Is Aduro Clean Technologies (CNSX:ACT) Turning Flexible Plastics Into Its Core Competitive Edge?

- Aduro Clean Technologies recently entered a collaboration with Mexican non-profit ECOCE to assess the use of its Hydrochemolytic™ Technology for recycling flexible plastic packaging and mixed, multilayer plastics in Mexico.

- This partnership not only targets a difficult waste stream but also seeks to create new recycling business models and market opportunities for ECOCE members and other stakeholders.

- We’ll now explore how this focus on Hydrochemolytic™ recycling for flexible packaging could shape Aduro Clean Technologies’ broader investment narrative.

These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

What Is Aduro Clean Technologies' Investment Narrative?

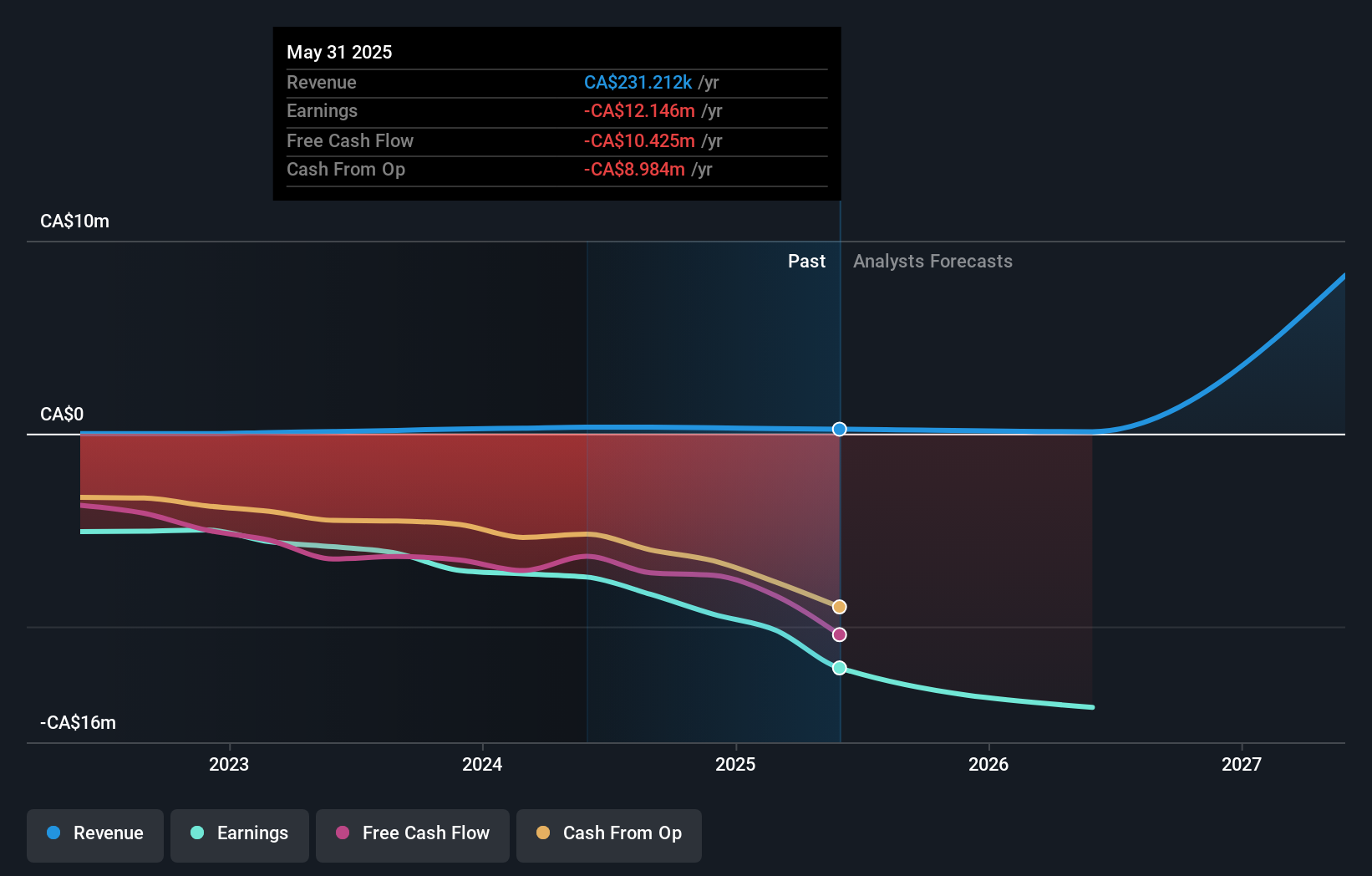

For Aduro Clean Technologies, the core belief you’d need as a shareholder is that Hydrochemolytic™ Technology can move from promising pilots to commercially relevant plants before the company’s limited cash runway becomes a binding constraint. Recent news around the ECOCE collaboration fits squarely into that thesis: it expands Aduro’s pipeline of potential applications for hard-to-recycle plastics and adds another channel for real-world validation, but it does not on its own change the near term picture in a material way. The main catalysts still sit with successful NGP Pilot Plant operation, securing a first demonstration-scale project with partners like NexGen or Cleanfarms, and crystallizing revenue beyond small trial work. Against that, ongoing losses, funding needs and a rich price to book multiple remain front and center.

However, one key funding risk tied to Aduro’s short cash runway is easy to overlook. The valuation report we've compiled suggests that Aduro Clean Technologies' current price could be inflated.Exploring Other Perspectives

Explore 3 other fair value estimates on Aduro Clean Technologies - why the stock might be worth as much as 30% more than the current price!

Build Your Own Aduro Clean Technologies Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Aduro Clean Technologies research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Aduro Clean Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Aduro Clean Technologies' overall financial health at a glance.

No Opportunity In Aduro Clean Technologies?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal