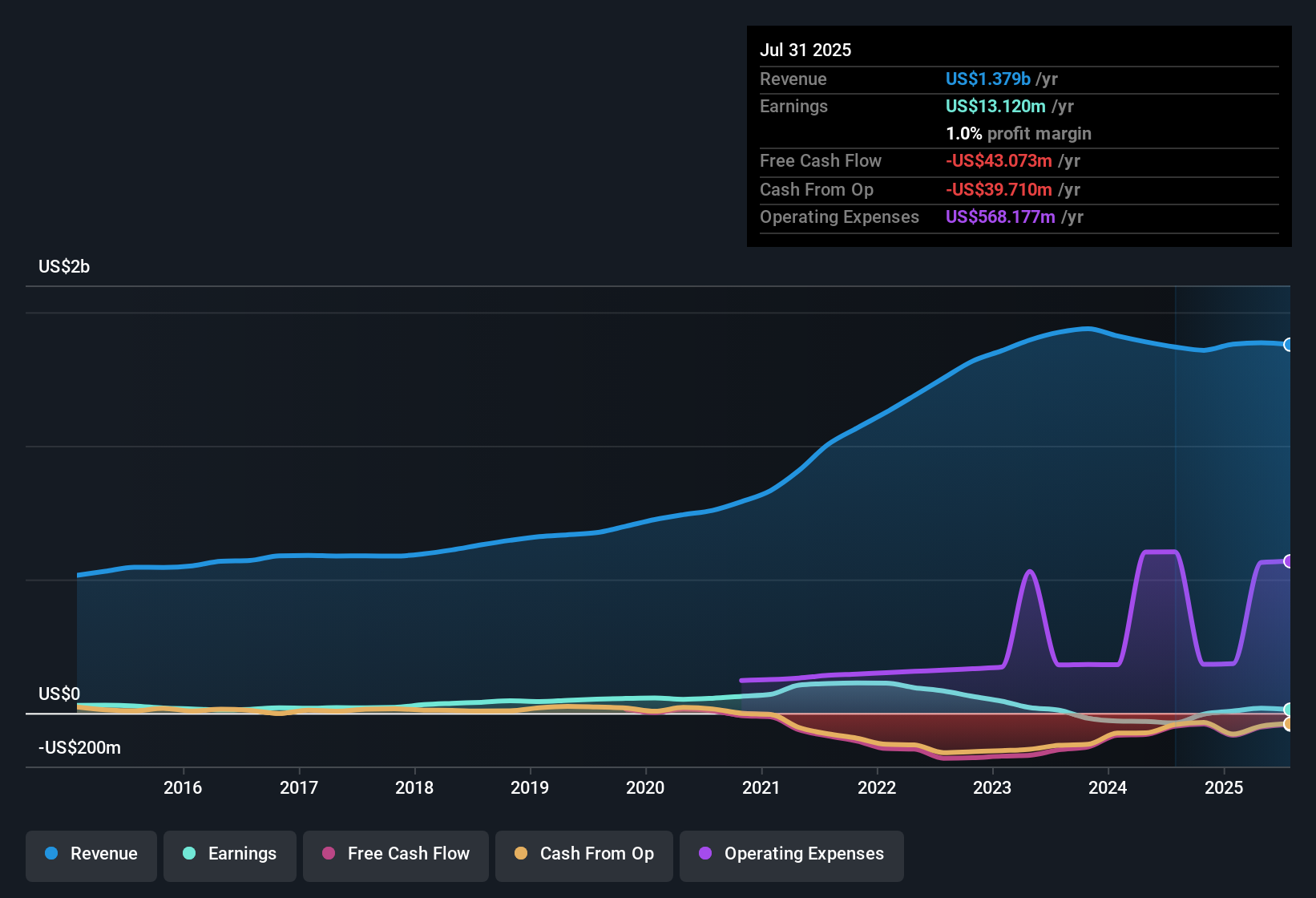

- With total revenue over the last 12 months essentially flat at about $1.38 billion, most of the earnings recovery has come from efficiency and credit performance rather than top line expansion, which can cut both ways if conditions tighten again.

Slow 0.7% Revenue Growth Versus Market

- Trailing 12 month revenue has grown about 0.7% per year to roughly $1.38 billion, well below the 10.6% annual growth benchmark for the broader US market.

- Consensus narrative highlights expanding inventory, financing, and digital tools as growth drivers, but the modest 0.7% revenue growth and mixed same store sales shifts from plus 3.1% in Q3 2025 to minus 4.1% in Q1 2026 underline how hard it has been to translate strategy into sustained top line momentum.

- Same store sales have bounced between negative 8.6%, negative 8.4%, plus 3.1%, and negative 4.1% across recent quarters, suggesting store level demand and ticket dynamics remain choppy even as new tools roll out.

- Analysts still project about 7.0% annual revenue growth ahead, so the current gap between actual 0.7% and that target is a key test of the bullish growth story.

Cheaper 16.3x P/E With Financing Risk

- The trailing price to earnings ratio sits at 16.3 times, below the US market at 18.7 times and the US Specialty Retail average at 18.5 times, as well as materially under a 37.1 times peer average.

- Bears focus on weak interest coverage, and the fact that recent profits only reached $13.1 million over the last 12 months while interest payments are not well covered means the lower multiple is being assigned alongside a real balance sheet concern rather than purely a bargain opportunity.

- Even with the stock at $25.86 and forecasts calling for earnings to grow around 42.5% per year, the market still prices CRMT below both industry and peer averages, which fits a cautious view on financial resilience.

- Investors weighing the risk reward trade off must balance that discounted multiple against a history of multi year earnings declines and management’s need to improve coverage before the bullish growth forecasts can fully translate into higher valuation.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for America's Car-Mart on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Spot something in the figures the consensus might be missing? Turn that into a clear, data backed view in just a few minutes: Do it your way

A great starting point for your America's Car-Mart research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Explore Alternatives

America's Car-Mart is grappling with shaky profitability trends, weak interest coverage, and uneven same store sales, raising real questions about its financial resilience.

If those vulnerabilities make you uneasy, use our solid balance sheet and fundamentals stocks screener (1940 results) to quickly focus on businesses with stronger balance sheets, healthier coverage ratios, and more durable earnings power.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal