The Bull Case For Thomson Reuters (TSX:TRI) Could Change Following New Frontier AI Research Lab Collaboration

- Thomson Reuters and Imperial College London recently launched a five-year Frontier AI Research Lab, committing multi-year funding, high-performance computing resources, and a dedicated facility to advance foundational AI, safety, and reliability research.

- This partnership could deepen Thomson Reuters’ AI capabilities and content integration across legal, tax, and risk workflows, reinforcing how its tools support complex, real-world decision-making.

- Next, we’ll explore how this long-term AI research collaboration with Imperial College London could influence Thomson Reuters’ broader investment narrative.

Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

Thomson Reuters Investment Narrative Recap

To be a Thomson Reuters shareholder, you need to believe its legal, tax, and risk platforms can keep adding value as AI reshapes knowledge work. The new five-year Frontier AI Research Lab with Imperial College London supports that thesis by strengthening AI safety and reliability work, but it does not materially change near term catalysts, which still center on AI product adoption and the risk that faster moving, lower cost AI competitors could eat into its core research franchises.

The most relevant recent announcement here is the Imperial College London collaboration itself, which sits alongside customer facing AI partnerships like Supio and Fieldguide. Together, they underline how much of Thomson Reuters’ near term opportunity depends on successfully turning heavy AI investment into tools that law firms, tax professionals, and corporate legal departments are willing to pay for, before open source or in house alternatives reduce the value of its proprietary content...

Read the full narrative on Thomson Reuters (it's free!)

Thomson Reuters' narrative projects $9.2 billion revenue and $2.1 billion earnings by 2028. This requires 7.8% yearly revenue growth and a roughly $0.5 billion earnings increase from $1.6 billion.

Uncover how Thomson Reuters' forecasts yield a CA$267.74 fair value, a 43% upside to its current price.

Exploring Other Perspectives

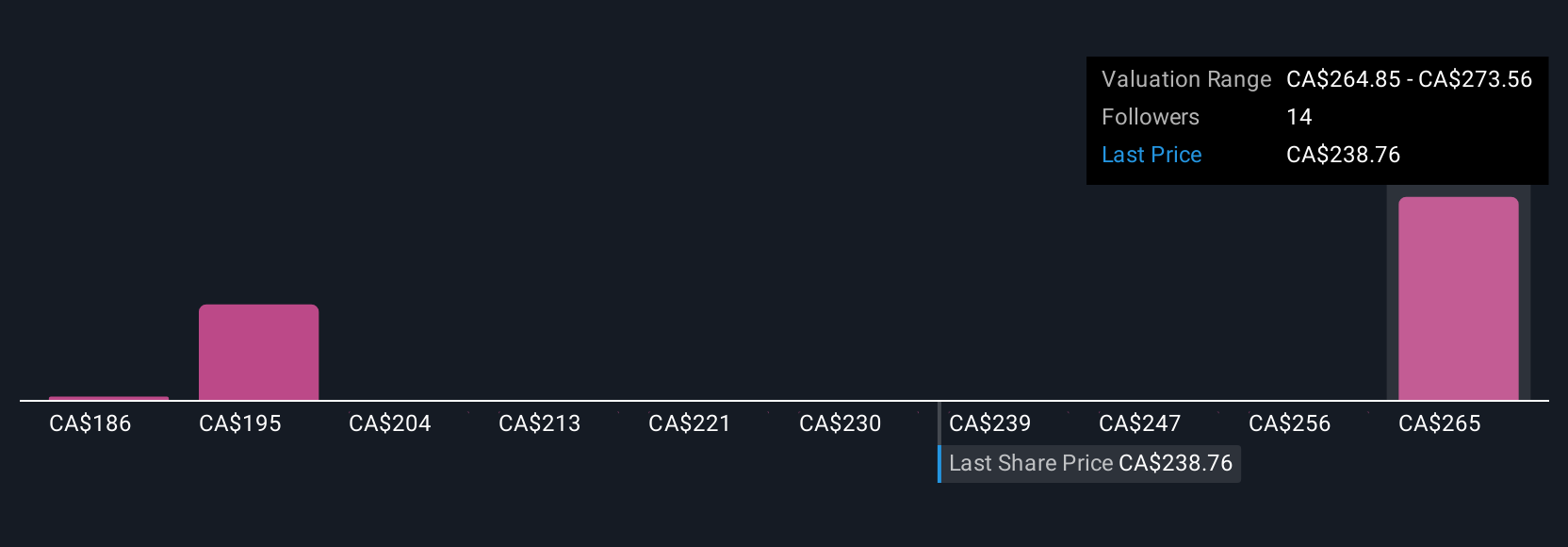

Four Simply Wall St Community fair value estimates span roughly CA$186 to CA$268 per share, showing how far apart individual views can be. You are weighing those opinions against the possibility that accelerating open source AI and in house legal tech initiatives could gradually reduce the pricing power that underpins Thomson Reuters’ earnings.

Explore 4 other fair value estimates on Thomson Reuters - why the stock might be worth just CA$186.45!

Build Your Own Thomson Reuters Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Thomson Reuters research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Thomson Reuters research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Thomson Reuters' overall financial health at a glance.

No Opportunity In Thomson Reuters?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal