What Leidos Holdings (LDOS)'s Early G1 Security Wins Mean For Shareholders

- In late November 2025, Leidos and Quadridox announced they had integrated Leidos’ Examiner 3DX CT with Quadridox’s DELPHI XRDI into an advanced checked baggage screening system that has completed internal testing and is being prepared for airport trials planned in 2026.

- A separate announcement that Leidos’ B220-HT explosive trace detection system achieved G1 Standard certification ahead of stricter European aviation security rules highlights how its installed base of more than 750 units is already aligned with upcoming regulatory requirements.

- We’ll now explore how early G1 certification for the widely deployed B220-HT system could influence Leidos’ investment narrative around margins and resilience.

These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Leidos Holdings Investment Narrative Recap

To own Leidos, you generally need to believe it can convert long term government security and modernization spending into dependable earnings, despite its reliance on public budgets and high debt. The new baggage screening and trace detection updates support its security technology positioning, but do not appear to alter the near term picture where contract wins and pricing pressure across IT and engineering services remain the key catalysts and risks.

The G1 certification of the widely deployed B220-HT explosive trace detection system is most relevant here, because it reinforces Leidos’ role in meeting tighter European aviation rules with an existing 750 unit installed base. That alignment with evolving security standards sits alongside its broader opportunity in multi year defense, border protection and infrastructure programs, which many investors currently view as central to the company’s ability to sustain margins and earnings.

However, while certification helps today, investors should also be aware of the risk that increasing competition for AI driven, outcome based contracts could...

Read the full narrative on Leidos Holdings (it's free!)

Leidos Holdings' narrative projects $18.6 billion revenue and $1.5 billion earnings by 2028. This implies 3.0% yearly revenue growth and an earnings increase of about $0.1 billion from $1.4 billion today.

Uncover how Leidos Holdings' forecasts yield a $218.08 fair value, a 16% upside to its current price.

Exploring Other Perspectives

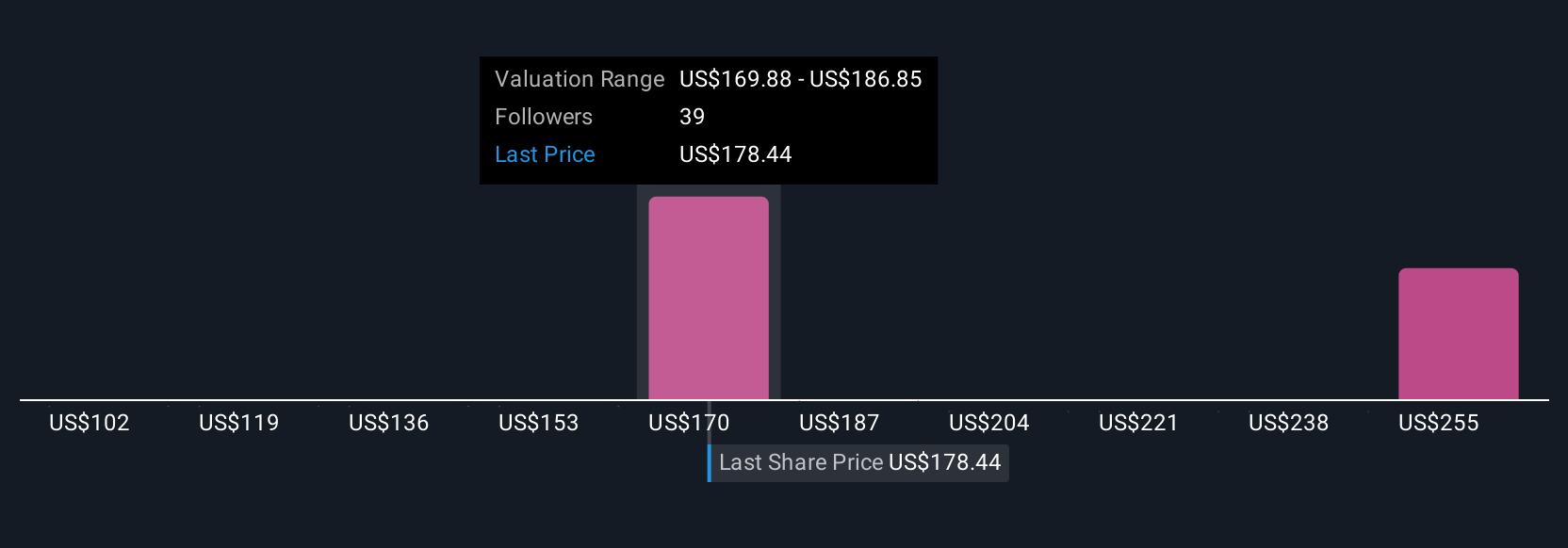

Six fair value estimates from the Simply Wall St Community span about US$152 to US$298 per share, showing how far apart individual views can be. Against that backdrop, Leidos’ exposure to shifts in government funding priorities may meaningfully shape how those different expectations around future resilience and earnings play out, so it is worth comparing several of these perspectives before forming a view.

Explore 6 other fair value estimates on Leidos Holdings - why the stock might be worth 19% less than the current price!

Build Your Own Leidos Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Leidos Holdings research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Leidos Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Leidos Holdings' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal