What Does Coincheck Group’s (CNCK) User Growth With Falling Volumes Reveal About Its Crypto Role?

- Over the past year, Coincheck Group’s Japanese cryptocurrency exchange saw trading volumes fall sharply even as verified user accounts kept rising, highlighting a shift in how customers are using the platform.

- This divergence between growing account numbers and reduced trading activity points to changing market behavior that could reshape Coincheck Group’s role in the crypto ecosystem.

- We’ll now examine how this shift between rising verified accounts and weaker trading volume influences Coincheck Group’s broader investment narrative.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

What Is Coincheck Group's Investment Narrative?

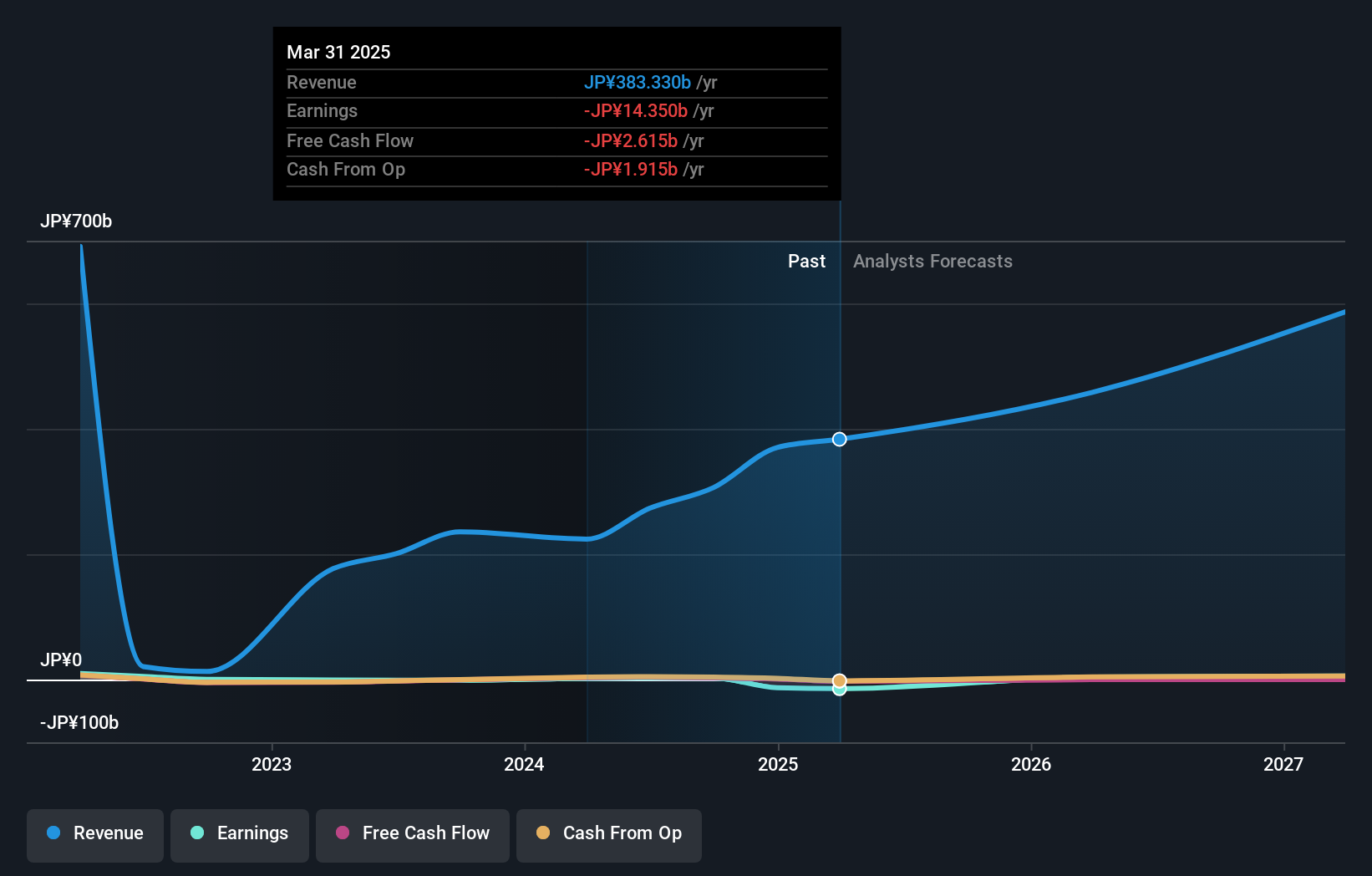

To own Coincheck Group, you have to believe its large and growing user base can eventually be converted into sustainable, profitable activity, not just headline account growth. The latest data showing sharply weaker trading volumes alongside rising verified accounts cuts both ways for that story. On one hand, it could blunt near term revenue catalysts that were anchored in higher turnover and a return to consistent profitability after recent net losses. On the other, it hints at users staying engaged on the platform, potentially giving management more time to refine monetization. With a very low price to sales multiple, a volatile share price and a relatively new leadership team, the risk is that prolonged volume softness turns what looked like operating leverage into a drag. This divergence in usage is now central to the thesis.

However, there is one emerging volume related risk that investors should not overlook. Our expertly prepared valuation report on Coincheck Group implies its share price may be lower than expected.Exploring Other Perspectives

Explore 2 other fair value estimates on Coincheck Group - why the stock might be a potential multi-bagger!

Build Your Own Coincheck Group Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Coincheck Group research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Coincheck Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Coincheck Group's overall financial health at a glance.

Seeking Other Investments?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal