Is Nutanix At $47 A Share An Opportunity After Recent 33% Slide?

- If you are wondering whether Nutanix at around $47 a share is a bargain in disguise or a value trap waiting to happen, this breakdown is for you.

- The stock has slid about 33.3% over the last month and is down 22.6% year to date, yet it is still sitting on gains of roughly 57.4% over 3 years and 59.6% over 5 years.

- That kind of whiplash in returns has coincided with shifting sentiment around high growth software names, as investors rotate between riskier cloud stories and more predictable cash generators. At the same time, Nutanix has stayed in the headlines for its role in simplifying hybrid multicloud infrastructure as enterprises rethink how they run workloads across on-prem and public cloud environments.

- On our framework, Nutanix scores 3/6 on valuation checks, suggesting pockets of undervaluation alongside some red flags. Next, we will unpack what that means across discounted cash flow, multiples, and peer comparisons, before finishing with a more structured way to think about Nutanix’s value story.

Find out why Nutanix's -30.6% return over the last year is lagging behind its peers.

Approach 1: Nutanix Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a business is worth by projecting its future cash flows and discounting them back into today’s dollars. For Nutanix, the 2 stage Free Cash Flow to Equity model starts with its latest twelve month free cash flow of about $773.8 million and then grows those cash flows based on analyst forecasts and longer term estimates.

Analysts see Nutanix’s free cash flow rising to roughly $802.99 million in 2026 and $918.09 million in 2027, before climbing to about $1.05 billion by 2028. Beyond that, Simply Wall St extrapolates cash flows out to 2035, gradually slowing the growth rate as the business matures. All of these projected cash flows are discounted back to today using a required rate of return, then summed to arrive at an intrinsic value per share.

On this basis, Nutanix’s estimated fair value is $74.46 per share, implying the stock is about 36.3% below its DCF value at around $47. That indicates potential upside if the cash flow assumptions are realized.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Nutanix is undervalued by 36.3%. Track this in your watchlist or portfolio, or discover 912 more undervalued stocks based on cash flows.

Approach 2: Nutanix Price vs Earnings

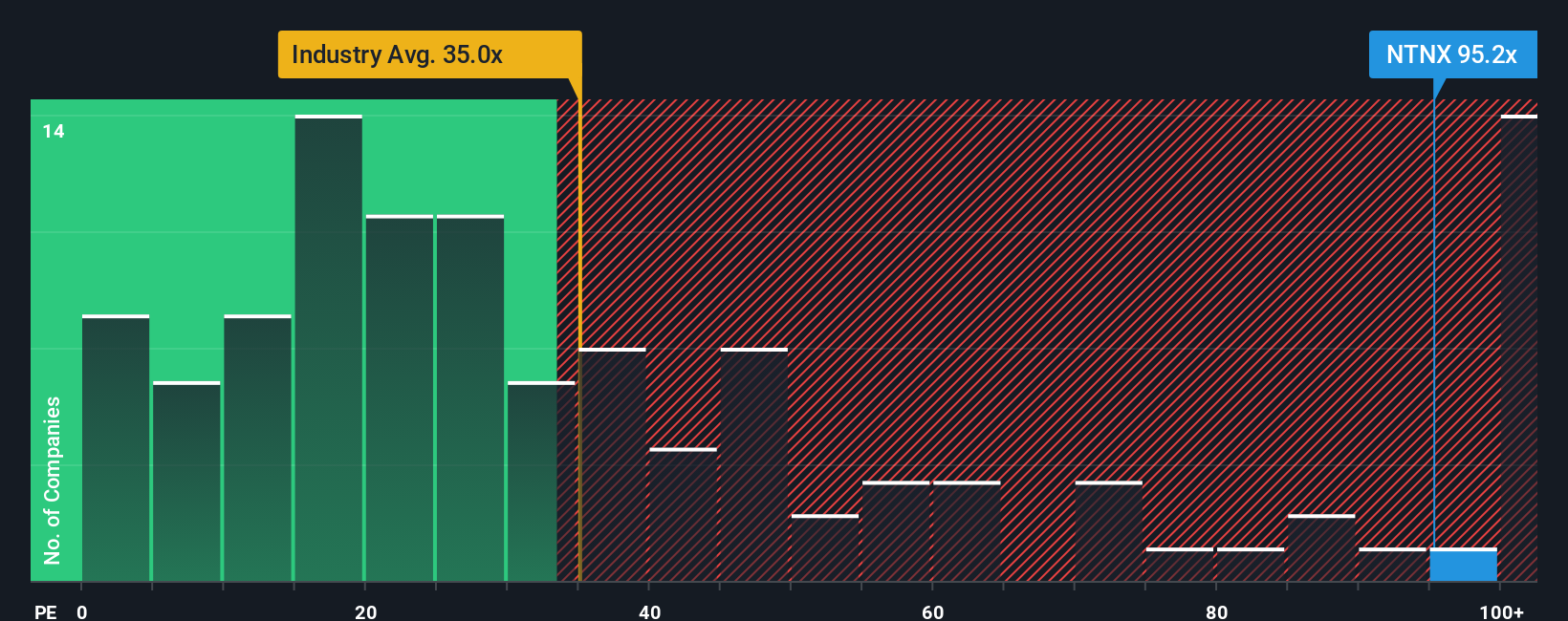

For profitable companies like Nutanix, the price to earnings, or PE, ratio is a useful way to gauge what investors are willing to pay today for each dollar of current earnings. The higher the expected growth and the lower the perceived risk, the higher a normal or fair PE investors are typically prepared to accept, while slower growth or higher uncertainty usually justifies a lower multiple.

Nutanix currently trades on a PE of about 58.26x, which sits well above the broader Software industry average of roughly 31.70x and also ahead of its peer group average around 44.15x. On the surface, that premium might suggest the stock is priced for strong growth and relatively contained risk.

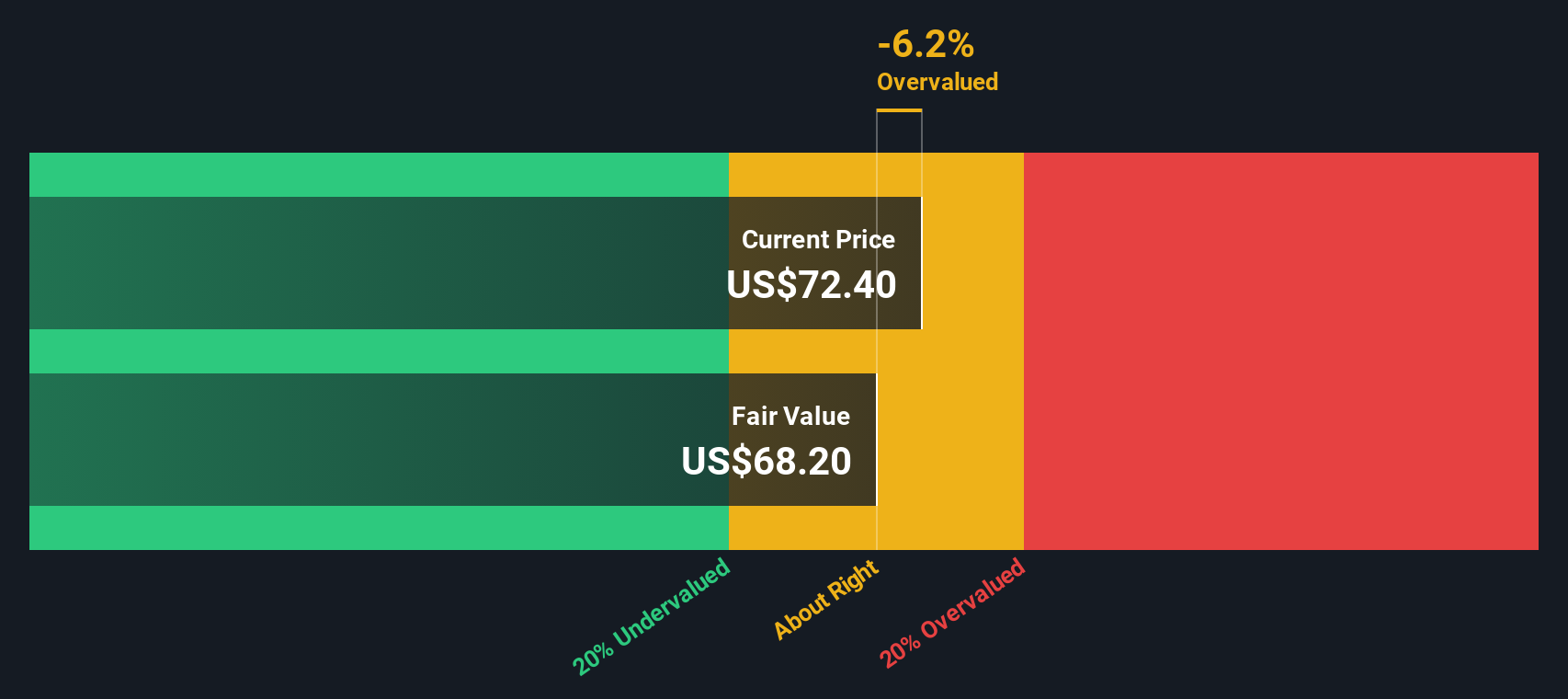

Simply Wall St’s Fair Ratio framework refines this view by estimating what PE Nutanix should trade at after adjusting for its earnings growth profile, margins, industry, size, and risk factors. For Nutanix, the Fair Ratio is about 43.55x, which is more tailored than a simple comparison to peers or the sector because it directly incorporates the company’s fundamentals and risk return profile. With the market paying roughly 58.26x against a Fair Ratio of 43.55x, Nutanix screens as meaningfully overvalued on this metric.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1443 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Nutanix Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to connect your view of a company’s story with the numbers behind its future revenue, earnings, margins, and ultimately its fair value.

A Narrative on Simply Wall St is your personal investment story for a company, where you spell out what you think will drive its business, translate that into a financial forecast, and see what fair value drops out at the other end.

Because Narratives live inside the Community page used by millions of investors, they are easy to access, compare, and update. They can help you decide when to act on an investment by showing whether your Fair Value is above or below today’s Price.

Narratives also stay current, automatically refreshing when new information like earnings, guidance, or major news hits, so your story and valuation do not go stale.

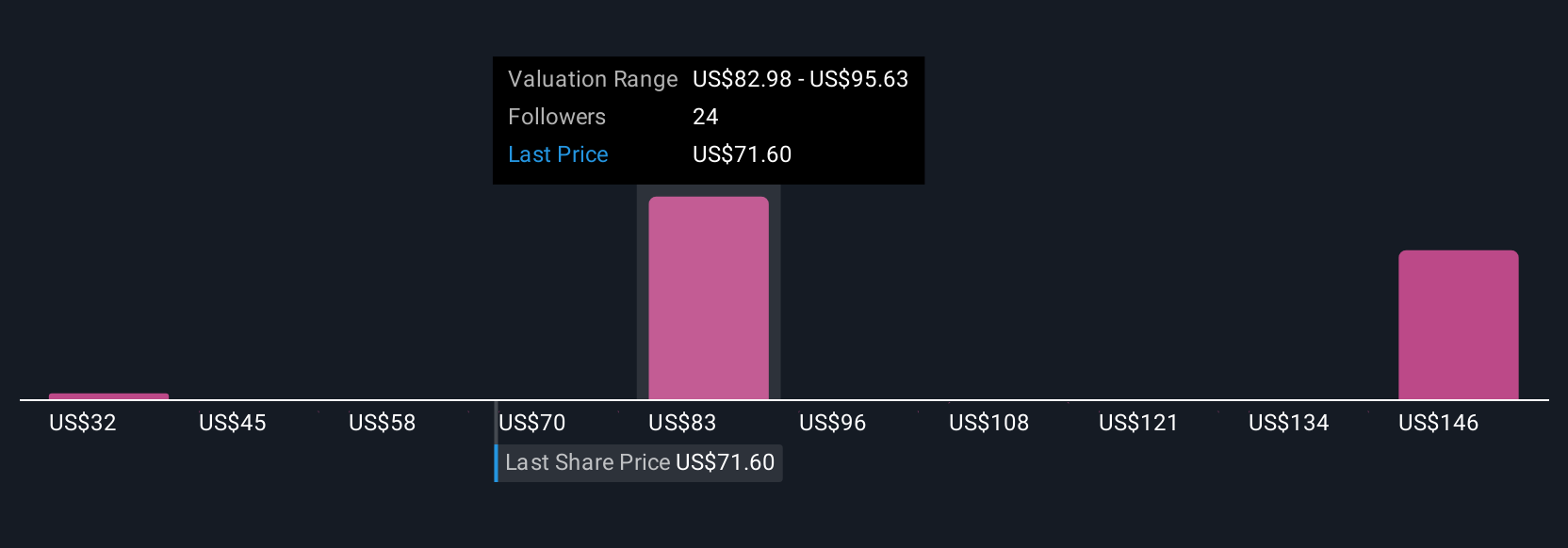

For Nutanix, for example, one investor might build a bullish Narrative that leans into accelerating hybrid cloud adoption and arrives at a fair value near the upper analyst target of about $95. Another, more cautious investor could focus on competitive and macro risks and land closer to the low end of roughly $71. Both can clearly see how their assumptions drive those different outcomes.

Do you think there's more to the story for Nutanix? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal