A-share subscription | Mu Xi Co., Ltd. (688802.SH) opens subscription to focus on developing full-stack high-performance GPU chips and computing platforms

The Zhitong Finance App learned that on December 5, Mu Xi Shares (688802.SH) began subscription. The issuance price was 104.66 yuan/share, the maximum subscription limit was 60,000 shares, and the industry's price-earnings ratio was 58.25 times. It belongs to the Shanghai Stock Exchange, and Huatai United Securities is its sponsor.

According to the prospectus, Mu Xi Co., Ltd. is committed to developing full-stack high-performance GPU chips and computing platforms. Its main business is to develop, design and sell full-stack GPU products used in the fields of artificial intelligence training and reasoning, general computing and graphics rendering, and to provide supporting software stacks and computing platforms around GPU chips.

As the physical foundation and underlying infrastructure for the development of modern information technology, GPUs have the characteristics of high value, high complexity, high technical threshold, and rapid evolution, and place high demands on the ability of enterprises to independently develop, stabilize supply, and continuously innovate.

With the diversification and rapid development of the domestic AI chip market, GPUs, as an important component of AI chips, occupy a central position in the artificial intelligence computing market. According to Bernstein Research's data measured in terms of sales amount and the issuer's calculation of computing power scale in combination with IDC data, the company's share of the AI chip market in China in 2024 was about 1%.

Since its establishment, the company has always focused on technological innovation and iterative upgrading of GPU products, forming a unique GPU product system and an independent and open software ecosystem, continuously providing energy-efficient and highly versatile computing power support for cloud computing, promoting artificial intelligence to empower thousands of industries, and focusing on application scenarios in science and research, finance, transportation, energy, healthcare, entertainment, etc., and has become an important force in promoting autonomous and controllable intelligent computing power infrastructure in China. It is one of the main leading enterprises in high-performance GPU products in China.

The company's main products cover the three major fields of artificial intelligence computing, general computing, and graphics rendering. During the reporting period, it successively launched the Xisi N-series GPUs for intelligent computation reasoning, the Xiyun C-series GPUs for training integrated and general computing, and the Xicai G-series GPUs being developed for graphics rendering.

In terms of commercial applications, the company is one of the few GPU suppliers in China that have actually realized large-scale commercial application of the kilocar cluster, and is developing and promoting the implementation of the 10,000 card cluster. Currently, it has successfully supported the 128B MoE model and the like to complete full pre-training. By the end of the reporting period, the issuer's cumulative sales volume of GPU products exceeded 25,000 units.

In terms of production model, the company is a typical Fabless model enterprise. It is mainly responsible for formulating GPU chip specifications and solutions, completing chip architecture design, core GPU IP development, package design, physical design, design verification, and delivery of GPU chip design layouts, etc., while GPU chip wafer processing and packaging testing are completed through outsourcing. The company procures custom-processed wafers from wafer manufacturers, packaging testing services from packaging testing plants, and board card processing services from processing manufacturers. During this period, the company was supported by process management and testing support.

In terms of sales, the company uses a combination of direct sales and distribution to sell products. The top five customers account for a relatively high share of the main business revenue. In 2022, 2023, 2024 and January-March 2025, they accounted for 100%, 91.58%, 71.09% and 88.35%, respectively.

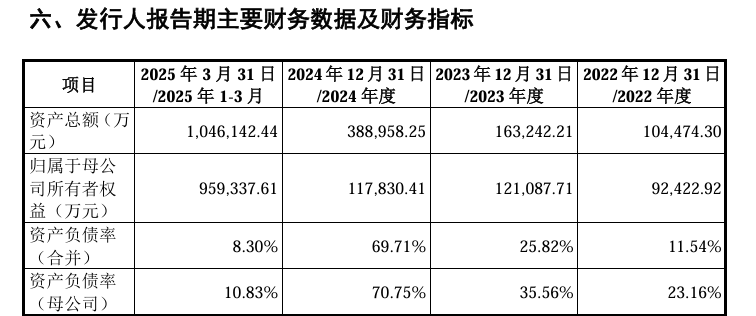

On the financial side, in 2022, 2023, 2024, and January-March 2025, Mu Xi Co., Ltd. achieved operating income of approximately 426,400 yuan, 53.0212 million yuan, 743 million yuan, and 320 million yuan.

In the same period, the company achieved net profit of approximately -777 million yuan, -881 million yuan, -1,409 million yuan, and -233 million yuan, respectively.

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal