Wavestone (ENXTPA:WAVE) Margin Expansion Reinforces Bullish Profitability Narratives After H1 2026 Results

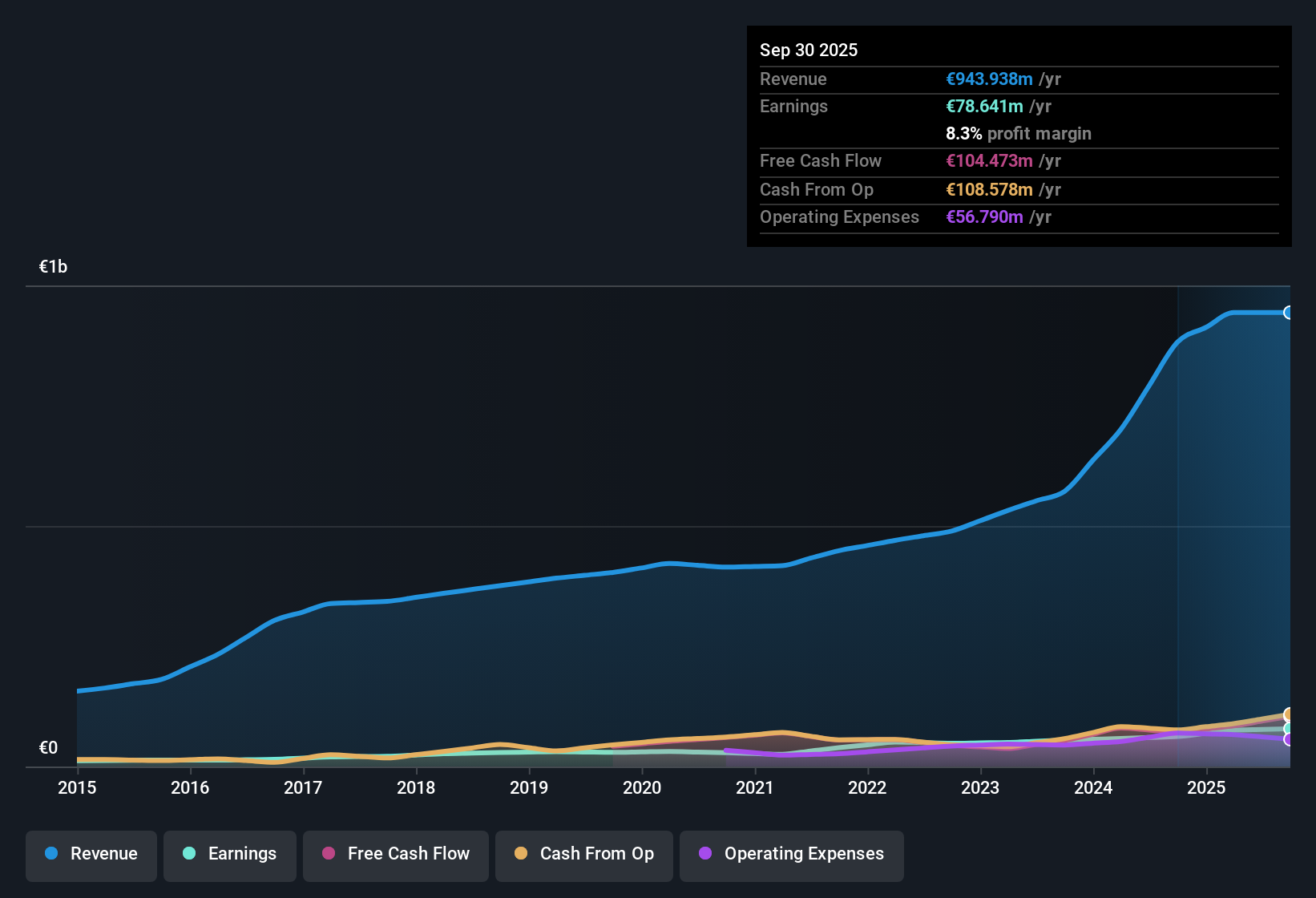

Wavestone (ENXTPA:WAVE) just posted its H1 2026 scorecard with trailing twelve month revenue of about €944 million and EPS of roughly €3.22, backed by year over year earnings growth of 25.9% and an 8.3% net profit margin. The company has seen revenue climb from €424 million in H2 2024 to €486 million in H2 2025 while EPS stepped up from €1.53 to €1.99 over the same stretch. Analysts currently forecast earnings growth around 11% per year, which they expect to support further margin resilience.

See our full analysis for Wavestone.With the latest numbers on the table, the next step is to see how this margin story lines up against the most widely shared narratives around Wavestone’s growth path and risk profile.

Curious how numbers become stories that shape markets? Explore Community Narratives

Margins Lift with 8.3% Net Profit

- The trailing twelve month net profit margin of 8.3%, up from 7.1% a year earlier, shows more of each euro of the €943.9 million in revenue is now turning into profit.

- What stands out for a bullish view is how this margin improvement lines up with 25.9% trailing earnings growth and a five year earnings CAGR of 18.9%, suggesting the business is not just growing but converting revenue into profit more efficiently.

- Supporters can point to net income rising to €78.6 million on a trailing basis alongside that 8.3% margin as evidence that recent growth has been backed by profitability, not just top line expansion.

- At the same time, the move from a 7.1% to 8.3% margin gives bulls a concrete sign that Wavestone has been able to hold pricing and utilization in a people intensive consulting model.

EPS Momentum Outpaces Revenue

- Basic EPS on a trailing twelve month basis climbed from €2.62 to €3.09 and now €3.22, while trailing revenue over the same snapshots edged from €882.2 million to about €943.9 million.

- From a bullish angle, this faster EPS progression versus revenue fits the idea that Wavestone is gaining operating leverage. It also means any slowdown from the current 11.0% forecast earnings growth rate would be closely watched.

- The step up in semi annual EPS from €1.53 in H2 2024 to €1.99 in H2 2025, together with the trailing 25.9% earnings growth, indicates that profit per share has been compounding faster than sales.

- However, with forecast revenue growth at about 3.8% per year, investors will want to see whether margin discipline can keep EPS ahead of that pace as the business scales.

Share Price Below DCF Value

- With the share price around €57.40 versus a DCF fair value of roughly €60.19, the stock trades at about a 4.6% discount even as its P/E of 17.8x sits above the 14.3x peer average and just under the 18.7x European IT industry average.

- Critics of a bullish stance emphasize that this premium P/E can limit upside if forecast earnings growth of about 11.0% per year or the 3.8% revenue growth rate falls away. The modest DCF discount must therefore be weighed against the richer multiple versus direct peers.

- On one side, the 25.9% trailing earnings growth and 8.3% margin help justify paying more than peer P/E levels because they show stronger recent profitability.

- On the other, slower expected top line growth than the broader French market means bears can reasonably question how long the market will keep paying a higher multiple if that gap persists.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Wavestone's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

Explore Alternatives

While Wavestone is delivering solid margin expansion, its relatively modest forecast revenue growth and valuation premium versus peers raise questions about long term upside potential.

If you want businesses with stronger upside potential than this slower growth and premium pricing suggest, use our high growth potential stocks screener (47 results) to quickly zero in on established companies forecast to compound earnings much faster.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal