Adyen (ENXTAM:ADYEN) Valuation Check as Shares Drift Lower Despite Ongoing Double-Digit Growth

Adyen (ENXTAM:ADYEN) has quietly drifted lower this year, and that slide is turning heads. With the stock down about 7% year to date, investors are rechecking what they are actually paying for.

See our latest analysis for Adyen.

The recent slide adds to what has been a choppy stretch, with a 30 day share price return of minus 5.7% and a 1 year total shareholder return near minus 10%, suggesting momentum is still fading despite solid underlying growth.

If Adyen’s pullback has you reassessing your options, this could be a good moment to explore fast growing stocks with high insider ownership as potential fresh ideas for your watchlist.

With revenue and earnings still growing double digits and the share price lagging, investors now face a key question: Is Adyen trading at a rare discount, or is the market simply pricing in all that future growth?

Most Popular Narrative Narrative: 26.6% Undervalued

Compared to Adyen’s last close of €1,330.60, the most widely followed narrative points to a materially higher fair value anchored in future earnings power.

Modularization and innovation (such as risk/fraud services, Intelligent Routing) enable differentiated, value-added pricing and higher take rates. This should support net margin expansion as operating leverage from scale continues to materialize.

Want to see what kind of revenue runway and profit margins could justify this richer future multiple? The core thesis leans on powerful earnings compounding and a premium valuation usually reserved for category leaders. Curious which long term assumptions turn today’s pullback into a potential upside scenario? Unpack the full playbook behind this fair value view.

Result: Fair Value of €1,812.87 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upside view depends on Adyen sustaining enterprise wins and wallet share gains, with rising competition and regulatory costs posing potential setbacks.

Find out about the key risks to this Adyen narrative.

Another Lens on Valuation

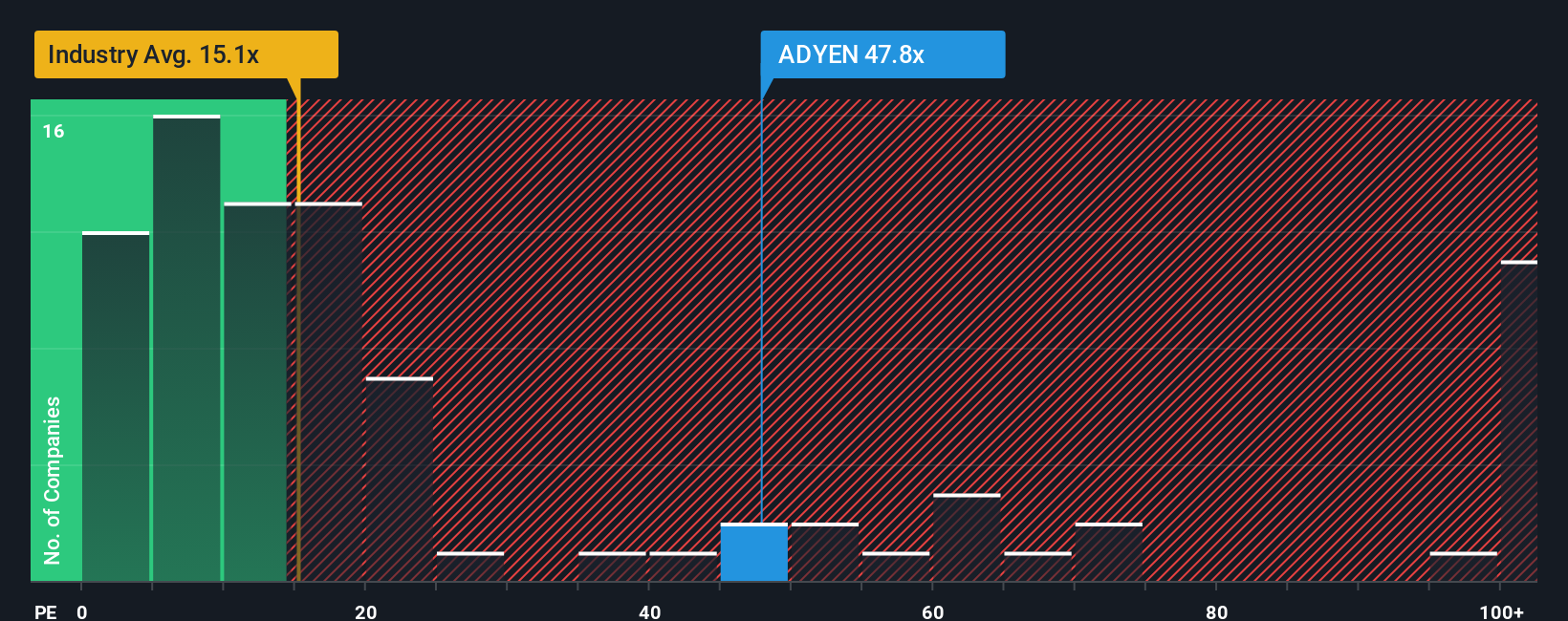

Look past the upbeat narrative and the picture shifts. On a simple price to earnings basis, Adyen trades at about 43 times earnings versus 13.9 times for the wider European diversified financials group, and a fair ratio closer to 20.8 times, implying meaningful valuation risk if sentiment cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Adyen Narrative

If this perspective does not quite align with your own, or you would rather lean on your own research, you can build a tailored narrative in just a few minutes, starting with Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Adyen.

Ready for more investment ideas?

Adyen might be just one chapter in your portfolio story, so do not leave potential opportunities on the table when focused, data driven screeners can help.

- Capture potential bargains early by using these 912 undervalued stocks based on cash flows to spot quality companies that the market may be underpricing based on their future cash flows.

- Supercharge your growth watchlist by scanning these 25 AI penny stocks for businesses building real products and revenue on top of artificial intelligence.

- Strengthen your income strategy with these 14 dividend stocks with yields > 3% that highlight companies offering yields above 3% while still maintaining solid fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal