Taking Stock of Sportradar (SRAD): Valuation Check After New Bearish Concerns on Grey-Market Exposure

Recent bearish commentary on Sportradar Group (SRAD) is putting its grey market exposure under the microscope, as critics question how sustainable its data and betting partnerships are in loosely regulated jurisdictions.

See our latest analysis for Sportradar Group.

Despite the latest bearish write up, Sportradar’s 1 day share price return of 3.91 percent and year to date share price return of 31.02 percent suggest investors still see meaningful growth potential, even after a 25.98 percent 3 month share price pullback from recent enthusiasm.

If Sportradar’s risk profile has you reassessing your options, this could be a good moment to explore fast growing stocks with high insider ownership as another way to spot compelling growth stories with significant insider alignment.

With revenue and earnings still growing double digits, and the share price trading at a sizable discount to analyst targets, is Sportradar a misunderstood compounder, or is the market already discounting all of its future upside?

Most Popular Narrative Narrative: 30.6% Undervalued

With Sportradar’s fair value narrative sitting well above the last close of $22.85, the story hinges on sustained growth and rising profitability.

Increasing demand for advanced, real time sports data, in play betting, and micro markets is driving greater adoption of premium, higher margin products like MTS and 4Sight, supporting both revenue acceleration and EBITDA margin expansion.

Curious how this growth engine translates into that higher valuation? The narrative quietly leans on compounding revenue, expanding margins, and a future earnings multiple that might surprise you.

Result: Fair Value of $32.92 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, intensifying competition and the potential renegotiation or loss of key sports data rights could quickly challenge the assumed pricing power and growth runway.

Find out about the key risks to this Sportradar Group narrative.

Another Angle On Valuation

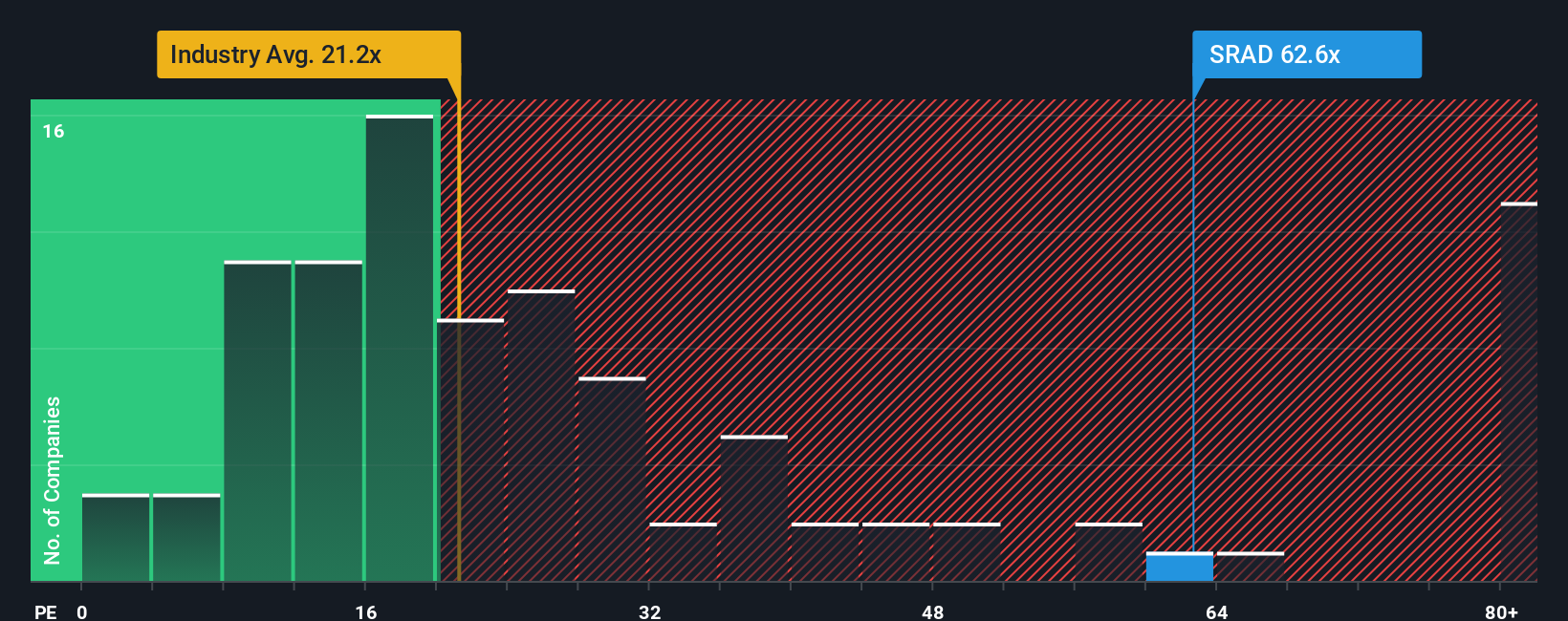

While narrative models suggest Sportradar is 30.6 percent undervalued, its 61.7 times earnings multiple tells a different story. That is nearly triple the US Hospitality average of 21.3 times and well above a fair ratio of 31.3 times, which implies potential downside if sentiment cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Sportradar Group Narrative

If the existing narratives do not quite match your view, dive into the numbers yourself and build a custom storyline in minutes, Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Sportradar Group.

Looking for more investment ideas?

Do not stop at one opportunity when a whole field of mispriced or overlooked businesses is waiting. Your next smart move could be just a few clicks away.

- Capture early stage momentum by scanning these 3573 penny stocks with strong financials that pair low share prices with balance sheets strong enough to support the next leg of your portfolio’s growth.

- Position your capital where innovation meets earnings by checking out these 26 AI penny stocks that are commercializing real world artificial intelligence solutions, not just selling a story.

- Focus on potential upside with these 908 undervalued stocks based on cash flows, concentrating on companies whose cash flow strength and current prices create a margin of safety that the market has not fully recognized yet.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal